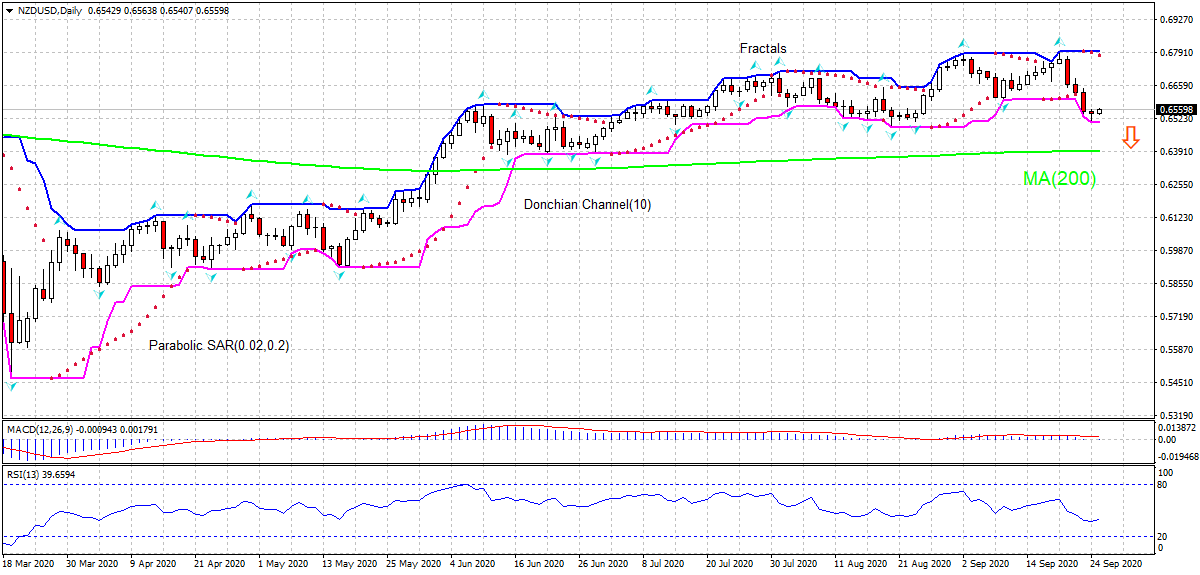

Recommendation for NZD/USD: Sell

Sell Stop : Below 0.651

Stop Loss : Above 0.6796

| Indicator | Value | Signal |

|---|---|---|

| RSI | Neutral | |

| MACD | Sell | |

| Donchian Channel | Neutral | |

| MA(200) | Buy | |

| Fractals | Neutral | |

| Parabolic SAR | Sell |

Chart Analysis

On the daily timeframe NZDUSD: Daily is declining toward the 200-period moving average MA(200) which has leveled off. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 0.651. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 0.6796. After placing the order, the stop loss is to be moved to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

New Zealand’s economic data weakened in last couple of weeks. Will the NZDUSD continue declining?

New Zealand’s economic data in the last couple of weeks were weak. Visitor arrivals continued to drop in July at unchanged pace, the services sector expansion stopped in August and manufacturing sector expansion almost stopped, while the trade surplus turned into deficit in August. Thus, visitor arrivals dropped 98.5% over year in July after 98.4% drop in previous month. The Business NZ Performance of Services Index fell to 46.9 in August from 54.4 in the previous month, and the Business NZ Performance of Manufacturing Index dropped to 50.7 in August from 59 in July. At the same time the balance of trade surplus of NZ$447 million in July turned into a deficit of NZ$353 million in August. Weak New Zealand economic data are bearish for NZDUSD.