I downloaded them from fxstreet HoG, yes. Many of them have almost the same lessons, but sometimes there is just another hint. So I can recommend to watch them all.

You have a great week, HoG! Don’t climb too high on that roof, lol.

I downloaded them from fxstreet HoG, yes. Many of them have almost the same lessons, but sometimes there is just another hint. So I can recommend to watch them all.

You have a great week, HoG! Don’t climb too high on that roof, lol.

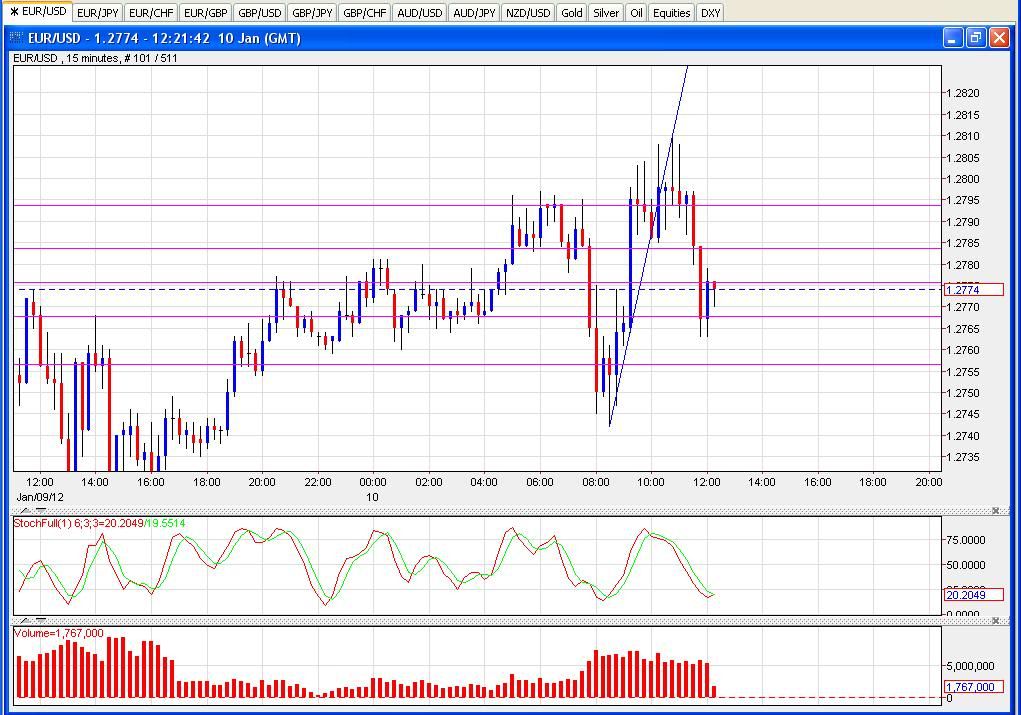

Been looking this morning to get back onto the short train. Hopped aboard at the first line of resistance at 1.2775. Sitting at around +25 pips now so stop moved to breakeven. Was thinking it might want to test the previous daily high at 1.2813 but it’s a free trade for me now so we’ll see.

Personally this is a question of timeframe and ‘feel’. If I am looking at a five minute chart, or a 15 minute chart or something like that, then I will draw a broad Support line that averages out the lows. So if there are half a dozen low tests, one of which has a wick lower than that of the others, then my line might be higher than that one, if you see what I mean - it might line up with the bottom of the five higher wicks, but the particularly low wick might breach it.

On a higher timeframe, like the Daily, I will take the low of the wick as the overall low. My Stop will be, as Bucks says, lower than that.

So I guess my basic answer is that for me it is the wick rather than the body that denotes the low/high, and my Stop will almost always be a few pips further south/north of that level. My Entry might be part way up the candle, but my Stop would not be.

ST

Closing that short at 1.2730 for +45 / +1.24% now that the 13:15 fix is over. Don’t see huge conviction one way or another at the moment today so booking profits. Will be looking for another short to hook into the trend again if we get another pop up.

Nice trade. Certainly agree with your view on picking moves in line with the stronger trend.

Today’s Merkel/Sarkozy conflab will also be casting shadows on the market, so that exit makes pretty sound sense.

I got it right at least yesterday with a gap trade by hand. Bought at 12676 and banked some nice pips today.

Nice work, I took a similarly timed Short for +1% - entered at 1.2754, 20 pip TP 20 pip Stop.

I agree with how you are reading the market, timing is everything at the moment!

ST

Ok boys and girls

First off let me apologise for being MIA over the last few days. My short foray back into the world of construction has taken it’s toll on my ability to stay awake past 10pm recently, however Bob The Builder has today completed all his tasks, and should be back in the relative comfort of the front seat of the cab as from tomorrow.

This means that I can get back to wiling my days away, by worrying what the EU is up to, instead of wiling my days away, wondering if I should really be up that high at my age !!

I have found it necessary though, to inform Mrs HoG, that if she ever volunteers me to fix anybodies roof again, I may find a brand new use for my 7 iron :56:

So can’t really say too much about EU over the last couple of days, I’ll get back to looking over the charts tonight and tomorrow and I’ll oficially start my year’s trading from then.

HoG

So since I’m doing not much else, I’ll throw a question out to see what y’all think.

Do you think you would end up in profit, or in loss, if you traded based on the average pip range per session ( Sydney, tokyo, London, New York, or daily) ???

Say you go back 2 years and work out the average daily range for each session, or just the day as a whole. Then you work out the average range from the open of the session, to the low of the session. Then you work out the average range from the open of the session, to the high of the session.

Then you trade purely on those numbers. Wonder what the outcome would be? I may just do that, (work out the numbers I mean) If I ever do get round to working it all out, I’ll post the results. If I die of boredom before I’ve completed the task, obviously I won’t !

I use ATR only a daily chart - mostly just for gauging how much room there might be left in a move for a day. If the ATR is 120 and we’ve travelled 90 pips long already in a day I’m not going to be chasing it - I’ll wait for a pullback. You can see the average daily range for each day very easily by using the ATR function in your charting package. Just select a period = 1 instead of the usual smoothed average over 14 days or whatever.

Quickly working out the session ranges might be a bit more trouble. If you went with a 4H chart that would be a fair approximate maybe - you’d see the 8am -12pm range, 12pm - 4pm ranges, etc. Or you could bump it up to a 8H and see your usual trading time range from 8am - 4pm maybe. Not sure there’s a whole lot to be gleaned from it all out properly though. I wouldn’t be placing any trades solely by it. I just use it as a confirmation about where there’s room to run in a trade or not.

What I do is look for long candles moving away from a congestion area and my main S/R level is what is called “break level” This is usually the open or close of the previous candle before the meaningful move…

these are resistance and support levels on my 1H chart

the longest the body of the candle where price moves away and the more time prices spend in the congestion area, the better the “break level”

Hi All,

As a newbie to forex / trading of any sort let me tell you what a welcome relief your thread: Beginners Disaster, was to me. Learning Fx is also learning a new language and interpretation of the dialect of that language. Fortunately there seems to be real heavy weight traders replying to this and the other thread to help us all out.

Thanks HoG for posting these charts. i can learn about charts but it’s really handy to have someone talk about what they are thinking and watching on the charts.

I have not traded with a live account yet because i’d like to learn more about FX before i follow you down that path HoG.

Thanks for these types of threads guys and keep up the great work.

GU’s been ranging predictably these last few days Not to say there weren’t pips to be made on EU… just thought it worth a mention. Glad to hear your done on the roof HOG… had visions of Mrs Hog scraping bits of Mr Hog off the tarmac and into a bucket… ahem… perhaps not! :33:

EDIT: 4h GU chart… yellow line is a long entry. Current long on EU also at around the same time.

What with equities firm on the day, US futures up, oil up, EZ bond auctions not bombing, etc. figured a long would be on the cards for today. Missed the early action this morning as busy with work but have entered a small long at the 61.8% retracement from the LO low at 1.2768.

Bit concerning that the Euro seems to be struggling hard when there should be more factors playing in its favour today so I’ll be looking to move to BE pretty quickly. Think we’re still kind of ranging so I’d be targeting 1.2820 or thereabouts. Reckon there’ll be decent sellers at 1.2820-30 but I’ll try to have a look at PA before deciding if we get back up there again.

Closed out at 1.2809 for +41 / +1.44%. Too many sellers about looks like still which had me worried as theoretically there’s a good few Euro short-term supporting factors out there today which I thought might have squeezed shorts a bit more than it has failed to do so far. So I’m flat again rather than see my profit disappear as the 15m phase takes a trip south.

There are no new sellers. It’s no demand and no buyers what keeps it ranging. If sellers would come in it would drop rather quick with high volume which is not the case.

Imho this up move has at least potential til 129ish.

True enough. Looks like decent 2 way action at the moment but for a day when EZ equities are up 1.5-2.5%, US equities are up 1%, oil is up 1.5% it’s not translating into much EUR demand. Periphery bond yield spreads with Bunds narrowing a bit too which should be EUR supportive. Looks like Mr Market isn’t convinced that EUR is set for a rally just yet.

Thanks for the feedback warp897

However, you will find with this thread, as with the Beginner’s Disaster thread, that it’s not me who does most of the great work on the thread.

I’ve always found that if you ask the guys on this forum to share what is rattling around in their heads, the vast majority are more than willing to help.

Almost at the end of the Beginner’s Disaster, I spoke to couple of friends about giving up the forum completely. And they reminded me that fx trading is a lonely adventure, and that it is good to have somewhere to go to talk to like minded souls.

I’m glad they talked me out of it, I’ve been in touch with some lovely people here.

However the thing to remember about this site, not just this thread, is the reason it is here in the first place. In Newbie Island, IF YOU DON’T KNOW THE ANSWER TO A QUESTION, ANY QUESTION, JUST ASK. Because someone WILL help you out.

Talk soon and stay in touch

HoG

Well played for today PipBandit.

Unfortunately my optimism about being finished on the roofs had peaked too early and I found myself back up there today. Now looking over the charts for the first time in a couple of days. I’m sure I haven’t missed much eh? LOL

20 years ago RC, it was a fearless, fit young HoG who would climb the ladders into battle.

Nowadays, a rather shaky, slightly greying guy ascends the ladders, telling himself constantly that he just shouldn’t be there at all.

Back to trading now anyway. Hopefully it’s a much safer pursuit.

HoG