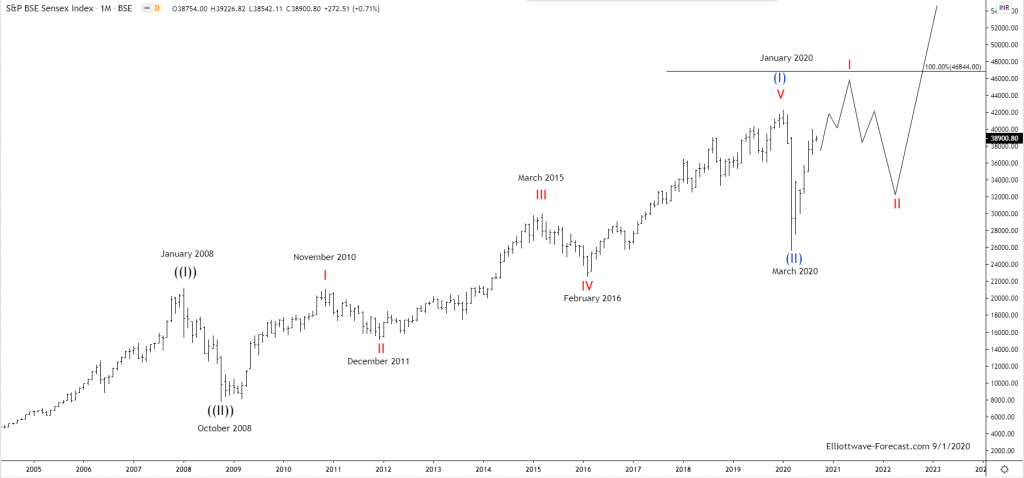

The Sensex Index Long Term Elliott Wave & Bullish Cycles

The Sensex Index has been trending higher with other world indices. Firstly in it’s base year 1978 to 1979 the index’s point value was set at 100. From there it rallied with other world indices trending higher into the January 2008 highs. It then corrected the bullish cycle as did most other world indices. It ended that larger degree correction in October 2008. From those 2008 lows, the index shows a bullish sequence that favors further upside. I will describe a less bullish alternative Elliott Wave count that has a target extension shown on the chart at 46844. This is where a larger black ((I)) could be ending. However it is not the favored view which is shown below and is more bullish.

Secondly, this Fibonacci extension is measured is as follows. Use a Fibonacci extension tool on a charting platform. Point 1 will be at zero a hypothetical beginning. Point 2 is at the January 2008 cycle high. From there on up to the March 2020 lows will be the point 3. This gives a Fibonacci extension area fifth wave target where the fifth wave would be equal to the wave one. That is not the favored count where a larger ((I)) would end but it would be a valid count. The preferred analysis continues below the chart.

Sensex Index Monthly Chart

The currently favored view in the Sensex index is as shown. It’s showing a nested Elliott Wave bullish cycle. It is in a larger wave ((III)) higher. From the 2008 lows there is a clear five waves up into the January 2020 highs as subdivided on the chart. The pullback in wave (II) into the March 2020 lows was very fast in time. However it is deep enough it will suffice as all of the preferred view correction. Thus at this point the index is favored to remain above there during dips. This is in either the preferred view or the previously described alternative where the larger ((I)) would be ending near 46844.

In conclusion. Either way while price is above the March 2020 lows the index should trade higher.