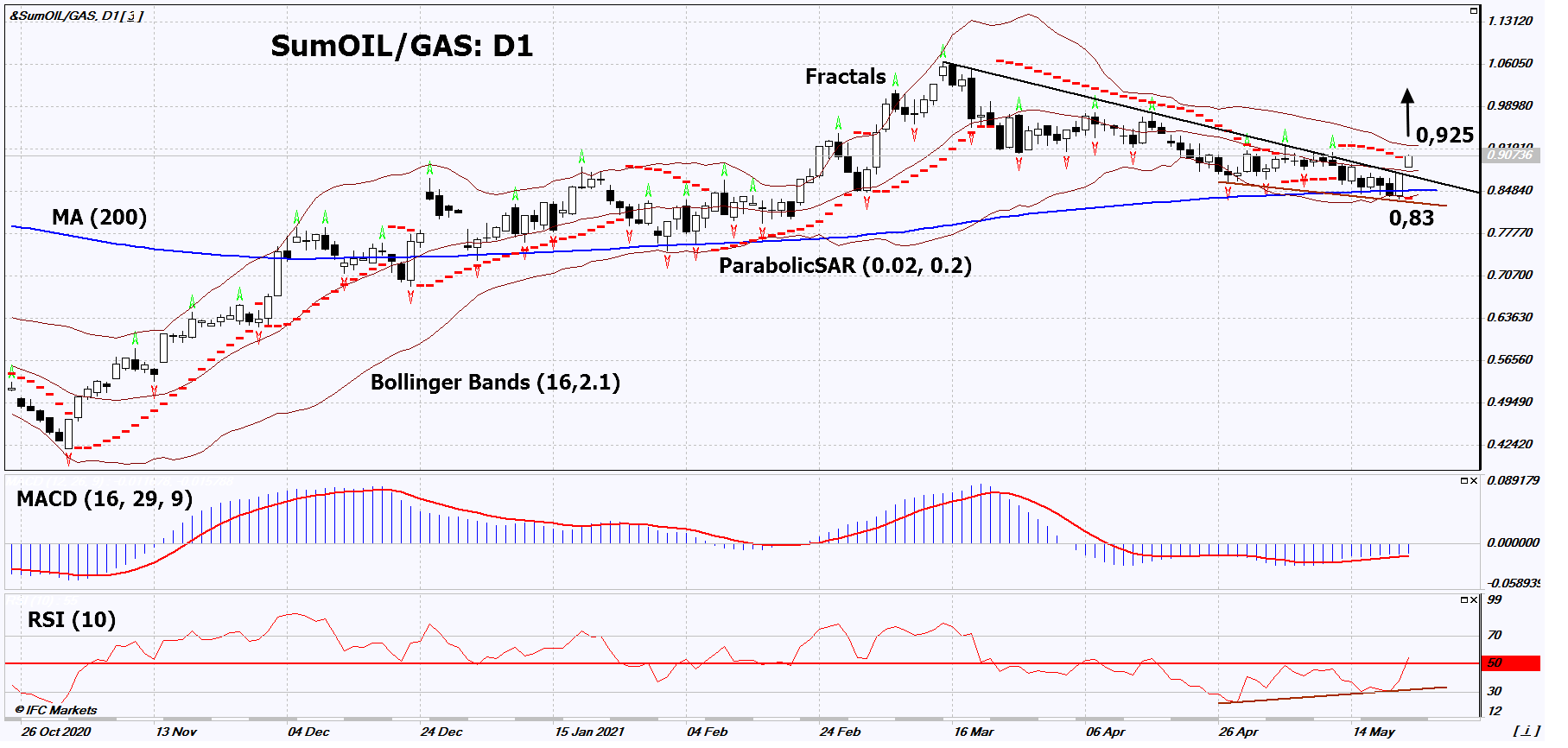

Recommendation for Oil vs Gas:Buy

Buy Stop : Above 0,925

Stop Loss : Below 0,83

RSI : Buy

MACD : Buy

MA(200) : Neutral

Fractals : Neutral

Parabolic SAR : Buy

Bollinger Bands : Neutral

Chart Analysis

On the daily timeframe, SumOIL/GAS: D1 went up from the downtrend. A number of technical analysis indicators have formed signals for further increase. We do not exclude a bullish movement if SumOIL/GAS rises above the last 2 upper fractals and the upper Bollinger band: 0.925. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the lower Bollinger band and the 200-day moving average line: 0.83. After opening a pending order, we can move the stop-loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most cautious traders can switch to the four-hour chart and set a stop-loss, moving it in the direction of the trend. If the price overcomes the stop-loss (0.83) without activating the order (0.925), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis

In this review, we suggest considering Personal Composite Instrument (PCI) &SumOIL/GAS. It reflects the price dynamics of a portfolio of oil futures for two brands - Brent and WTI versus natural gas futures. Will the SumOIL/GAS quotes rise? Such movement means that oil is getting more expensive and natural gas is getting cheaper. Natural gas quotes in the US have been declining for several days in a row. Maxar predicts lower temperatures in Texas and neighboring states. This can reduce the demand for gas to generate electricity for air conditioners. Meanwhile, gas production in the United States for the week increased by 7.1% compared to the same week last year and amounted to 91.8 billion cubic feet per day. Oil rose in price after US Secretary of State Anthony Blinken said that the US does not yet see whether Iran is ready to fulfill the terms of the Joint Comprehensive Action Plan (JCPOA) or the so-called “nuclear deal”. Investment bank Goldman Sachs does not exclude that Brent will rise in price to $80 per barrel by the end of the year, as global demand recovers.