The drawings here are of sufficient quality to be used in the final PDF.

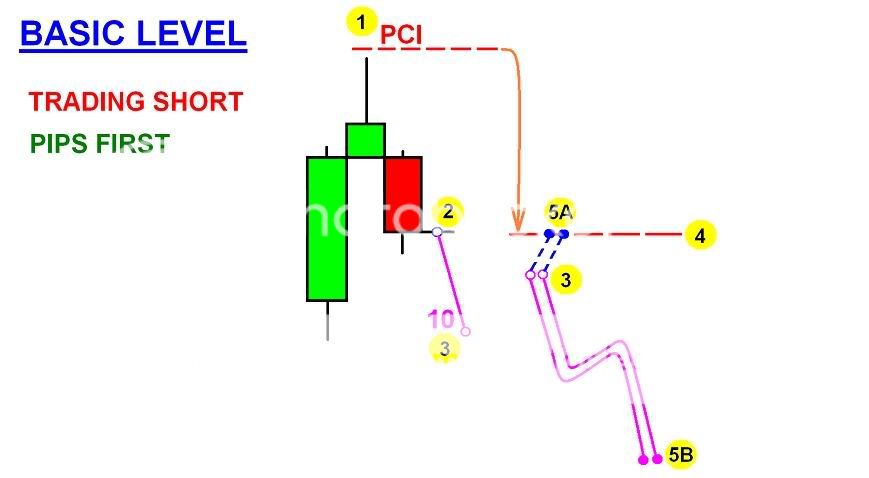

Basic Level - Short trade - Strategy B -Pips first.

Full Explanation.

Here an evening star is used as an example showing a short trade.

This is a pips first trade - here the price action goes in your favour immediately.

The method is the same for all short candlestick patterns.

The numbers indicate the stages in executing the trade.

Blue lines/circles are negative positions, magenta lines/circles are positive positions.

-

Set the PCI stop loss about 3 pips above the star. Please allow for the spread.

-

We enter with only one amount once the new candle starts.

-

When the price action has gone in our favour by 10 pips, we enter the 2nd amount.

3 continued) Here we see 2 pink circles where the computer has averaged the 2 short entries.

- The PCI is moved to break even.

5A) If the price action goes back to this line, we will lose 5 pips on each amount

making a total of 10 pips lost.

We will then call this a lost trade.

However, the loss is small, being only 10 pips.

5B) If the price action does not go back to the PCI (we hope it does not), then we set a good profit target for both amounts.

We exit both amounts when this profit target is reached.

This is Strategy B for a pips first trade.

By using the multiple amount approach, we improve the risk/reward ratio.

(In strategy A, we improve the win/loss ratio).

By entering one amount first, then delaying the 2nd amount, we use the clever tactic of getting a target profit with 2 amounts.

If, however, the trade loses, we again use the break even approach and lose with only one amount.

Thus the risk/reward ratio is improved.

The same strategy and approach is used for a long trade.