Hi, and welcome to this forum.

I think I can shed some light on the calculations you posted.

• Let’s start with the example in your second post, and then look at the examples in your first post.

In your second post, you used an actual EUR/GBP price for your entry, and you correctly calculated an exit price based on a 1% price rise.

Entry (long) at EUR/GBP = 0.90935, Exit at EUR/GBP = 0.91844

Your profit was 0.91844 - 0.90935 = 0.00909 = 90.9 pips

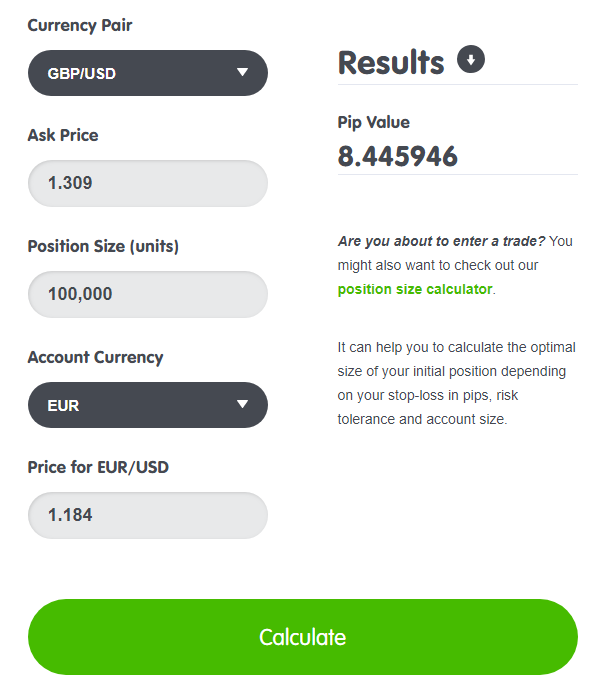

Using the Babypips Pip Value Calculator, we calculate that 1 pip = 10.996866 EUR per standard lot.

Therefore, your profit was

[10.996866 EUR / pip / lot] x 90.9 pips x 1 lot = 999.61511 EUR

which agrees with the result you displayed in your second post.

• If we apply exactly this same methodology to the two examples given in your first post, your two examples will produce results that agree with each other, just as you expected they would. However, those results do not agree with either of the results you displayed in your first post. Let’s go through it.

But, first –

Actually, pip-values do affect these calculations, as the following examples will illustrate.

Starting with your EUR/JPY example –

Entry (long) at EUR/JPY = 100.00, Exit at EUR/JPY = 101.00

Your profit was 101.00 - 100.00 = 1.00 = 100 pips

Using the Babypips Pip Value Calculator, we calculate that 1 pip = 10 EUR (exactly) per standard lot.

Therefore, your profit was

[10 EUR / pip / lot] x 100 pips x 1 lot = 1,000 EUR

Now, let’s apply the same methodology to your EUR/GBP example –

Entry (long) at EUR/GBP = 100.0000, Exit at EUR/GBP = 101.0000

Your profit was 101.0000 - 100.0000 = 1.0000 = 10,000 pips

Using the Babypips Pip Value Calculator, we calculate that 1 pip = 0.1 EUR (exactly) per standard lot.

Therefore, you profit was

[0.1 EUR / pip / lot] x 10,000 pips x 1 lot = 1,000 EUR

so the EUR/GBP example yields the same result as the EUR/JPY example.

As for the results in your first post, I have no idea how your calculator arrived at those figures.

One point needs to be made here:

Your calculator obviously used your entry prices to determine pip values. In order to get my example (above) to agree with the result in your second post, I plugged your entry price (0.90935) into the Babypips Pip Value Calculator, as well.

This is technically incorrect. When a trade is closed, P/L is calculated based on the pip value at the closing price of the trade, not the entry price.

Last point –

Always pay attention to the difference between the yen and all other major currencies. One yen is worth about 1/100 of what each of the other currencies is worth. Accordingly, all the yen metrics are multiplied by 100, in order to make calculations versus the other currencies possible.

That’s why one pip in any yen pair is represented by the second digit to the right of the decimal point, whereas in all non-yen pairs one pip is represented by the fourth digit to the right of the decimal point.

However, this does not explain the weird results you got in your first post. As I said above, I have no idea how your calculator got those results.