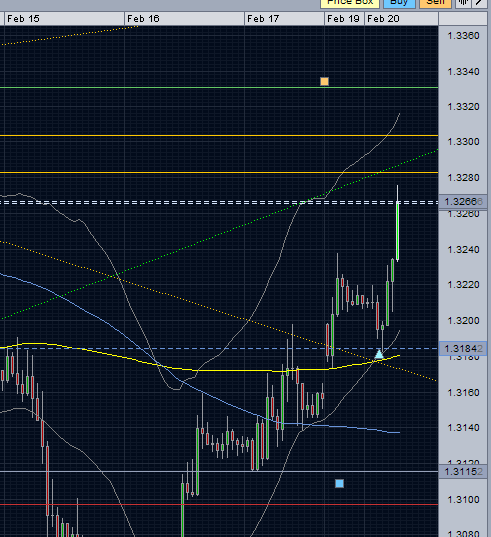

Entered long at 1.3185 after that pullback just before LO. Closing now at 1.3227. Not really convinced we’re going to go much higher today. Those overnight highs seem to be resilient so far. Maybe some Greek deal will give it that push but I’m taking profit to get the week started. Don’t feel like relying on the EZ to actually come up with something other than some smoke and mirrors nonsense.

I saw you mentioned that level as your probable entry into the long on Sunday. It obliged nicely rubbing off Fridays high, which was also the high of last Wednesday.

Nice rejection hammer on the hourly off that gap pullback, backed up with 15 minute hammers & doji’s too. Wouldn’t mind betting you won’t receive a cleaner trigger for the rest of this week

Not tempted to leave just a little bit in there to test the waters?

Yep the entry worked out very nicely. I just made a bit of a mess out of the exit. Should have left a portion on to roll the dice that it went higher as you mentioned. It’s something I know I need to work on - always had the all in / all out habit but need to try and make some changes to that.

I understand your reticence, & I also note your penchant for following along with current market events. I don’t know where you’ve picked that up from because I haven’t seen much evidence of that dual analysis view on here at all so far, but I’d stick with it if I were you. And that was why I mentioned the bit about leaving some of your trade in the market, especially today.

Knowing what you know about the early week price action behavior leading into London - which you appear to have picked up on very smartly I might add - & given the background drivers weighing heavily on today’s market, which sector do you suppose would be most interested & obtain more leverage in gaining a head start & taking the initiative on bullish flows into today’s higher low pullback gap?

They’re the one’s who are usually pretty good at taking on high odds calculated risks, & they quite often leave a smoke trail behind as they did this morning off that whopping great rejection level from last week, courtesy of those price bars mentioned in the previous post.

You did all the (good) hard work, shame to hand it across to someone else to benefit from when the load gets noticeably easier. But congratulations on your early week profits. You have a good trading style.

I have moved my SL and locked in 50 pips profit… any delay with the finmin meeting will drag the price down

my SL was hit for 50 pip profit, but I just reenter at 1.3190

looking for 1.3390 if price can pierce 1.3334

I got +60 with limit orders for the Greek deal news last night. Looked like they were going to finally announce something last night so put in a small limit order which worked out. There was reportedly decent topside sell orders so figured they would hold the first time. Looks like they got tested a couple of times overnight so if we get up there again this morning I think we’ll get past them so I’m In again long with 2 combined small entries to give me an average entry of 1.3242. Was about the best I could put together this morning.

Edit: Out at B/E on this morning’s trade. Was +37 for a bit but BIS decided 1.33 was going to hold for now it seems.

still in this trade but last night I didn’t lock in any profits, my SL is at B/E  Usually when I take a trade in the 1H chart, after 40 pips i lock in profits, but this time I was very greedy. As I said before, taking profits has proven to be the most difficult part of trading for me

Usually when I take a trade in the 1H chart, after 40 pips i lock in profits, but this time I was very greedy. As I said before, taking profits has proven to be the most difficult part of trading for me

I know what you mean. I struggle a bit with judging momentum to know if a trade is going to break up past a level or fail. Thought the 3rd tap up around 1.33 earlier would do it but not to be. I got +30 from the afternoon fall after it retraced a good bit of the earlier drop despite risk being neutral / off. But I ended up leaving more money on the table than booked profit with breakeven trades today.

Not really sure where E/U is going to go next. I could see the risk trade fizzling out for the rest of the week a bit as the EU deal gets fully dissected and shown up more and more. Daily chart on E/U looks a bit toppy to me. We’ll see - I think I have a slight bearish bias at the moment but that could change easily enough.

Probably a wise decision… looks on first blush to be setting up for a retrace on the 4h? Would not be suprised to see a dip to at least 1.32 on London. Already short on the GU retrace from 40 hours ago.

Would think so but it’s twitchy headline driven stuff at the moment. Have a little short open - I don’t like leaving anything of size open over the Asian session. Find I have a better night’s sleep that way!

Overnight short stopped out at B/E this morning. Took another small one at LO when price was rising up ahead of what looked like a slightly risk off day. Entered at 1.3255 and closed at 1.3222 as overnight lows seemed to be holding first time around. Equities are looking a bit weak today so might look to get in on another short around 1.3250 to see if we can get a deeper retrace in the afternoon. Don’t have much conviction though either way at the moment - looks a bit messy to me.

check bollinger bands on the daily, they have contracted in a way not seen at least in the last 2 years… price is about to explode

Think I’ll stay out of the way today and judge again to night seems key levels on fiber and aussie not fitting the plan lost out on a scalp short on loonie did not look at bigger levels before entering. Cable is just doing its own thing . Anyone else find it hard to sit on there hands?

Boring day, not a single trade today. Calm before the storm…:31:

I’ve been kind of wondering about that for a little bit myself. I think it’s because we’re in a sort of middling patch of economic data mixed in with a stock market rallying on I’m not sure what and EZ debt issues muddying the waters. We had a similar sort of sustained 1,000 point rally in the Dow back in start Dec 2010 - mid Feb 2011 and E/U rallied by around 700 pips. With this recent 1,000 Dow rally we’ve actually lost about 200 pips in E/U.

Guess we’ve just had a few factors conspiring to just chop us around for a bit and I don’t really see a catalyst to push us decisively into an explosive move one way or another at the moment. Maybe there’s something big right around the corner though!

I’m not one to prempt tops/bottoms, however GU looks fair value at 1.5658. Perhaps a light long into London.

Yes, good support in the area below 1.5643-1.5603

I have a buy limit at 1.5610, just above the bottom of the channel, just in case the down move has another leg.

Missed out catching the pop up this morning to bust that 1.33 barrier. Was hesitating a bit about entry before the LO and missed it. Took a short just now at 1.3333 - taking a little punt to see if it wants to drift back into the range again. Not high on hopes on this one so will close if it comes back to B/E. US jobs news later make or break it.

Edit: Out for +25 - not going to push for more today with a short.