Look for the US dollar to rally the rest of the week

Look for the US dollar to rally the rest of the week

I finally got my computer back

Note; I will be on vacation (holiday) all next week and will not be watching the markets. US elections are next Tuesday and this could make for some large swings for stocks and currencies

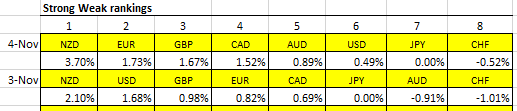

All green day ( except for USD)

A nice surge in NZD, USD got hit pretty hard

This is my last post until Nov 13,

You all have a great week

Enjoy your vacation Dennis. Rejuvenate. Thanks for being you; giving unreservedly to help us be great traders. For me following what you do has given me that ‘something more’: psychological trading confidence. It is a great addition to complement my technical skills.

Thought I would tell you. Sometimes I hold back on social media, which is not helpful. Why hold back something positive!!!

Unusual to see AUD and NZD recently behaving oppositely.

@tommor, Perhaps AUD has been dragging its feet a bit but comes around to following NZD as you have pointed out before?

Well I’m sure there must be some convergence between these two just around the corner.

Market is still being lead by the DOW, this tells me the smart money is still buying safe havens and selling risk. maybe we get a Santa rally but new lows for the NASDAQ seem likely

Red day for stocks and an all green day for Yen pairs

If you are a candle stick trader, there is no better signal than the pin bar reversal ( also called a hammer), you can find these on all timeframes, the longer the timeframe the better. If you spot one, feel free to share it here .

the once-great dollar continues to decline, is this really a trend change or a needed pullback,

Stocks down, still trending toward safety , Currencies led by Euro and Pound

Guys, please can anyone suggest a good strategy to trade with Dennis’ rankings. I’m still struggling to make profits

Here is a pattern I have seen repeat with some consistency. As I have said before you want to trade in the direction of the long-term trend, if you trade against the long term trend also called a counter-trend, you can still make money but those trades tend to last only a few days before turning against

you. Here is a great example in EURJPY, I use the 200-day MA to determine long-term trends. EURJPY is well above its rising 200 ma, this tells us to look for longs but SW gave us a counter-trend short signal, If you took this trade you only had a day to take profits before a pin bar reversal signaled a return to the long term trade. A counter-trend move that ends with a reversal right at or above the long-term ma is a near-perfect setup and one I will be watching for in the future, If you spot one of these, please share it with the group

Slow day

IMHO you would need to give more details, for example, are you a day trader closing by the end of the day?

Or do you want to hold for days and weeks, which is what the thread is about?

The underlying question is, can you give me an entry strategy or signal to use with this system.

Read back through the thread and there is a method for entering on the 1-hour using the 200 SMA, that might be what you need.