The $QQQ Nasdaq Tracker Long Term Cycles & Elliott Wave

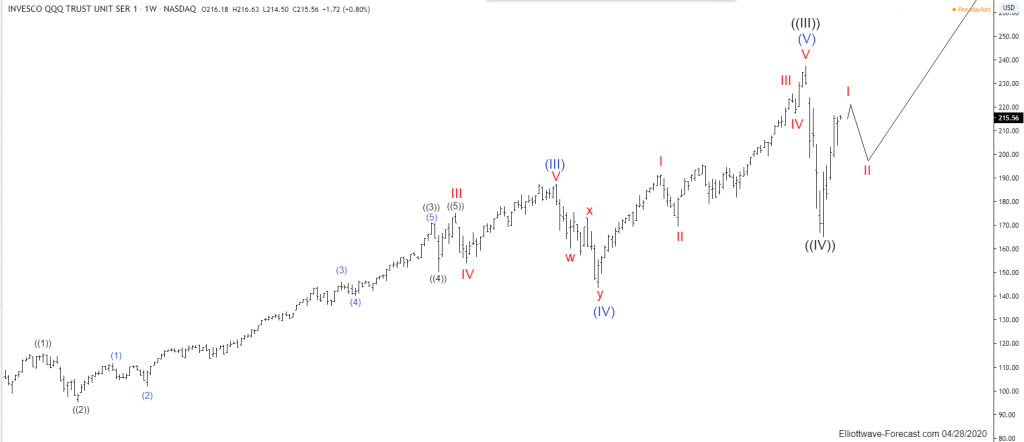

Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq which did that. As shown below from the March 2000 highs the instrument experienced a steep correction lower in three swings to the October 2002 lows. From there to the October 2007 highs it ended the first of the current series of impulses in the blue color. This makes up the subdivisions of the wave ((III)) that has ended on February 19 2020. It appears possible the correction of the cycle up from the October 2002 lows ended on 3/23/20.

As can be seen, the pullback from the October 2007 highs was in 3 swings that ended in November 2008. This corrected the cycle up from the October 2002 lows. The wave I was extended in the subdivision of wave (III). The wave II low created in August 2015 was strong enough to suggest it was correcting the cycle the November 2008 lows.

Additionally it appeared the wave IV was only deep enough to be correcting the cycle from the August 2015 low. Afterward it saw another high in August 2018. The wave (IV) into the December 2018 lows was strong. It suggested it had corrected the cycle from the November 2008 low.

The analysis and commentary continues below the QQQ monthly chart.

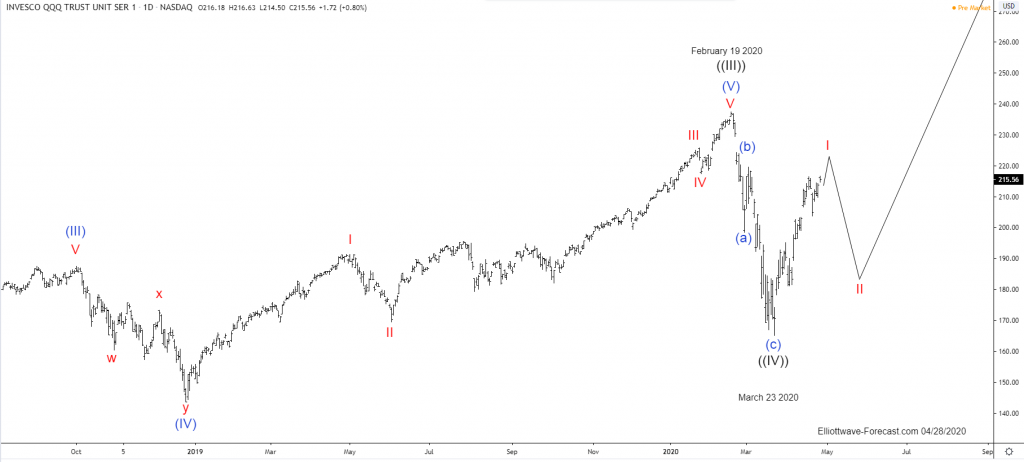

Secondly as previously suggested the QQQ instrument mirrors the Nasdaq highs & lows. As already mentioned, the cycle up from the October 2002 lows ended February 19 2020. It is now favored ended correcting the cycle up from the October 2002 lows on 3/23/20. As known, impulses progress in 5-9 & 13 swings. Corrections against the trend proceed in 3-7 or 11 swings. That correction is three swings so far however it remains possible there will be three more to make 7 swings.

The analysis and conclusion continues below the QQQ weekly and daily chart.

In conclusion the instrument can see a pullback lower of the same magnitude as like in the March 2000 highs to October 2002 lows in the wave ((IV)) before turning higher again. This in not the favored view. After another high in the near term it should look like five waves up from the 3/23/20 lows. Afterward, it should see three swings lower to correct the cycle up from the 3/23/20 lows. Since this daily pullback lower has not began I can not measure an extension area until there is some further data to give the area. Do expect the instrument to remain above the 3/23/20 lows for the turn higher.