The Clorox Company (NYSE: CLX) is an American global manufacturer and marketer of consumer and professional products. Its’s brands include its namesake bleach and cleaning products.

During a pandemic, the demand for sanitizing products rises significantly which helped Clorox to avoid steep declines in the recent weeks as rest of the stock market was plunging down.

The stock is currently up 30% year-to-date while SPX is -26% which made CLX as one of the few stocks which provided an edge for investors during this rough period of time. Can the stock really remain supported for long term ?

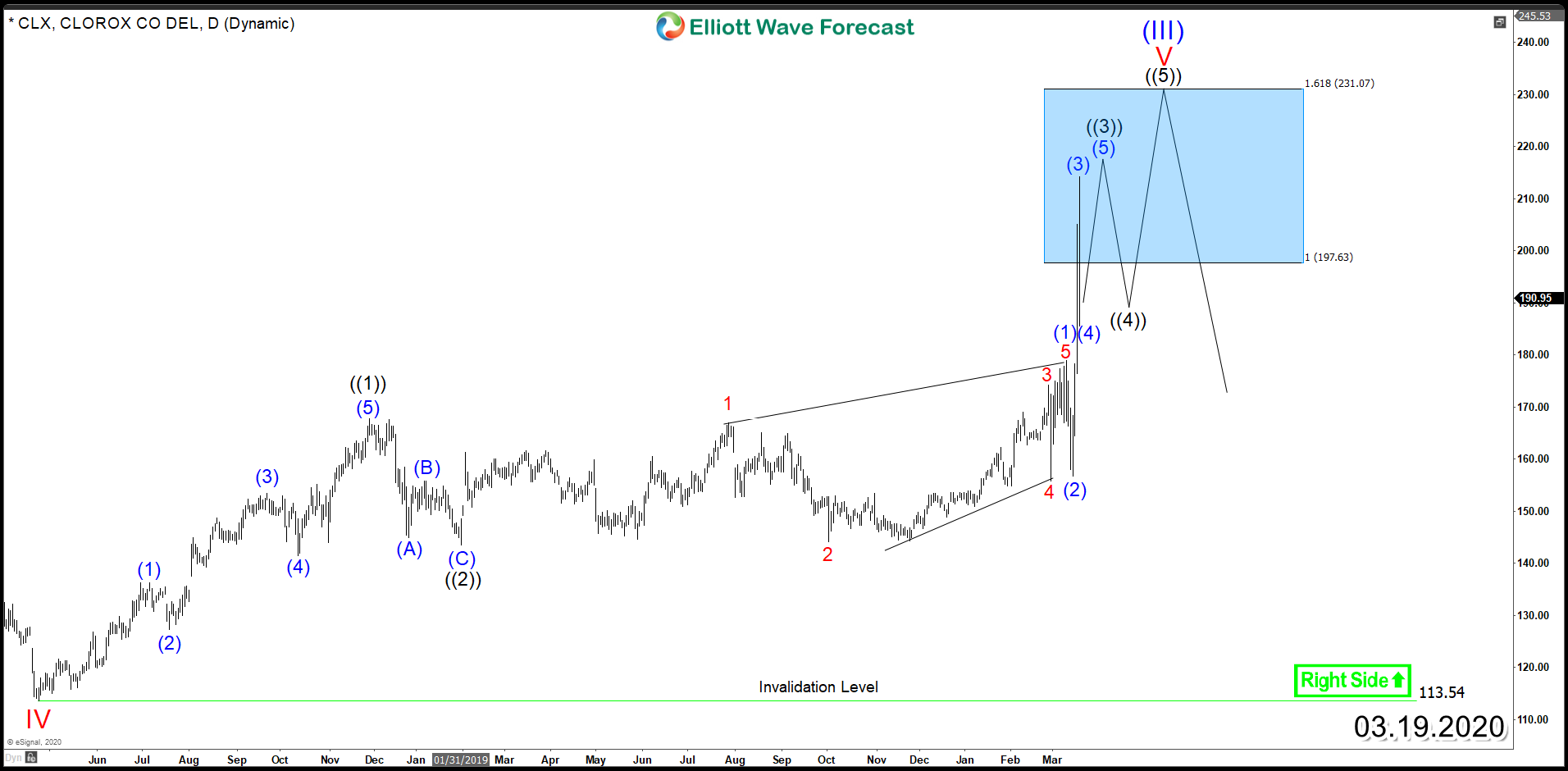

Looking at the daily cycle from 2018 which the majority of stock ended triggering the larger correction, CLX has also traded higher into a target area which is presented with a blue box in the following chart between $197 - $231. Based on Elliott Wave Theory, after an impulsive 5 waves advance, the market reverse lower to correct the previous cycle within a 3 waves structure before resuming the rally within the main trend.

In this case, CLX cycle from 2018 remain in progress as it’s still didn’t finish the 5 waves advance despite reaching the blue box in our chart which is a the High-frequency area where the Market is likely to end cycle and make a turn. However, investors needs to be careful at this stage as the stock is entering take profit territory and even further gains can still be seen in short term but it won’t be the best time to try to chase the longside as the risk reward at this stage is becoming lower.