The main goal of this thread is to show what Power Trades is and how it works in different markets. We will show some patterns on the ES and NQ futures, as well as discuss possible improvements to this functionality.

What the Power Trades?

Ok, first we will consider what the Power Trades is and how it finds zones.

Power Trades shows the zones with the execution of a large number of orders in a very short time, which will affect the price change with a high probability.

Here are a few examples of how it looks like

How it finds zones?

There is a continuous process of placing, changing and executing orders in the market. All this affects the price change and the expectations of traders regarding the future price.

When a large order appears at a certain level, the price is more likely to come to this order and it will be executed because the market is always looking for levels with liquidity. This already applies to the order flow and the mechanics of orders matching, so we will omit the principles on which the orders are matched.

It is only important to understand that “abnormal events” occur in the market at certain times. Execution of a significant volume of orders in a very short time is one of such events.

The Power Trades Scanner has several important settings that directly affect the results:

Total Volume — the minimum value of the volume that should be traded during the specified time interval

Time Interval, sec — the time over which the Total Volume should be traded

Basis Volume Interval, sec — this parameter shows how much % took the traded volume in the total volume for the specified time.

Zone Height, ticks — this parameter will show only those zones where the height is less than or equal to the specified value (in ticks).

Level2 level count — the number of levels that are involved in the calculation of Imbalance and the Level 2 Ratio column in the table of results.

Filter by Delta,% — the parameter will show zones that have a delta value greater than or equal to that specified in the setting. The value must be specified by the module, so the table will show both positive and negative delta values. We recommend paying attention to the zones with the delta above 50% (taking into account the specifics of each trading instrument).

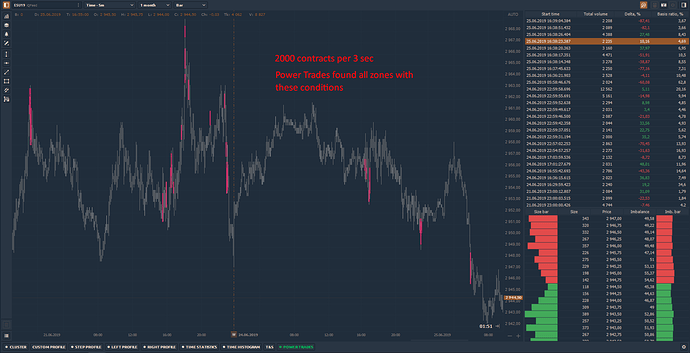

For example, let’s set the Total Volume of 2000 contracts and Time Interval in 3 seconds on the E-mini SP500 futures. This means that the scan will be based on the available history and will show on the chart only those zones that have such a volume for the specified time.

Additionally, it is worth to set a delta value to filter out the zones with one-side trades. The more delta value, the high probability that the price will reverse.

So, as a starting point about this scanner, I think this information will be enough