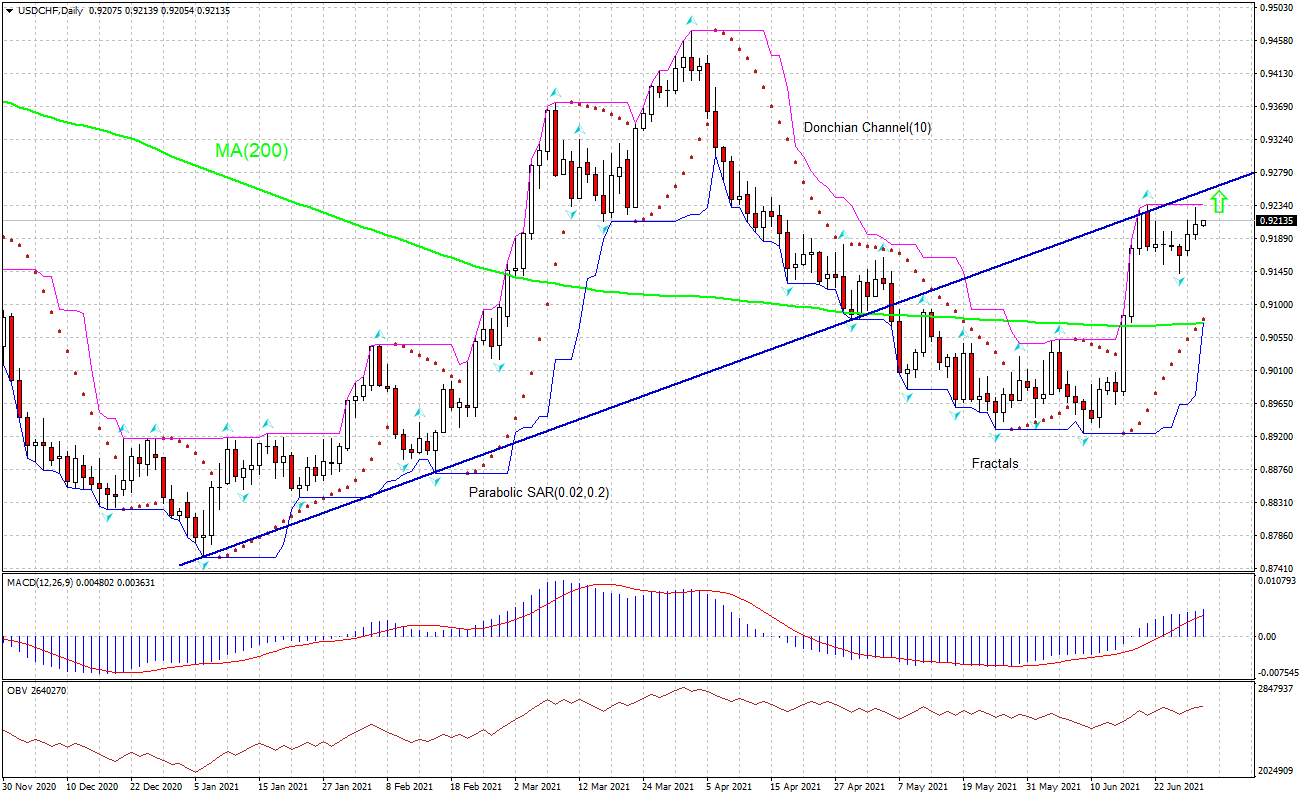

Recommendation for USD/CHF:Buy

Buy Stop : Above 0.9236

Stop Loss : Below 0.9141

MACD : Buy

Donchian Channel : Buy

MA(200) : Buy

Fractals : Buy

Parabolic SAR : Buy

On Balance Volume : Neutral

Chart Analysis

The USDCHF technical analysis of the price chart on daily timeframe shows USDCHF,Daily is rebounding above the 200-day moving average MA(200) which is starting to rise. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 0.9236. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.9141. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

Swiss economic data have been improving in last couple of weeks. Will the USDCHF reverse its climbing?

Statistical data portray improving Swiss economic performance. Thus, producer and import prices rose more than expected in May, and trade surplus rose in May instead of declining. Swiss Federal Statistical Office reported Producer Prices Index in Switzerland increased 0.8% over month in May after 0.7% growth in April, when 0.4% increase was expected. Balance of trade surplus rose to 4.3 billion Swiss francs from 3.3 billion in April when a decline to 2.9 billion was expected. This is bearish for USDCHF. However technical setup is bullish for USDCHF.