We will see, last week of November into the first week of December are normally down weeks ahead of the Santa rally, we seem to be heading in that direction, but we have a news driven market that can turn on a dime based on the next headline

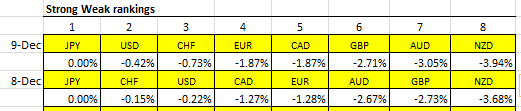

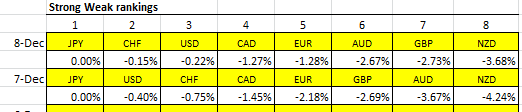

I am not sure why but I cannot upload my rankings, so here is the order hand-typed

JPY

USD

CHF

CAD

EUR

GBP

AUD

NZD

another up day for most Yen pairs, top trade AUDJPY has completely reversed its move, so I hope you locked in profits

update: Look at my post 5176-7 bro,l i did the contrarian analysis and AUDJPY flipped today, so more retailers are shorting it hence it’s going up @BCShaf

Yen pairs were up again today but US stock rally looks like it is running out of steam and that will affect the Yen pair rally

Can you clarify this please?

Which is the decider; the long short condition or the percentage?

For instance, if EURUSD is 95% Long and 5% Short, is the assignment still EUR +1 Strength Unit and USD get -1 Strength Unit?

In that case, take no notice of the strength percentage, only the Long vs Short condition.

Thanks

Question on the Sentiment, when 85% of traders are Long, then we should be Short, correct?

That is the current situation for GBPAUD

So to me, that means most traders are contrarians; they are trying to do the opposite of price but in fact, being a part of the majority herd they are in the wrong; your thoughts.

Another one to watch, Dennis has NZD as the weakest, 91% of traders are Long NZDCAD, is it Time to Sell?

Most traders try to catch tops and bottoms, but the reality is there’s a much better chance of a trend continuation than of a reversal.

In future, probably not a good idea to relate to Post 1381.

The post is poor and he sounds angry.

Just a thought.

Poor post. Explains little and comes over the wrong way.

After reading previous posts it does not make much sense. I can only ask again why the JPY is the one that you use your calculations for?

Thank you

That post also refers to Post 1267

Does that help at all?

If not, please be sure to give a critique.

Honestly, these questions have been asked ad nauseam over the past 3 or 4 years, unless you provide extra detail in your specific question, I don’t see why the answers do not satisfy your curiosity.

You do not see why the answers do not satisfy my curiosity?

“Nothing wise about it, only a convenience, and maybe lack of computing skills”.

No interest in comments like this.

I have no critique.

It just does not make much sense when put in this way.

Not those answers, the answers given by DENNIS.

Which part are you not understanding? The calculations? The results? Why use YEN?

It’s already been proven that the same result can be obtained no matter which currency is used as the base.

Dennis has been a huge asset to the Forex community for years. This thread was built on helping each other and positivity. If you can’t adhere, please politely follow but refrain from the negativity.

Hi yes I agree with you.

I am just trying to make sense of it and when I was referred to other posts they did not help me understand.

I think it is hard for new people to grasp what it is but that could just be me lol

I think we can say that most traders are not consciously assessing the situation and deciding to take contrarian positions. They are blindly gambling on a trend failing and making them much money very quickly so they can get out of the trade asap because they really have no idea what risk they are exposed to and therefore think it must be safer to make some fast money and get out quick.

They are intuitive contrarians, they are just buying because price is low and selling because price is high.

What do all these Yen pairs have in common, Yen is listed last making it a nature common denominator. Unlike the US dollar where taking a long position on the dollar would require going long USDJPY but going short EURUSD , this adds confusion and another step to compute my rankings, I like keeping things simple stupid and using the Yen the way I do does just that

That makes perfect sense thank you for that I now understand it

Down day for Yen pairs, now the question was today just a healthy pullback following three up days or has the Yen pair rally ended