thanks !

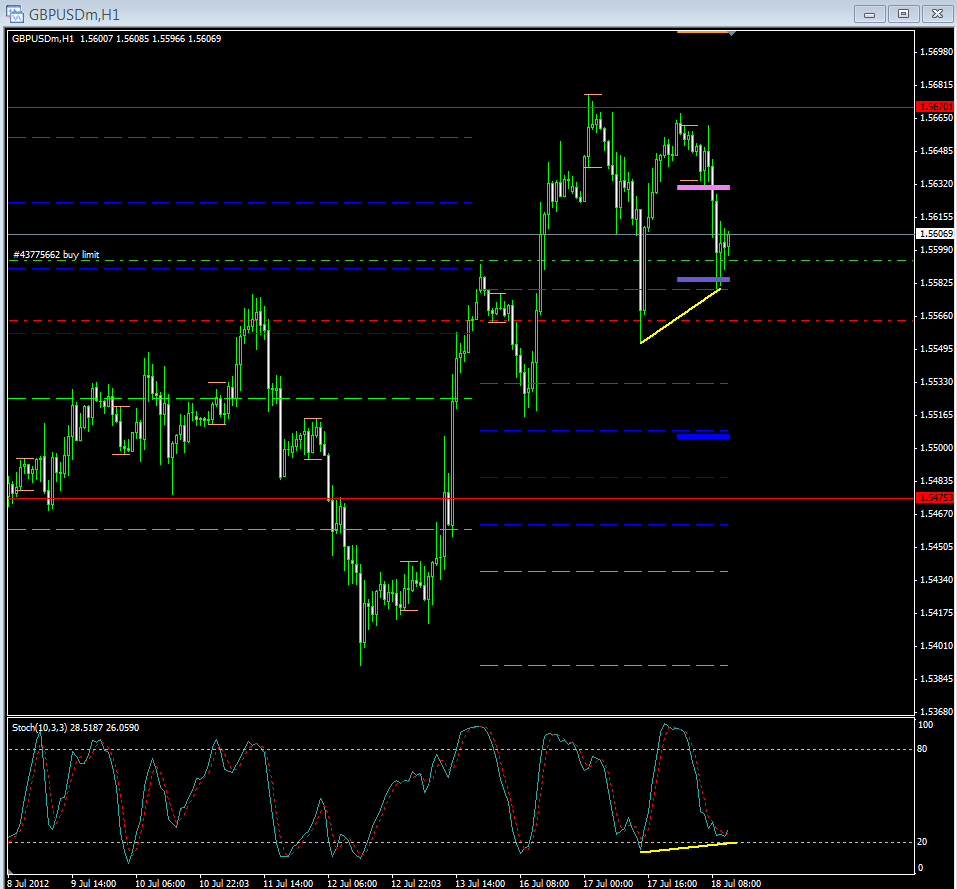

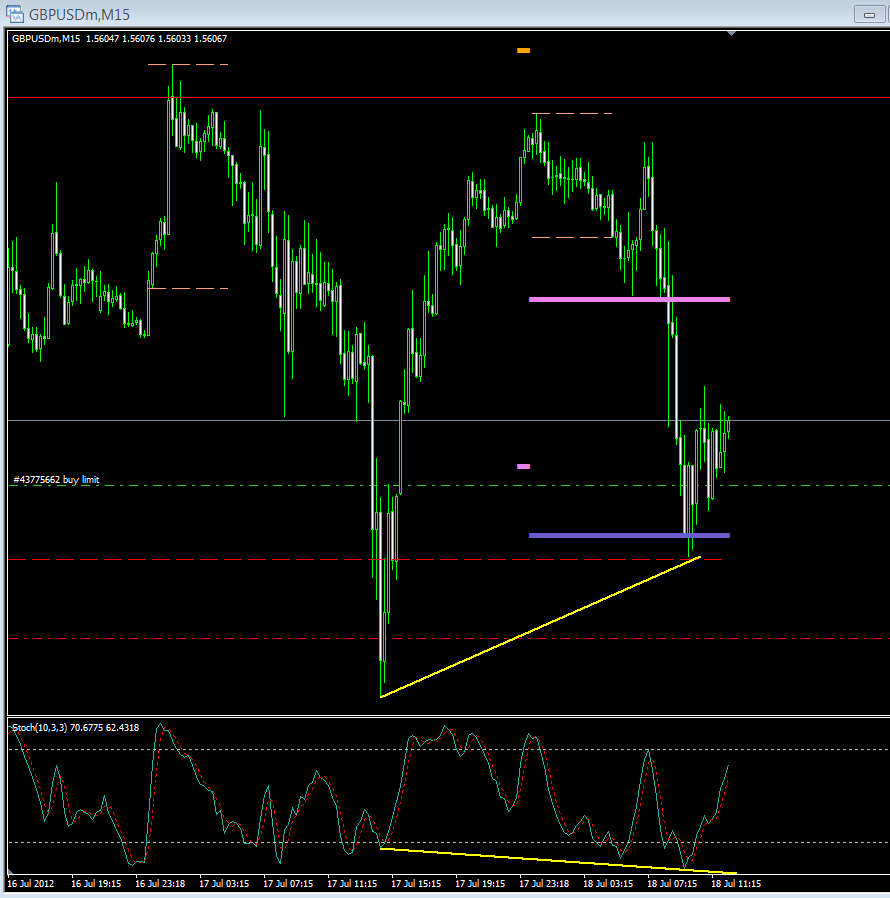

So my question is (mainly for Michael), what does it mean when the different TFs don’t match up in the stoch? I was eyeing the 1.5580-1.5585 level for LO/NYO, and I saw the stoch divergence on the 15, but not on the 1H (see below)…

Soooooooooo, does that mean anything? Does it make it any less valid of a holy grail set up? Is it still valid, but a stronger set up if all the different TFs show divergence? Or am I over thinking it, and as long as you see some divergence, you can use that as one factor to add to your decision making?

Still took the long, but just curious what y’all think…

Matty

Edit, I noticed that the 1h stochastic on the Fiber was showing a divergence during the same time, I wonder if thats a new trick that ICT will reveal soon…stochastic v. stochastic divergence :13: hehe

Hey Michael I’ve been waiting to ask this for 2 weeks now lol. Any way you could give me a top 10 of books or material? I’ve read Larry Williams trade stocks like the insiders and his second version of long term secrets to short term trading…it has really helped put your concepts into perspective for me and helped clear up some things that were fuzzy. I think it would help to read some of the other materials that have influenced you for myself…plus I really enjoy reading lol. Thank you.

Matty,

Look at the larger swing

Also, I have been watching EURO/GBP even though GBP is lower it is not making a lower low on Cable

I have been following the EURO/GBP for a few weeks and looking back in time and seeing some interesting things unfold. I know it didn’t go with your question. But some food for thought.

The main reason I do not use stoch. Different timeframes will say different things. What time frame are you using to take a trade thats the stoch you need. If you get them all to line up great but if thats what you are waiting for you will have high probability trades but maybe 1 a year. Good question though I am interested to see what ICT says. I only gave my opinion on the matter of stochtasics on different time frames giving different results. I see ICT is back sorry I got a virus and had to be down a little bit (if thats what you call it) little upset my broker had to fix it and not my anti virus programs. Whats up with that?

That would be very scary lol. Your broker got a virus or you did?

interest rate tide change? am i doing it right :D?

One of primary video ICT showed how indicator can fool us.

Then he reveals the solution- the price action. I was too

astonished by his explanation that I had to quit my attitude

about indicator, though it was my havit for couple of years

use those indicator to mess up my chart with several of them.

I almost do not use any indicator for last four and half months.

The logic was too strong to me, indicator has no power to move

the price but it is the price that can.

Recent we are introduced the “ICT Holy Grail” trade setup. I am,

sometime little bit confused. ( Please see the chart) It’s always

crystal clear to me after end of the day , where is trade setup,

like OTE, reflection pattern etc. Specially when watch market

review, slap my head, how could I missed those ABC!

Anyway, this is my personal thingking. As last market review says,

“Devote yourself to an idea. Go make it happen. Struggle on it.

Overcome your fears. Smile. dont you froget: This is your dream.”

Yes, follwing my dream.

Hello Shaer, You are very right about the price action. Indicator’s are only a added ocnfluence to our price reading. Though, i follow stoch and SMT divergence, I plot them on H1 chart’s and most of the time i see they are accurate when we are trading with the bias. Once we have some confirmation on H1 then we can drop down to M15 for entries with small SL. But checking M15 at first with out top down analysis will be a real problem.

Shaer, in your picture you say PA caused the Indi Div to fail. What PA?

PA means Price Action. In USDx Div shows supposed to go up, so the other currency should

come down. But what we have found that other currencies like cable or fiber going up while

usdx down. Cause due to price action market flow is down in the picture. Stockhastic showing

divergence so price will move but actually not and when price going down indicator also following.

Those, we are entering in to the trade with divergence may lose money. My point was to show

an example of how indicator may fool us. Look at the first picture, does not divergence look like to go long?

GS888,

You are right, HTF can show the profitable trade. Indicator may be some confluences (ICT says just have a look before enter in to the trade. Thanks a lot.

Regards

Thought id give my input in terms of the divergences…

As many of you know (as some of you have chimed in and started following  - thanks btw!), i’ve started strictly focusing on HTF setups and really started swaying away from the intra-day stuff which wasnt really giving me the consistency in my trading that i wanted…

- thanks btw!), i’ve started strictly focusing on HTF setups and really started swaying away from the intra-day stuff which wasnt really giving me the consistency in my trading that i wanted…

I have since too been mainly looking at divergences on the HTF only. Stochastic divergences i monitor as kind of an intra-day filter to go with agreement of my entry… But generally, i pay very little attention to intra-day divergences when daily highs and lows are broken - but i especially try not to pay much attention when they are against the trend of the HTF… I think if you can find a SMT / USDx divergence on the HTF, and then find a smaller one through the intra-day action, confirmed with other criteria and match that with a solid entry - youve struck gold!

The way i am looking at the market at the moment - we are in a buy program, im expecting higher prices and this was shown through this divergence:

Cable - Right

Fiber - Left

To me, this is a major market divergence which has lead to the bullish action we have seen this week. Now the next real divergence i am looking at on the HTF would be this - which is officially happened today:

Note the new divergence in purple:

In this case, the cable has made a higher high at a significant swing point on the HTF…

But also, what is better to note, is that because this divergence happened on the HTF, it doesn’t mean we will have an instant sell program on the Cable and Fiber… In fact, i expect more buying to occur til probably going into the end of this month… What interests me more is this setup:

As the Fiber will be the pair failing to make the higher high…

Fiber Daily Chart

Anyway, will be interesting to see how this all plays out in time to come…

:57:

The Grail is a continuation pattern, as far as I know, so seeing the USDX was in a down move you would be looking at the highs and seeing a higher high on the stoch, in your pics your looking at the lows.

Wally

I’m new and would like to know When/Where can I find the registration for today’s ICT Webinar?

"Inside the Range"

Thursday at 3:00 (eastern time).

Any help is appreciated!

1gratefuldude

The webinar isnt til 19th [B]August[/B]…

Now thats what i call an eager learner, showing up a whole month early to ensure he’s not late

lmao!!!

i thought it was on the 19th of july too

btw

wasn’t it supposed 2 b on news and event trading???

SanJ!

Thanks!

I’ll just sit here until next August… thank God for pizza delivery!

Ha!

Thanks again!

Great lesson for me to pay attention!

1gratefuldude

Follow ICT on twitter - @ICT_Babypips

Also if your totally new check his YouTube videos out and also his other thread as otherwise I can’t see the webinar being too useful?

Oh, I’ve been through all the videos, but still feel “new”.

Just looking forward to more, and grateful for all the great advice on this thread!

Yep me too. I’m away whilst the seminar is on so I’ll catch up on it later when I’ve had a chance to watch the videos again. No point in me over cramming the mind until I grasp the basics.

And yeah there’s a few good people here who get the concepts well and are good enough to help each other.

Good luck

im thankful that theres such a great community here

i get most of the concepts and i see how it works in hindsight. but i guess everyone is successful in hindsight.

i dont want to give up, because i have a strong belief that i can make it in this business. im all into financial markets.

but how to get focused and determined. thats where im struggling. getting rid of all that intraday noise, trying to catch session moves. i want to get to the hfts.

any suggestions welcome