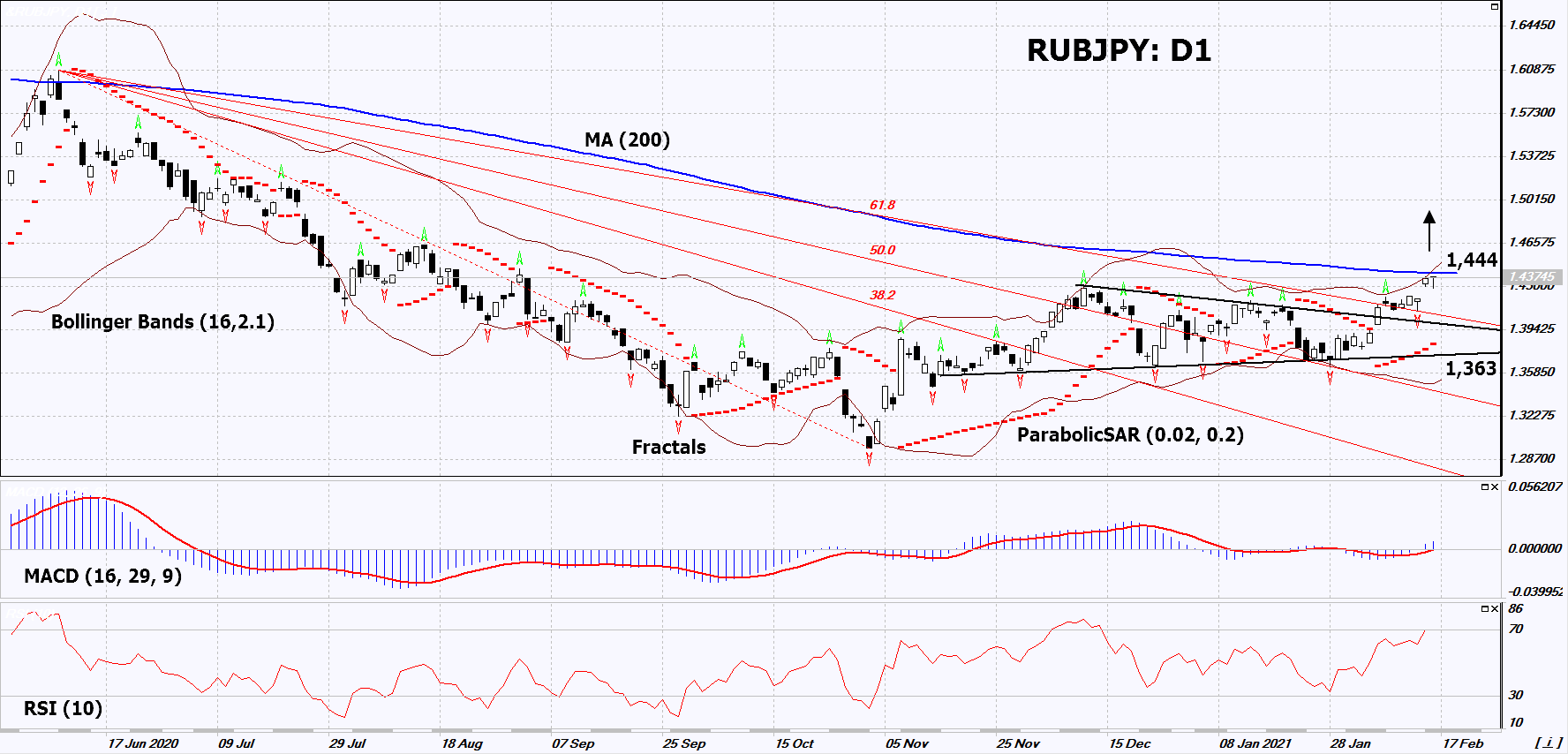

Recommendation for Ruble vs Yen: Buy

Buy Stop : Above 1.444

Stop Loss : Below 1.363

| Indicator | Value | Signal |

|---|---|---|

| RSI | Neutral | |

| MACD | Buy | |

| MA(200) | Neutral | |

| Fractals | Buy | |

| Parabolic SAR | Buy | |

| Bollinger Bands | Buy |

Chart Analysis

On the daily timeframe, RUBJPY: D1 came out of the triangle and the long-term downtrend. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if RUBJPY: D1 rises above the 200-day moving average line: 1.444. This level can be used as an entry point. We can place a stop loss below the Parabolic signal and 2 last lower fractals: 1.363. After opening a pending order, we move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.363) without activating the order (1.444), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Fundamental Analysis

In this review, we propose to consider the RUBJPY personal composite instrument (PCI). It reflects the price dynamics of the Russian ruble against the Japanese yen. Will the RUBJPY quotes increase? The upward movement means the strengthening of the Russian ruble and the weakening of the yen. The strengthening of the ruble is possible against the background of stable high oil prices. Hydrocarbons account for approximately 70% of Russian exports. OPEC+ is in no hurry to raise oil production. Meanwhile, investors expect an increase in global demand amid massive vaccinations in the developed world. Japan released positive preliminary data on Q4 GDP. At the same time, industrial production in December was weak. It has been declining annually since September 2019. This week, important economic data, such as trade balance, industrial orders, and inflation, will be published in Japan that could affect the yen and RUBJPY dynamics.