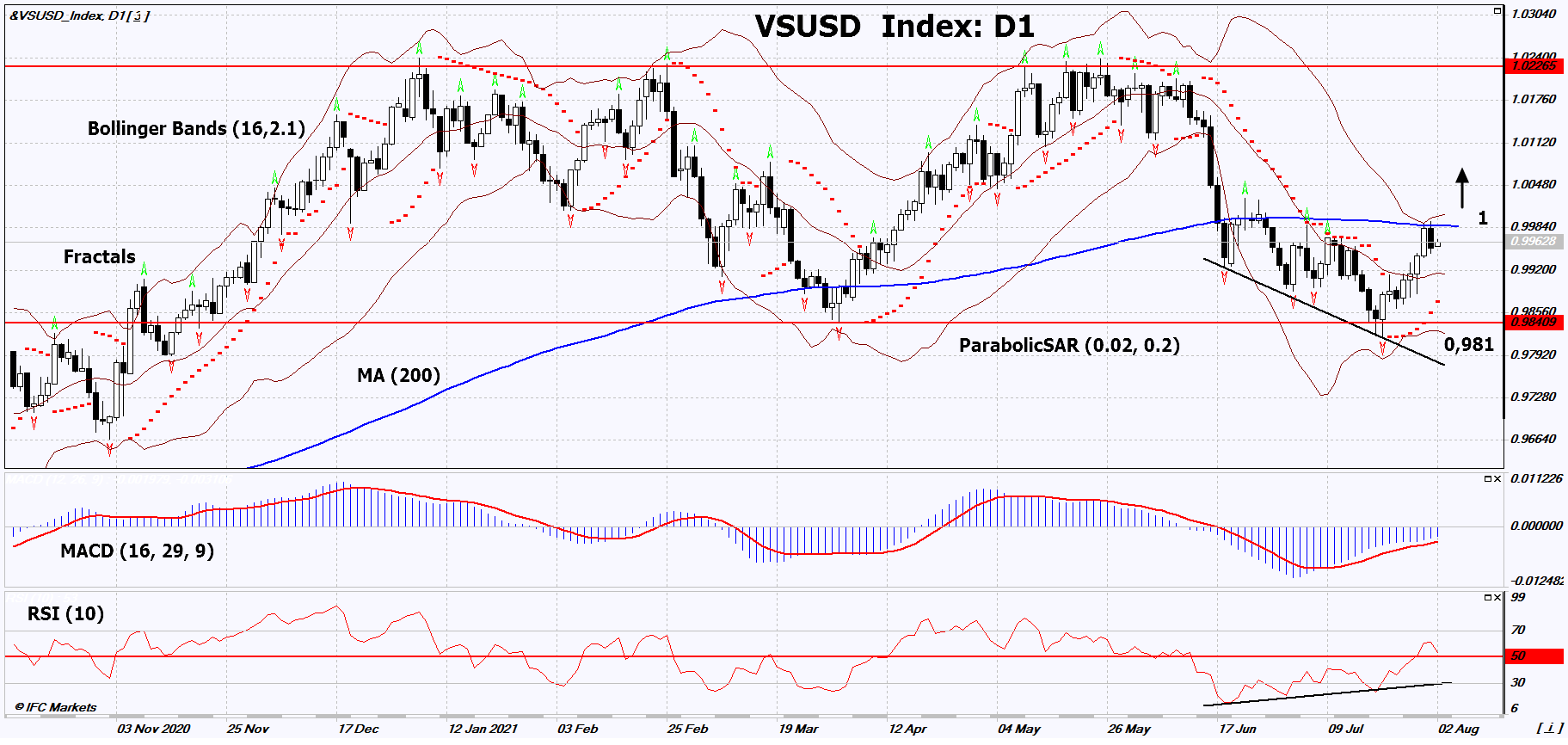

Recommendation for Currencies vs USD:Buy

Buy Stop : Above 1

Stop Loss : Below 0,981

RSI : Buy

MACD : Buy

MA(200) : Neutral

Fractals : Neutral

Parabolic SAR : Buy

Bollinger Bands : Neutral

Chart Analysis

On the daily timeframe, VSUSD_Index: D1 is in the neutral range. Recently, it pushed off from its lower border and is moving towards the upper border. A number of technical analysis indicators have formed signals for further growth. We do not rule out a bullish movement if VSUSD_Index rises above its last high, the upper Bollinger band and the 200-day moving average line: 1. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the last lower fractal and the lower Bollinger line: 0.981. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving in the direction of movement. If the price overcomes the stop level (0.981) without activating the order (1), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis

In this review, we propose to consider the Personal Composite Instrument (PCI) & VSUSD_Index. It reflects the price dynamics of a portfolio of major currencies: EUR, GBP, JPY, AUD, CHF, CAD against the US dollar. Will the growth of VSUSD_Index quotes continue? An upward movement in this case means a weakening of the US dollar. The main factor for this trend is the Fed’s opinion that it is necessary to continue the soft monetary policy. According to the FedWatch service of the American exchange CME, with a probability of 20%, the FRS rate may be raised only in September 2022. The likelihood of a rate hike in February 2023 is estimated at 40%. Recall that now it is 0.25% with annual inflation in the US 5.4% in June this year. This is well above the Fed’s target of 2%. Now representatives of the American regulator do not focus on high inflation and note that a tightening of monetary policy is possible if the labor market in the United States stabilizes. Just on August 6, on Friday, there will be data on the labor market for July, which may affect the dynamics of the US dollar. Preliminary forecasts are negative for him. Nonfarm Payrolls’ employment is expected to decrease to 381 thousand new jobs from 850 thousand in June. If the real data is indeed weak, then this may prompt the Fed to continue monetary stimulation of the US economy. VSUSD_Index quotes can be influenced by the results of the meetings of the Reserve Bank of Australia (August 3) and Bank of England (August 5).