“Nowhere does history indulge in repetitions so often or so uniformly as in Wall Street.”

- Jesse Livermore

“Nowhere does history indulge in repetitions so often or so uniformly as in Wall Street.”

after early mayhem, we did see a pretty good bounce back into the close

stocks rallied in the afternoon, the NASDAQ even finish green

Aye SNB and the Swiss regulator put out a statement that Credit Suisse is ok with capital right now but if that changes the CB will provide liquidity.

At the same time a leak from the Swiss suggest ‘an announcement’ come Monday which could well be a merger of some sort.

So better chance of nerves being settled until then.

Still think that all CB’s need to think hard about these endless rate rises and their unintended consequences.

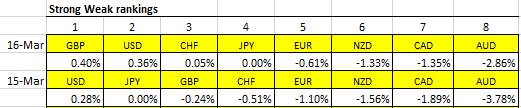

GBP takes #1 by a hair

GBPAUD fail in February

and down we go again, but look at Bitcoin

I am looking at a monthly chart of the tech heavy NASDAQ, following the peak in year 2000 it would take the NASDAQ 15 years before seeing another new high. With rising interest rates, tech companies starved for cash and a major bank failure, could we be looking at another 15 years before we see the NASDAQ at new all time highs .

While I am a long term investor, I don’t think I can wait that long.

The only good thing I can say about last week is the Yen has stopped following the stock market. Stocks down , Yen up, that is how the world is suppose to act

Good day for Stocks but a mixed day for the currencies

Interesting day so far, we have an up stock market led by the Nasdaq, which would indicate a risk-on market but our risk-on currencies AUD and NZD are weak

it is getting crowded at the top

We have a risk-on rally in stocks but the risk-on currencies have a different opinion, who will be right?

@Dennis3450 My guess is the FED will sit on their hands and do nothing tonight, (5am my TZ) while taking all the glory for the slowing US economy…

NASDAQ up, no matter what the announcement… zero increase will accelerate my LT positions…

Stocks and Yen pairs all take a big hig on the Fed’s 0.25 interest rate hike, normally you only see such big moves when the Fed does something no one expected, but the 0.25 was the expected hike, so there must be something else the market is looking at

Note; I will be traveling tomorrow and will not be able to post an update

I do hope you are right but when has the Fed ever given us a “soft Landing” ? It has always been boom or bust

It’s a total sh!t show globally… And no one has a clue when the Merry Go Round is going to stop!!

Those of us older folk won’t be severely affected, most purchased our property(s), started our businesses in lower cost fiscal environments… Those of us that purchased property(s), say 1990 -2015 will have have no mortgage or enough equity, saved wealth etc. to see us through…

Right off the Bat, after 24 months of lockdowns and Job losses caused by stop start economies, once again, it’s the 20 to 30 something’s that have to bare the brunt of more Government incompetence…

Governments who threw money into the economy like confetti due to recently *revealed over reactions* to the pandemic…

Currency circulation more than doubles in 18 months in most countries… Except in nations such as Sweden, who took the more measured approach to most wannabe tyrants in the Western World…

Now we have the perfect storm of wayward inflation after 24+ months of fiscal stupidity…

The result… Affordable Property has gone off the clock, affordable mortgages are practically unobtainable, and rental fees have gone through the roof… Adding to a massive increase in homelessness in major cities across the globe…Putting a roof over your head is now a serious challenge for so many…

“Quick, lets throw some more 20 to 30 something’s on the fire… Ma & Pa might get cold…”