I watch them but do not chart them with the currencies

Well, for instance - SP 500 is also a pair just like the currency pairs. In this case SP500/USD. Unlike Dennis I use USD as my common denominator since it pairs with the most instruments, not just fx instruments.

So adding XAU/USD or oil or a stock index etc really isn’t that difficult?

What Is the S&P 500?

When news reports and financial experts talk about what’s happening in “the stock market, chances are they’re referring to the S&P 500.

Indexes like the S&P 500 track the prices of a group of securities. They aim to represent the performance of a particular market, industry, or segment of the economy—or even entire national economies. There are indexes that track every asset class and business sector, from the U.S. corporate bond market to futures contracts for palladium.

The S&P 500 tracks the prices of large-cap U.S. stocks, or stocks of companies whose total outstanding shares are worth more than $10 billion. By following the S&P 500, you can easily see whether the largest U.S. stocks are gaining or losing value.

Therefore, the S&P 500 is often treated as a proxy for describing the overall health of the stock market or even the U.S. economy.

Basically, it is the strength meter for stocks, and not the focus of this thread which is finding the best Forex pair to trade.

But still be interesting to see your calculations and Excel sheet when you figure it out…

So how would you approach it? Lower time frame confirmation that aligns to the daily time frame?

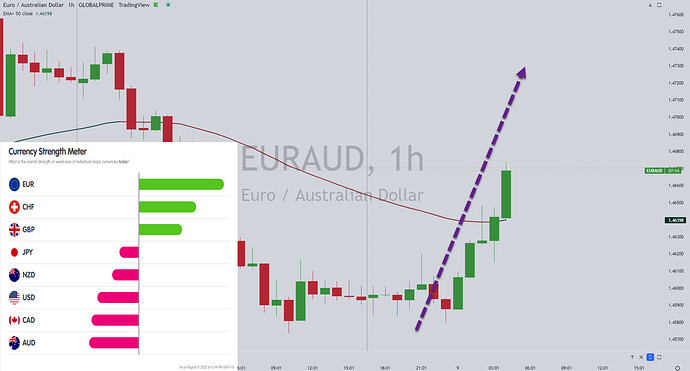

If you like waiting for pullbacks we had one today in Top Trade EURAUD*

The downtrend channel for Oil continues, I paid 3.29 for gas last week, could sub 3 dollar gas be close at hand

Markets gap up on open, big move for Bitcoin, oddly Yen stocks are down, but you notice that the risk on currencies AUD and NZD are down the least.

Is the bear market for stocks over or is this rally a bear trap, my crystal ball is in the shop, so I would love to hear everyone’s views on where this market is headed

I’m not expecting the stock market to turn bullish yet, which probably means it turned bullish weeks ago, lol.

Predictably unpredictable.

Without wishing to sound arrogant Dennis I honestly think if we don’t know where the market is going then nobody knows where its going.

I’m getting fewer and fewer trend-following entry opportunities but actually doing alright on momentum-based entries. In both cases I’m being really cautious - now looking for at least 2 successive closes in the same direction plus a breach of a new high/low.

It never works well for me when I play short term with tight stops, the market knows where people place stops and price always goes to those levels before reversing

Are you criticizing your own method?

I did not mention stops, I did not mention short term

These are trades for long term as per SW signal given

That looks interesting, do u have facts ? Every daily candle it’s possible or must happen something special?

Facts? No, I don’t have facts.

Are you following the thread?

Look back a few posts; the most recent signal was EURAUD

Yes, it was a daily candle and it was special…

Think about it… Dennis even suggested to enter trades on a pullback

Anyone else following and not able to understand this simple picture, I have no words…

Please get help

Why are you so rude to everyone? I do not understand why you are allowed to remain on the forum speaking to people like that.

I called you out on this two times before and you just report my post so it gets removed but your behaviour remains the same.

Please sort it out, I am tired of reading how you speak to people here.

I can only agree with mjh2222, you seem really rude.

I was planning to share a little of how I trade in many ways similar to Dennis’ style but with some differences. People like FOK help me remember why I pretty much left BP years ago.

I will not be posting in this thread again and if I find the time to start a thread dedicated to my trading, you’re not welcome there FOK fyi.