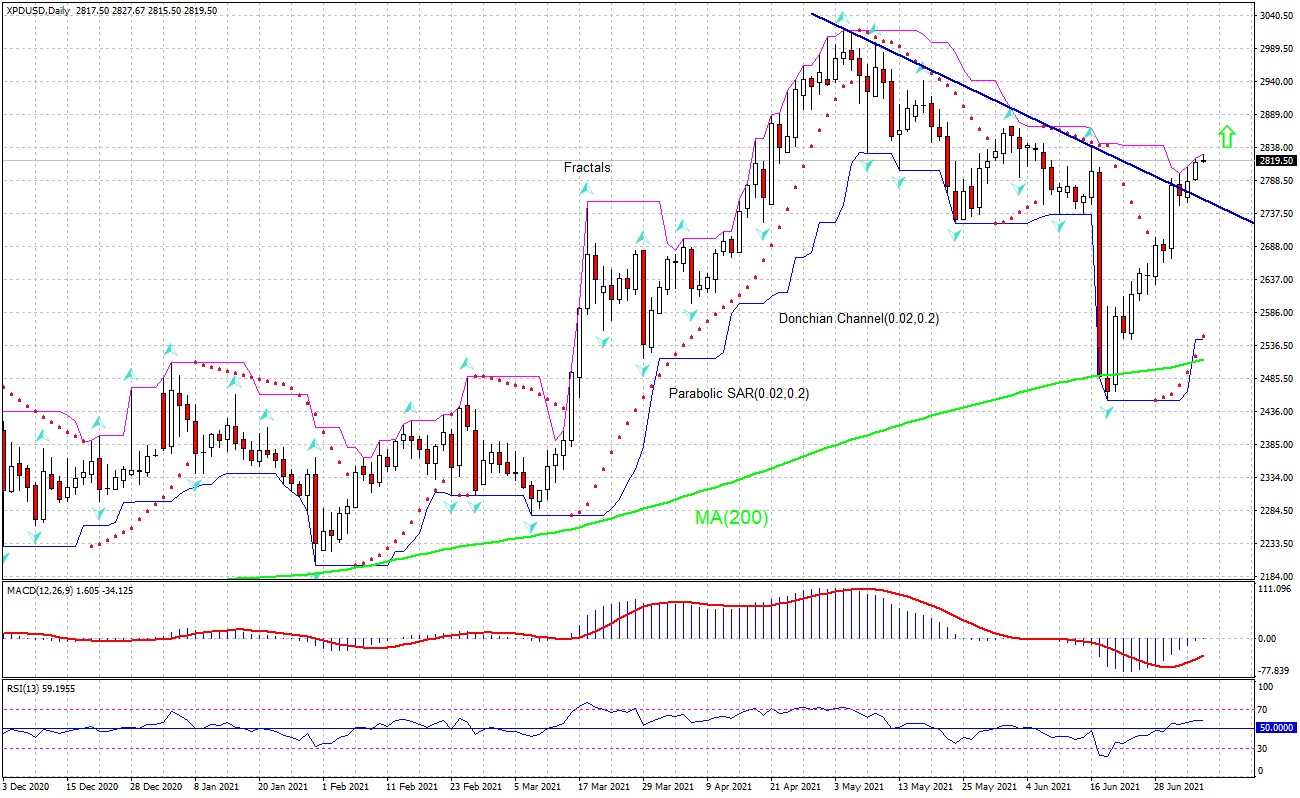

Recommendation for Palladium:Buy

Buy Stop : Above 2841

Stop Loss : Below 2549.99

RSI : Neutral

MACD : Buy

Donchian Channel : Buy

MA(200) : Buy

Fractals : Sell

Parabolic SAR : Buy

Chart Analysis

The XPDUSD technical analysis of the price chart on the daily timeframe shows XPDUSD,Daily has breached the resistance line above the 200-day moving average MA(200), which is rising. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 2841. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower Donchian boundary at 2549.99. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (2549.99) without reaching the order (2841), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

XPDUSD is rebounding on recovery of global car sales. Will the XPDUSD continue rising?

Palladium is a main ingredient in catalytic converters together with platinum and rhodium to reduce pollutant discharge of car exhausts. Car sales have been rising buoyed by excess household savings and pent-up demand from the pandemic. US new-vehicle sales in the first half of the year are expected to reach about 8.3 million units, according to an estimate from J.D. Power, a 32% increase over the same period in 2020 and up nearly 1% from the first half of 2019. General Motors reported a nearly 40% increase in vehicle sales for the second quarter compared with the same period a year ago. Volkswagen reported its best first-half US sales in nearly a half-century while managing tight supplies. Higher car sales are bullish for XPDUSD.