Only ever long?

Ugly start to the week, we are still in flight to safety mode.

Note; most of the time when Monday has a hard selloff in stocks, buy Friday we will be above Monday’s low, let’s see if that holds true at weeks end

By top trade I mean the strongest currency against the weakest.

When all the markets are in the red and being short term bearish it tend s to make other equities bearish also most of the time. IMHO- in other words don’t be bullish in a bearish market but also it means equities are re-setting theirselves for the same setup when they where bullish.

IMHO.

GBPNZD is 1/8 again, this trade first started on December 27 and if you took the trade it has made a new high 10 days in a row. SW does it again

Big late day reversal in stocks, Nasdaq even turned green, my guess is we have seen the low in stocks for the week and might get a little rally here even if only a dead cat bounce

We had a follow-through day with stocks rebounding and this time the currencies joined in the buying

Top Trade GBPJPY after a Flag Pole pattern pull back, it looks ready for new highs

Stocks open higher, Yen and USD weak. The rally continues

The rally seemed to run out of steam in the last half of the day, nothing to do yet but if we were to break below the lows from Monday that would confirm a downtrend

Stocks sold off and the Yen rallied. GBPUSD is our new Top Trade but that is not an encouraging daily candle to enter a new trade on

The selling continues, we are back to risk-off mode

Down week for Yen pairs but Pound refuses to give up the top spot

Stocks start the year off on a bad note, but the weekly of the S&P show an uptrend with just a minor pullback. Sentiment on the market is very negative, with lots of know-it-alls calling for a market crash. That tells me we could be looking at new highs soon

US markets are closed today, so we will see tomorrow if today’s gains show up in stocks

Yen pairs all green today

Long Term SW trade USDJPY has completed a 3 candle rising star, very bullish!

If you found a reason to remain in this trade since September 27th you would be up 300 pips and up as much as 500 pips

It was an ugly day for stocks but currencies while we’re down, it was not a huge move.

NZDCAD is our new Top Trade

Gains today in Top Trade NZDCAD

Miracles happen when the S&P moves upon extreme fear & greed.

Like a pump & dump ponzi.

Risk-on currencies AUD and NZD are leading the market lower, The DOW 30 is sitting just above its 200 DMA, the NASDAQ has already broken its 200 DMA, S&P still has a ways to go but it looks like it will join the party.

Buying stocks or Index ETF’s when the price is below their 200 DMA has been a good strategy and I will be a buyer once the selling panic ends

What do Americans do when the Markets are crashing, apparently we reach for an ice-cold Coke

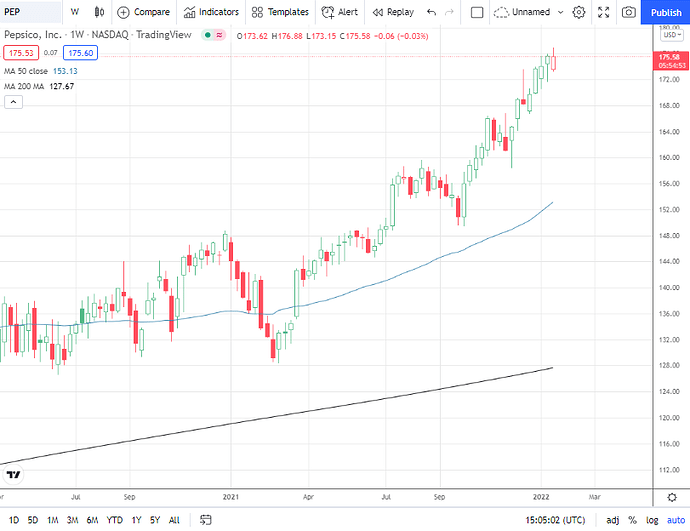

Both Coca-Cola and Pepsi are holding up very well during this market correction