Hi Traders. Today I will show you the best forex trading strategies and show how they work in live trading. So, let get started–

Scalping Strategy

Scalping is a trading style that specializes in profiting off of small price changes and making a fast profit off reselling. In day trading, scalping is a term for a strategy to prioritize making high volumes off small profits.

Scalping requires a trader to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain. Thus, having the right tools—such as a live feed, a direct-access broker, and the stamina to place many trades—is required for this strategy to be successful.

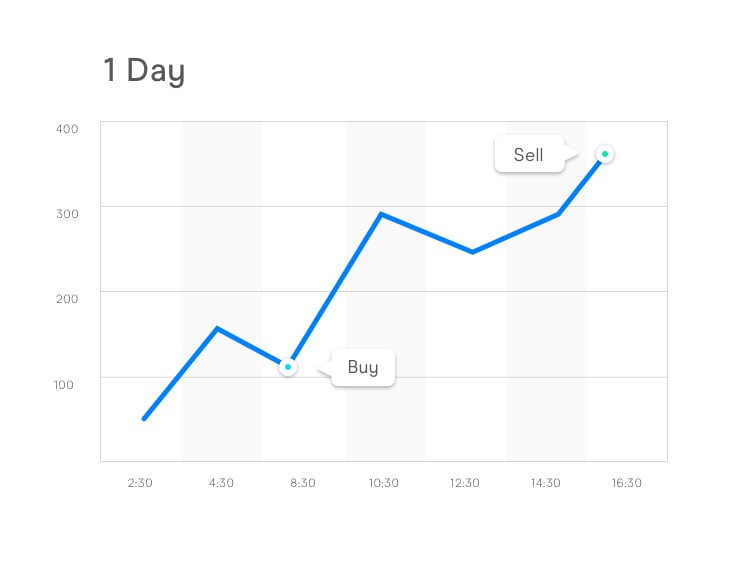

Day trading strategy

Day trading or intra-day trading is suitable for traders that would like to actively trade in the daytime, generally as a full-time profession. Day traders take advantage of price fluctuations in-between the market open and close hours. Day traders often hold multiple positions open in a day, but do not leave positions open overnight in order to minimize the risk of overnight market volatility. It’s recommended that day traders follow an organized trading plan that can quickly adapt to fast market movements.

Just before the open of the FTSE and other European markets, traders should look to study the support and resistance levels and the possible reactions to the previous night’s trading in the US, as well as moves that have occurred in the Far Eastern markets. Many traders look to trade European markets in the first two hours when there is high liquidity. Otherwise, traders usually focus between 12 pm – 5 pm GMT when both the UK and US markets are open.

News trading strategy

A news trading strategy involves trading based on news and market expectations, both before and following news releases. Trading on news announcements can require a skilled mindset as news can travel very quickly on digital media. Traders will need to assess the news immediately after it’s released and make a quick judgment on how to trade it. Some key considerations include:

-

Is the news already fully factored into the price of an instrument or only partially priced in?

-

Does the news match market expectations?

Understanding these differences in market expectations is crucial to success when using a news trading strategy.

Swing trading strategy

The term ‘swing trading’ refers to trading both sides on the movements of any financial market. Swing traders aim to ‘buy’ security when they suspect that the market will rise. Otherwise, they can ‘sell’ an asset when they suspect that the price will fall. Swing traders take advantage of the market’s oscillations as the price swings back and forth, from an overbought to an oversold state. Swing trading is purely a technical approach to analyzing markets, achieved through studying charts and analyzing the individual movements that comprise a bigger picture trend.

Successful swing trading relies on the interpretation of the length and duration of each swing, as these define importance to support and resistance levels. Additionally, swing traders will need to identify trends where the markets encounter increasing levels of supply or demand. Traders also consider if momentum is increasing or decreasing within each swing while monitoring trades.

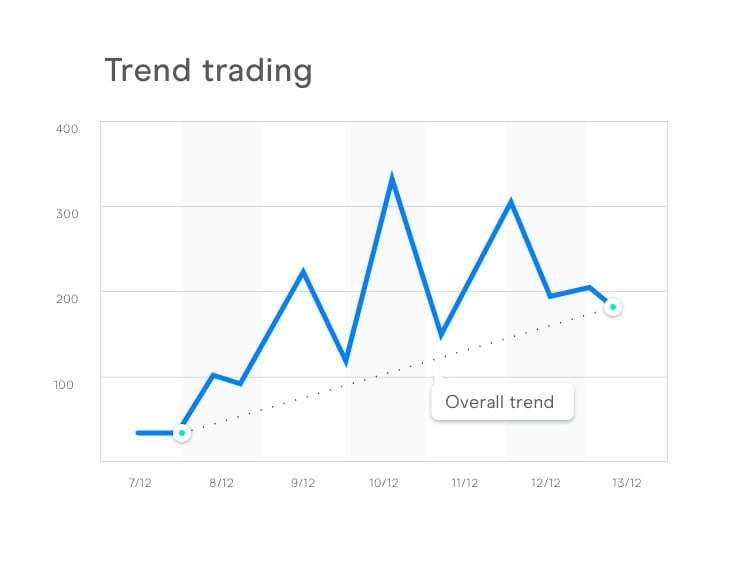

Trend trading strategy

This strategy describes when a trader uses technical analysis to define a trend, and only enters trades in the direction of the predetermined trend.

‘The trend is your friend’

The above is a famous trading motto and one of the most accurate in the markets. Following the trend is different from being ‘bullish or bearish. Trend traders do not have a fixed view of where the market should go or in which direction. Success in trend trading can be defined by having an accurate system to first determine and then follow trends. However, it’s crucial to stay alert and adaptable as the trend can quickly change. Trend traders need to be aware of the risks of market reversals, those which can be mitigated with a trailing stop-loss order.

Several trend-following tools can be used for analyzing specific markets including equities, treasuries, currencies, and commodities. Trend traders will need to exercise their patience as ‘riding the trend’ can be difficult. However, with enough confidence in their trading system, the trend trader should be able to stay disciplined and follow their rules. However, it’s equally important to know when your system has stopped working. This usually occurs due to a fundamental market change, therefore it’s important to cut your losses short and let your profits run when trend trading.

So, please comment below which one is your favorite strategy and how you extract profit from the market?

Best of luck with your trading!

Source: 6 Trading Strategies Every Trader Should Know | CMC Markets