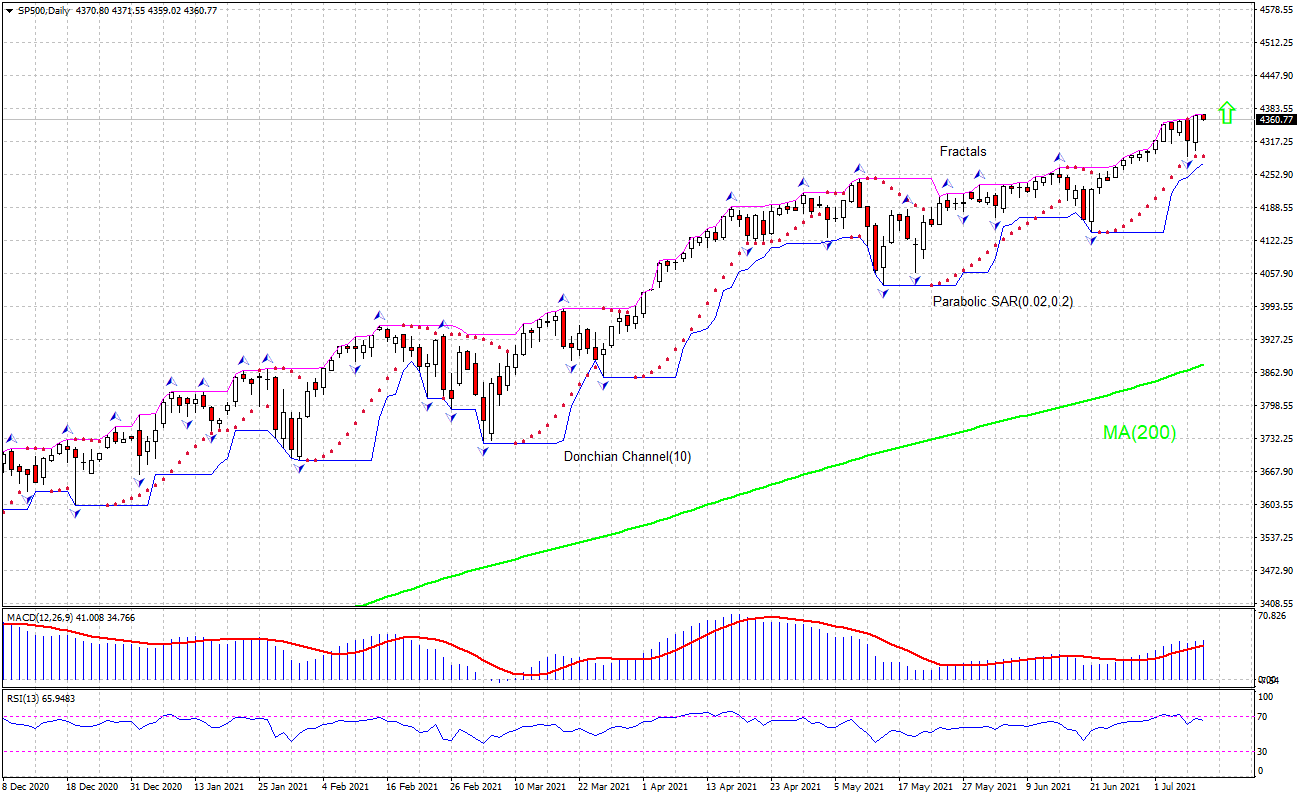

Recommendation for S&P 500 Index:Buy

Buy Stop : Above 4371.55

Stop Loss : Below 4274.03

RSI : Neutral

MACD : Buy

Donchian Channel : Neutral

MA(200) : Buy

Fractals : Buy

Parabolic SAR : Buy

Chart Analysis

The technical analysis of the SP500 price chart in the daily timeframe shows SP500,Daily is retracing up after pulling back from all time high it hit in mid-June. It is above the 200-day moving average MA(200), which is rising. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 4371.55. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 4274.03. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (4274.03) without reaching the order (4371.55), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

US economy’s expansion continues according to recent data. Will the SP500 rebound continue? Recent US economic data were positive. May factory orders rose more than expected. June nonfarm payrolls report was stronger than expected. And services sector expansion continued in June albeit at a bit slower pace. Thus, factory orders rose 1.7% over month in May following 0.1% contraction in April. Labor Department reported US economy added 850 thousand new jobs in June after 583 new jobs creation in May when a 700 thousand increase in nonfarm payrolls was expected. And US Institute for Supply Management (ISM) report showed its non-manufacturing PMI index declined to 60.1 in June from an all-time high of 64 in May. Readings above 50.0 indicate sector expansion, below indicate contraction. Positive US economic data are bullish for SP500.