NYSE closes at 21:00. You could have just googled that rather than arguing the toss.

The only doubt I have is that the 22:00 candle makes more sense for this system since the 4h and daily candles typically line up with this.

NYSE closes at 21:00. You could have just googled that rather than arguing the toss.

The only doubt I have is that the 22:00 candle makes more sense for this system since the 4h and daily candles typically line up with this.

We don’t really care about NYSE = Stock Exchange, this is Forex trading, not Stocks trading.

Many times, I have pointed out FOREX daily close is New York local time 5pm all year long.

If you choose to ignore, I’m done helping people here!

Gator, good to see you are still liquid, and you still have your hide

The Ever Salutin FL VIPER

Stocks rebound and currencies where mixed

Hey F, you do know that when you are trading Spot Currency, you are trading a derivative right. So on the macro level, all of the stock markets matter, and always impact the underlying products. So being mad will not change the reality.

The Ever Educational VIPER

Sounds great in theory, but in reality, it’s…complicated.

And the focus of this thread is on Forex, Strong vs Weak, as determined by 2 points of price, I’m going with that.

Hey F, most retail platforms close at 5 for server reset, my Currnex platform with my 3 primes do not, and that is one of the differences in retail and institutional. For educational purposes the charts I post here are taken from my Oanda retail, it fits most of the other retail platforms folks use here.

The Ever Swimmin With The Sharks VIPER

Not a theory, get a futures feed and watch the price action pre market of futures that correspond to the product one is trading. That’s why the Gator has had good success with his method. Anyway we have trade the way we trade, it is individual, so I wish you success.

The Ever Well Wishing VIPER

Good for you, good luck with your thread and the way you trade, bye.

I am traveling, no reliable internet here, next post will be on Wednesday

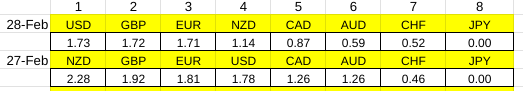

The last time NZDCHF was our Top Trade we did not see any follow-through, maybe this will be different

![]()

NZD was the big winner for the week

Got to love Monday’s market, starts off totally upside down, and there is big news looming on Wednesday, let’s see what happens.

all my attention has been on Bitcoin today, up as much as 6%, This market just wants to print money

Note, my numbers yesterday (26-Feb) for CHF were incorrect, below posting has been corrected

It is crowded at the top as the market switches back to safety with AUD and NZD lead currencies lower, but all eyes remain on Bitcoin as it is up as much as 7K today