This is going to be a short presentation on my use of trendlines.

I will be using 30 minute charts from my own trading platform, showing how I use trendlines to trade the past weeks EUR/USD price movements. I will be using these charts to walk you through a week of trendline trading so you can see how to make the most of trendlines.

There are two main reasons why I chose to use these charts.

First and foremost because I spent most of last week trading the EUR/USD so it is easy for me to remember what I did and why, secondly I don’t want to make a tutorial based on theoretical after the fact old charts that I didnt trade on.

By using my current charts from the past week you will be able to see this tutorial is based on a real live trading scenario.

I will only be looking at downward trends for now because even though I could show both up and down trendlines it would make the charts very cluttered with lines and harder for you to read and for me to describe, but it is worth remebering, everything I talk about these downward trends applies in reverse to upward ones.

I’m going to attempt to put this whole presentation on as few posts as possible so I will put as much on each post as is allowed, this forum limits posts to 4 images each so there should only be 4 posts, I want to try and keep it short and sweet so you can scroll through it easily instead of having to trawl through a ton of posts with interruptions etc, so if anyone has any comments they will be after the end rather than in the middle of it.

Before I start I want to answer two questions.

What is a trend ? and what does a trendline signify ?

These are important concepts to understand and will be neccesary in understanding why we do what we do while trading with trendlines.

A trend is the result of a large amount of people doing the same thing, as in a fashion trend, the reason it becomes a trend is because a lot of people do the same as everyone else.

This is a fundimental concept in forex trendline trading and the power of the trend should not be underestimated.

In forex trading the trendline helps us not only see that trend, it also helps us predict what that trend will do in the future.

In order to make the most of trendline trading the first thing you need to do is get in the mindset of a trendline trader, I’ll explain a little more about this as we go along but for now, what this means is you have to be aware you are trying to become a part of the trend, you need to be a follower of fashion, if you can do this you can get with the trend and make money from it.

In this presentation I will be using a couple of forex related terms that most of you will already know but just for anyone that doesnt, lets define support and resistance.

Support is a level at which the price stops falling and is usually the point at which a price reversal is seen, resistance is a level at which the price stops rising, also a point at which price reversal is usually seen.

Both support and resistance levels are temporary and can be breached later but this is what we want to happen, you will see why later on that too.

OK lets get started.

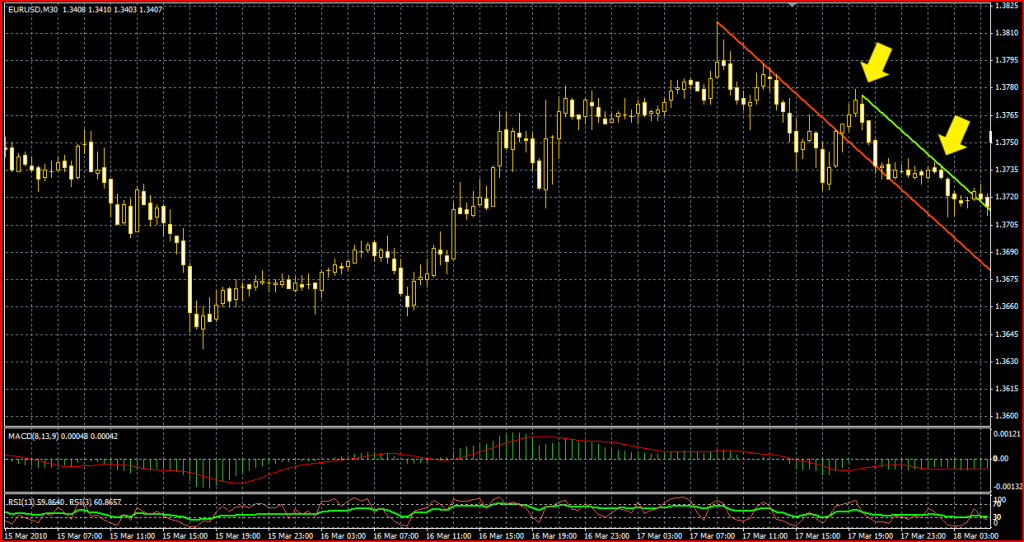

First of all lets take a look at our first chart, from 17th Feb.

As you can see towards the right hand side of the chart, there is a price rise which ended with a nice spike candle at the top, then a price fall began which I have marked by three yellow arrows, what we are going to do is mark out the beginning of that price fall with a red trendline, the way to do this is pull the line between the FIRST TWO obvious highs, so when you pull your trendline you want to see a high followed by a fall followed by another high.

Join these first two highs with the trendline and let it ride !!

…

Now this next chart shows the red trendline.

As you can see it was a short lived little trend, the trendline was broken shortly after I drew it when the price rose through it, so what do we do now ?

We leave that red trendline in place and we draw another trendline as soon as there are two new highs after the trendline break.

The reason we do this is simple, we are simulating live trading, if you are live trading you can’t see the whole trend revealed like you can in analyctic charts.

In live trading you only see the beginings of the trend so you have to mark it out with a trendline as soon as you can. Why ? You may ask.

Because millions of other traders are doing this, so we want to do what they do so we can see what they see and make our decisions on the same information they do.

If we wait untill a trend is established for sometime and pull trendlines across the average highs, our trendline wont match the trendlines of the live traders who are pulling theres as the action happens, and therefore our decisions on when to buy and when to sell will be out of sync with the rest of the trading world. We obviously don’t want that so we pull ours across the first two obvious highs that show themselves.

…

This next chart shows how we draw the second trendline.

As you can see after the red line trend break I have drawn the second trendline this time a green one between the first two highs after the red trend line was broken.

…

Now lets have a look what happend after that.

You can see the trendline was broken again I marked this by the first yellow arrow.

This trendline break was a small one, barely enough to be considered a break but there is one bull candle cleanly above the trendline, but only just, this is very important to note, it was only barely a trendline break, but we are still going to pull another trendline.

You can see I drew a yellow one from the high at the trendline break to the top of the next high that occured, where the second yellow arrow is.

We now have three trendlines drawn, lets have a look where they take us.

…