A small development: I resisted FOMO with an NZD/USD trade.

I was in the process of filling out my journal entry and placing a market sell order. It would have been a small position for starters–just 0.038% risk.

But I decided to wait.

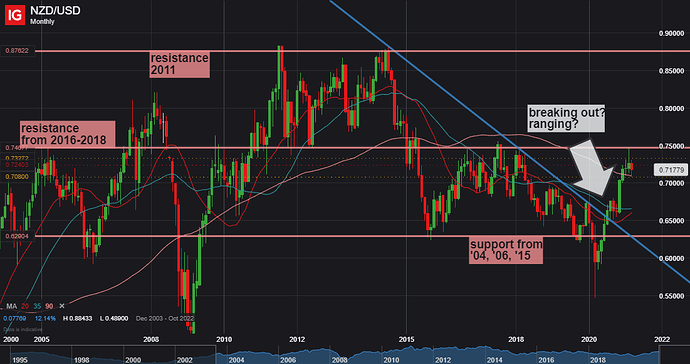

Here’s the M1. It looks like it’s breaking out of a downward channel. Much like EUR/USD and USD/CHF. However, it also looks like it’s in a range. I really like trading ranges. The entries, SLs, and TP are very clear. However, there are several things for me to figure out before I jump into this trade.

If it’s breaking out, it could keep going up. If it’s ranging it’ll keep going down.

I’m inclined to think it’s respecting the range limits because on Feb 23, 24 it bounced the zone immediately. Coincidence?

Here’s the D1 current consolidation zone.

I’m planning a straddle OCO. However, the NZD/USD in 2016 and '18 has bounced the resistance, then returned to hit it shortly after.

I’m suspect of this.

So, even though I like the swing/consolidation/swing rhythm this pair has, I have to think how I’m gonna trade this. Trading the MA on W1 would be unprofitable. But the D1 is great. Lots of volatility.

I could trade the MA and TL. I may even scale in.

But earlier today, I was so ready to just jump in. It’s half way thru its range, and I wanted to trade the remainder of the range, then ride the break out. This was my FOMO.

However, I’ve had a history of trading these little moves and getting chewed up. It’s the equivalent of trying to grab money at the bottom of a blender. Not a good idea.

I’ll set an OCO with a wide SL, and then watch it closely in case it decides to bounce resistance again.