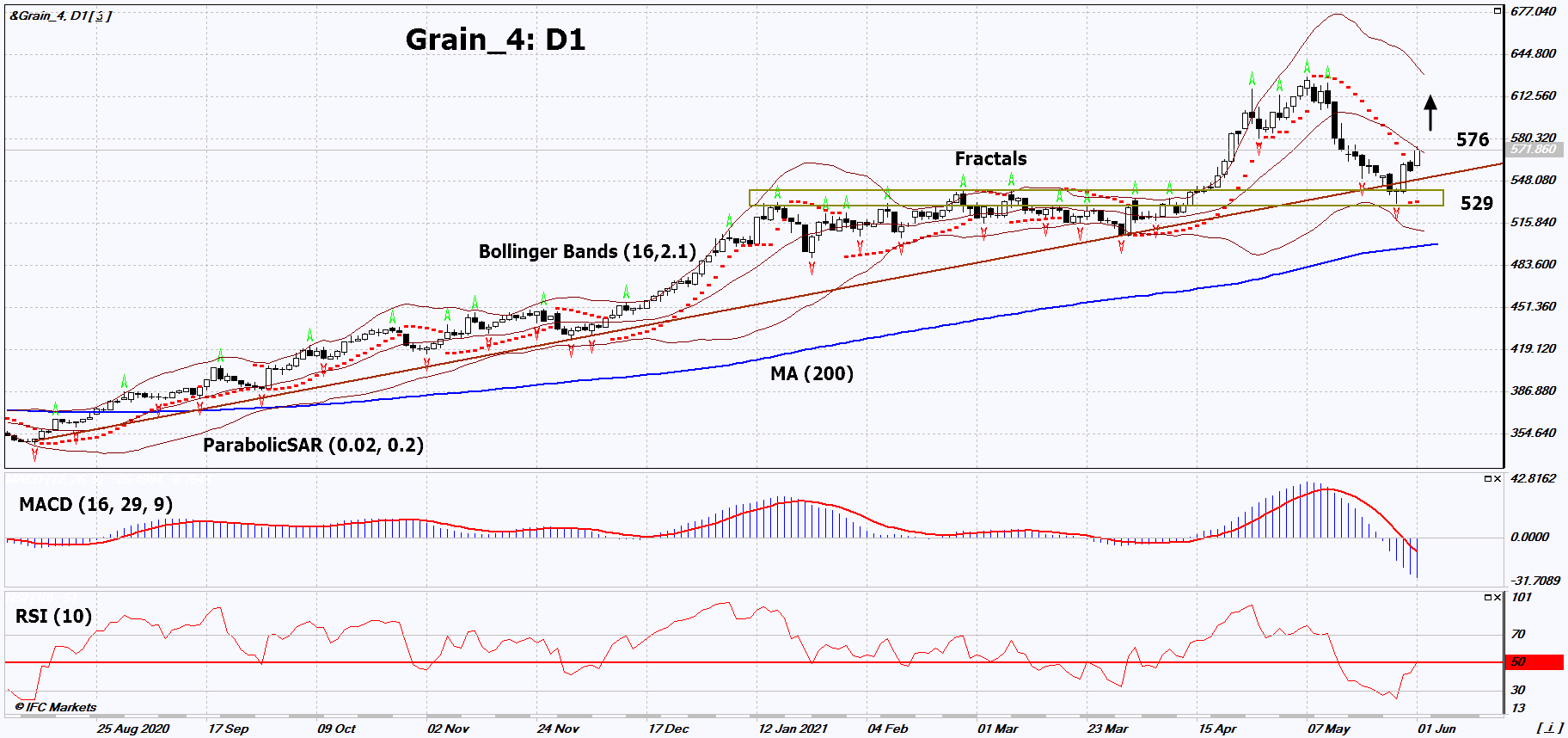

Recommendation for Grain Index:Buy

Buy Stop : Above 576

Stop Loss : Below 529

RSI : Buy

MACD : Sell

MA(200) : Neutral

Fractals : Neutral

Parabolic SAR : Buy

Bollinger Bands : Neutral

Chart Analysis

On the daily timeframe, Grain_4: D1 failed to break down the support area and returned to the growing trend. A number of technical analysis indicators have formed signals for further growth. We do not exclude a bullish movement if Grain_4 rises above its last high: 576. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal and the last lower fractal: 529. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we are changing the potential profit / loss ratio in our favor. After the transaction, the most cautious traders can switch to the four-hour chart and set a stop-loss, moving it in the direction of the trend. If the price overcomes the stop loss (529) without activating the order (576), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis

In this review, we propose to consider the “&Grain_4” Personal Composite Instrument (PCI). It reflects the price dynamics of a portfolio of 4 popular grain commodities. Will the Grain_4 quotes grow? Several factors can contribute to price increase. Spring wheat and corn crops were affected by frost damage in northern Iowa, as well as in Wisconsin and Michigan. This has been reported by farmers and local authorities, but there is no confirmation from the US Department of Agriculture (USDA) yet. An additional negative factor for the future grain harvest in the United States may become a drought, which is predicted to begin next week. Consulting agencies StoneX and AgRural lowered their forecasts for the corn crop in Brazil to 89.7 million tons and 90.9 million tons. At the same time, the current USDA forecast is much higher and amounts to 102 million tons. It can be revised downward. Soybeans are becoming more expensive amid an increase in its exports from the United States since the beginning of 2021 by almost 60% compared to the same period in 2020. The current US soybean exports since the beginning of the year have already reached 56.4 million tons.