Very kind and patient of you. Would be helpful if this reply is pinned at the top of the page, regardless of the page.

Funny going back several years and seeing what I said, I try to be consistent and what I said 5 years ago should be on point with what I said yesterday. But I am only human and sometimes I need to read my own past post to keep on course

How do you enter this, as from the sw table. Gbp seems stronger than nzd?

Yen pairs started the day positive but then about noon NYT someone hit the sell button and everything crashed,

Yup. Shorting AJ and CJ. Weirdly, they always go up in Asia session. Then got hammered when UK/US come in.

Thanks Dennis for the thread. Works pretty well on daily with 1.7 atr sl for me. Still finding ways to incorporate this with strategy quant to make full use of it.

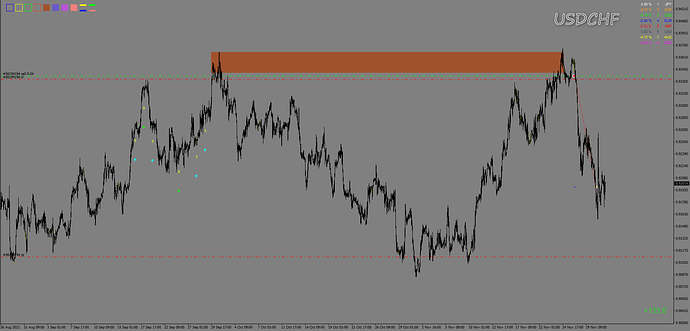

When I see price vigorously react to a level under high SW readings. I mark those levels and leave it on the chart. And in future if and when price test these levels - depending on

their reaction I take a trade.

A green day for Yen pairs, I was expecting another afternoon of selling like yesterday but today Yen pairs mostly held on to their gains led by GBP, US stocks look like they have found some support be it weak support. The market is jittery about the new virus and government officials are foaming at the mouth at the thought of new lockdowns and forcing people to take a vaccine that has no effect on the new virus. We clearly are living the back story to the novel 1984

Downtrends are fine but hopefully risk-off and global economy suppression won’t continue for ever. But I’m finding it hard to think up a fundamental news and events sequence that will dramatically neutralise all the bad news. I can’t see there being a V-shaped recovery for the comms currencies.

another day of blood in the street, the good thing is SW is keeping us on the right side of the trade, Top Trade AUDJPY short has now made nearly 200 pips from its entry

That is a big gap between 1 and 8, Crypto got hit hard this weekend, it could be an ugly day on Monday. But our Top SW Trades are doing just fine. Who says currency trading is high risk

Thought I’d take a look at the long/short balance of traders with open positions with my broker.

On AUD/JPY, 67% are long. Meanwhile on AUD/USD 73% are long, while on AUD/CHF its currently 50-50.

On NZD/JPY, only 33% are long. On NZD/USD 67% are long, on NZD/CHF its 50-50.

So there’s some disagreement but I think we can say there’s some preference for being long, even on these wretched pairs.

Have to note that only 31% of their active traders are profitable.

A classic case of traders trying to call the bottom. And they might be right, at the moment, given the changing news on covid and how it affects the risk sentiment.

But I do have a pending order short in both AUDJPY and AUDCHF right now, and open positions in AUDJPY and NZDCHF.

Last week I closed AUDUSD short for 220 pips at the big D1 support. That was me also guilty of calling the bottom (but in healthy profit). I missed another 130 pips …

Very interesting that only 31% are profitable and 67% are taking the other side of my trade … I have had a really good 3 weeks swing trading SW pairs

You’d have to find the average of each currency across all of its 7 pairs to be more accurate. Forex moves towards the minority sentiment (contrarian)!!!

Where did you get these readings from?

The broker shows the percentages of long and short clients at the top of the chart for each pair. The figures represent the percentage of their clients with open positions who are long and short at that specific moment. Of course, the figures are just a snapshot - they don’t disclose how many clients have open positions, nor how much money is involved, nor how many positions are involved.

It is the same mental state that has people betting red after 3 black numbers come up, also called the Gambler’s Fallacy

Being a contrarian trader and going against the crowd has always been my trading philosophy

( that is when I became a profitable trader, I was part of the majority chasing the wrong side of the trade early on)

Hi Dennis

I only like to go short on these. Do you go both long and short or do you have a bias?

Thanks

Matt