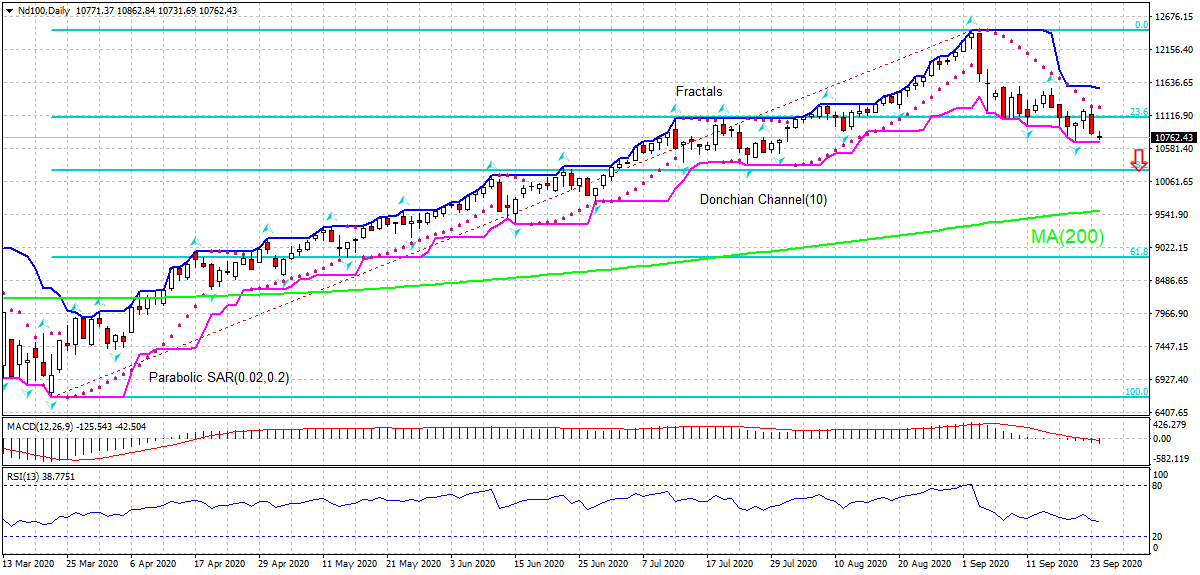

Recommendation for Nasdaq Index: Sell

Sell Stop : Below 10675.86

Stop Loss : Above 11547.67

| Indicator | Value | Signal |

|---|---|---|

| RSI | Neutral | |

| MACD | Sell | |

| MA(200) | Buy | |

| Fractals | Sell | |

| Parabolic SAR | Sell |

Chart Analysis

On the daily timeframe the Nd100: Daily is retreating toward the 200-day moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 10675.86. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 11547.67. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (11547.67) without reaching the order (10675.86), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Fundamental Analysis

Markit’s composite purchasing managers index for September declined in US. Will the Nd100 retreat continue?