cool, thank you. i was just curios how u look to enter a trade, since u ve caught that move and i didn t cos of different view and expectations. i m always learning.

cheers

No its perfect that’s how we learn. I wanted you to see from my perspective what I saw. I look at the long term trend of a pair and follow that because obviously with the current situation pairs have large range areas currently. Even the closing shows a bullish reversal in play on the D chart and I expect it to hit the mid 1.41 or 1.42 region before taking a pause for direction.

Close them

Got some USD/CAD still cooking and added more positions from when I held them over last week. Looking for it to jump into mid 1.41 today and let’s get some good setups going on.

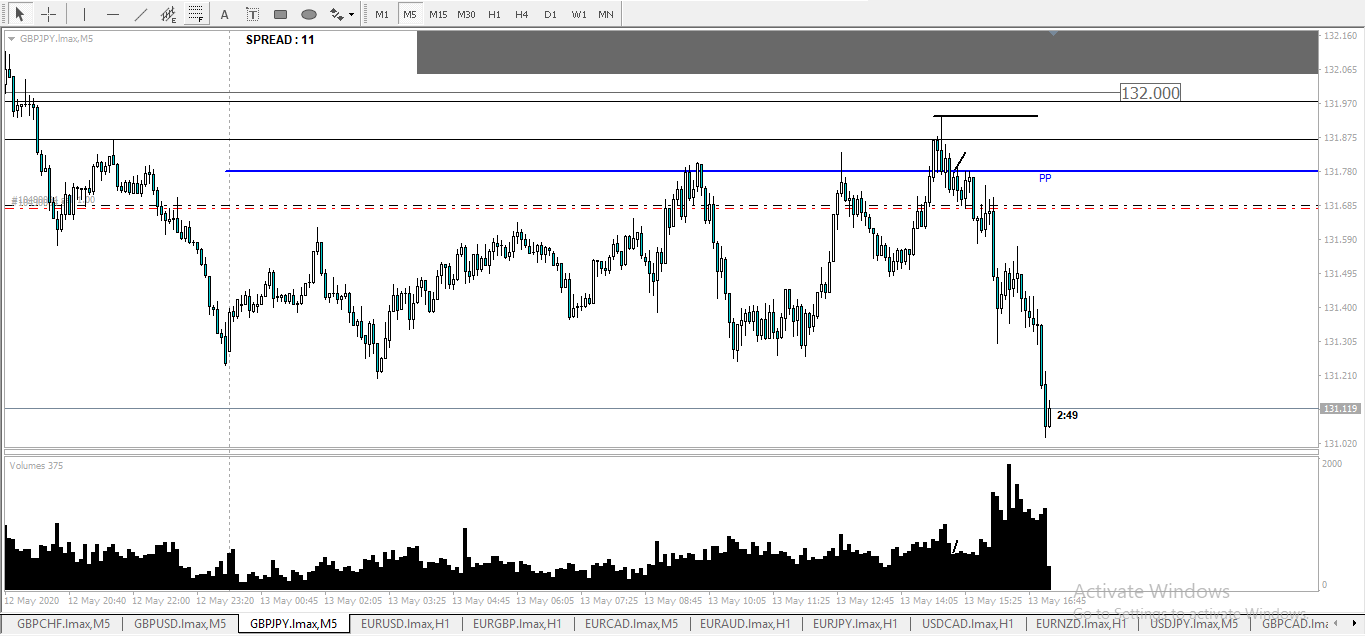

literally just took this trade now, only trade for today mind u that s a 9 pip stop, going for 2R and see from there how it behaves

and that s what i was looking at 1hr that made me look for an entry setup on 5m

for the other vsa thread lool

u guys flagged that thread till they removed it…sad…u should ve kept it as an example of what not to do

charts for this coming week that i m interested in.

so far i m seeing dollar strenght according to the vol that came in last week, also the yen looks strong for now atleast, ofc that can change .

swiss yen, as it stands right now i m gonna look to short, unless some high vol comes in off the lows.

aussie dollar, so far to me looks like distribution, so i d expect a break and continuation down, unless that support gets faded and high vol buying comes in.

same thing for kiwi dollar, downwards slope, unless they decide to buy the so called break of support, trap traders in short and then go long, but for that high vol needs to show.

EURO YEN in a big channel, the simetrical move would look to go exactly to that channel support. the vol shows more sellers then buyers at the moment, so downward bias.

EU also looks rather weak at the moment, so i ll be bearish for the start of the weak and go from there.

same story with GJ.

This thread seems very interesting . It is fun and informative to have such discussions

the spread increase got me in with these buy stops, anyways, the proper way would be to wait for a bull candle to close and then enter

target always 3times the SL, and BE set at R1

just entered, and the other 2 pos on EC and EA are in profit and SL at BE

another possible buy scenario, SL 20 something pips 1 hr setups, target atleast 3R

some other possible scenarios, altho weekly and daily are uptrends by def, possible sell scenarios are in play imo, at weekly double tops, resist etc, willingness to go lower

waiting on the 1hr candle to close on chfjpy, if it closes bull and the next 1hr trades 1pips above i ll get in long. and i guess that could be all for todays london, maybe some moves at NY open

updates

only trade so far for today

looking also at GBPAUD and GBPNZD

i took also the other 2 trades, GA and GN long

let s see how it pans out…altho beeing friday, can t expect 2 much movement

only trade so far for today, targetting the daily high of the range

Wondering which is the best way to test strategies.

forex tester or trading view, ofc depending on the rules u have and confirmations etc…if u need multiple timeframes to confirm a trade and so on…and on the amount of discretion ur market aproach uses…if it s only mechanical then it s easier