Hi, A golden Tip by @tommor, thanks

Going on holiday now for few weeks so won’t post SWA

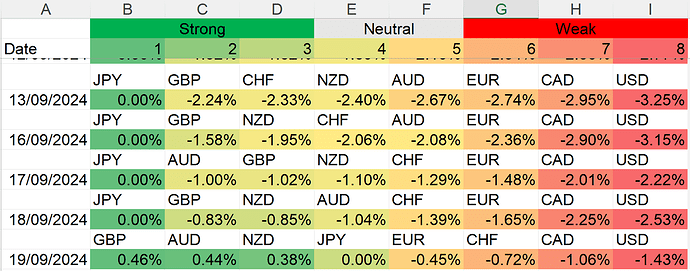

USD weakness continues, still some big news these last 2 days of this week.

The USDJPY according to my way of monitoring this method.

New top trade GBPUSD. Fundamentals are strong here. Central bank divergence between BOE and Fed. BOE standing pat and not raising rates at their recent meeting. Rates markets only pricing in ~50BPS of cuts before end of year, compared to the Feds 100BPS in the FOMC dot-plot.

The bond yield differentials support this and the difference between the UK and US 2 year and 10 year spread widened by 2BPS and 8BPS respectively.

what happaned to strong weak analysis???

Hi, Mr Dennis is still on vacation.he posted that…

Morning guys

I did try and continue, but as it’s not my thread it didn’t let me post more than 3 times in a row. So thanks for replying and unlocking it ! ![]()

I am back! I hope everyone made money in my absence, Thank you to everyone who kept things going while I was away.

Welcome back, not much has happened, and I am cautious about the US election this week.

Question: do you sort the pairs manually as this is not the 1st time I noticed a mix up in the numbers? Why not make Excel do the sorting as well as the math?

Included my current sort, which matches pretty much spot on, considering how close the numbers are.

Welcome back Dennis,

Hope all went well for you.

Yes, and I do make mistakes, so don’t bet the farm on anything you see here

I think this looks right, if you see any big differences let me know, There could be a flight to safety until the election results are final

Hello guys

As Dennis dedication and consistency inspired me to keep my own spreadsheet, I have added bond yields for USD, GBP, EUR and JPY. I focus mainly on these currencies only. I have a 2 year bond yield spread that I fill in daily that I can post on here from time to time if people find useful?

Welcome back!

Watch out for some big volatility as the election results start coming in, it could be a wild night

I would say the markets like the way the US election went