AI Crypto Related Portfolio

Although not my main focus in my trading, this will most likely be the main focus of my journaling here.

The idea behind it is simple…

The crypto market historically has followed a 4 year cycle which evolves around the Bitcoin halving due to laws of supply and demand.

The last 3 cycles:

9th July 2016

Bitcoin Price on halving date: $648

Total Market Cap on halving date: 10.51 Billion

Bitcoin high during cycle: $19,688

525 days after halving

Total market cap peak 546 days after halving

11th May 2020

Bitcoin price on halving date:$8624

Total Mark Cap on halving date: 235 Billion

Bitcoin high during cycle: $69,214

546 days after halving

Total market cap peak 546 days after halving

20th April 2024

Bitcoin price on halving date: $64,000

Total Market Cap on halving date: 2.31 Trillion

Date after 546 days will be: 18th October 2025.

During every cycle there is “alt coin season” and normally always one particular type of crypto whch performs the best. This year I am assuming it will be AI related crypto projects.

I have made a list of AI related cryptos which i have will have in my portfolio.

They are (In order of highest to smallest market cap):

TAO

RENDER

FET

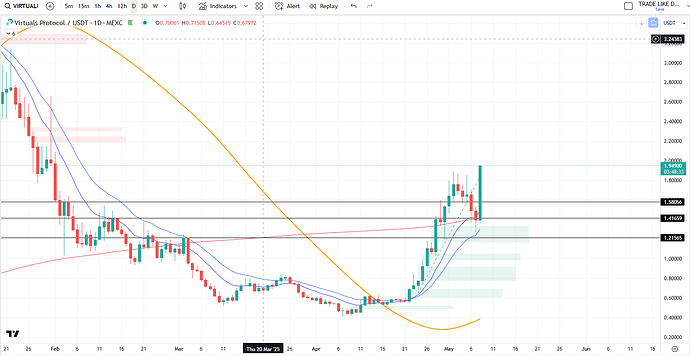

VIRTUAL

QUBIC

AI16Z

PAAL

AIXBT

NMR

GOAT

ALI

SPEC

FREYSA

HGPT

Please note - I have not done a lot of research on most of these only that they have some relation to AI. Researching crypto projects is not my strong point and most likely never will be.

I have made sure the list includes a mixture of bigger and smaller market caps to try and maximise any gains and cover a broad range.

In the next few posts I will explain the TA I am using and also my April recap.