A trader’s journey is typically a long and painful route. Usually, to survive through this process a trader must be very patient with their studying of the market and strategy but simultaneously understand the process and most importantly survive through the journal i.e. not get burnt out, emotionally and monetary.

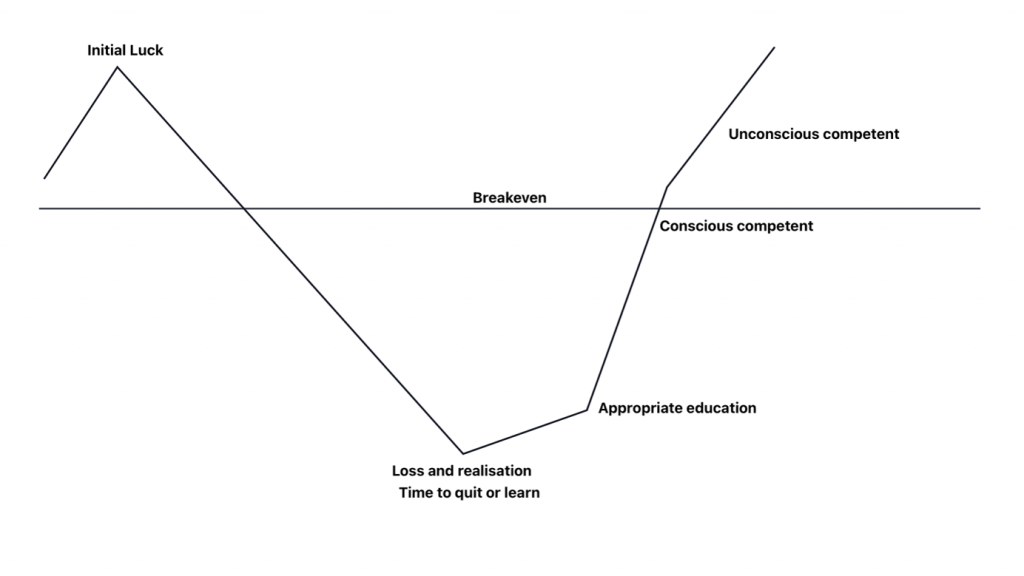

Here is a visual representation on how I see a trader’s journey:

Initial luck

When traders start, typically they do not want to learn and apply a strategy appropriately. They think they know what they are doing, make a bit of profit but this is purely based on luck. A trader without an edge and mature trading psychology. But the next step proves them a realisation.

Loss and realisation

This is where they keep applying the same luck, but it eventually runs out the market tends to humble this trader at this stage. They either burn their account or realise that the market is not based on beginner’s luck. At this stage, it’s either a make it or break it. The trader either realises that this is not the game for them, or they stick to it and education themselves the right now. This means, by learning a strategy such as the Elliott Wave Theory and learning how to apply it to the market.

Appropriate education

This is the main and first stage to success. It sounds like common sense, but you would be surprised how this stage is highly ignored. Even those who are aware of this but not everyone is willing to do things properly without shortcuts.

A trader must educate themselves by understanding the market, so you build an edge as an analyst like for example one of the most reputable strategies is the Elliott Wave Theory. However, this is not enough, as you are then just an analyst. In order to be a trader, i.e. capitalise from the financial markets, you must be able to have a trading strategy that you can apply to your analysis. Risk management is extremely crucial when it comes to managing positions and your portfolio. Finally, the most ignored, again it is to do with the human mind, trading psychology.

The human is not naturally engineered to be a successful trader therefore there is a whole process for you as an individual to go through prior to seeing any positive results. You could have FOMO, fear of entering the market, gambling tendencies, greedy or lack confidence. Even one of them can jeopardise your account.

Here are Elliott Wave Forecast, we have courses conduct by not only successful but professional analysts and traders you can start that stage here: Educational Products

Conscious competent

You consciously know what you need to do but it is not in auto-pilot mode. Therefore, you have to work a little extra hard to get things right, but the end result is good. This is where you are reaching breakeven. You make mistakes but you rectify them.

Unconscious competent

Analysis and trading are second nature to you. You are confident with making decisions and you are very sensible with your emotions. You pull the trigger at the right time and know when to get out at the right time.

Losses do not affect you as you know this is part of the business! And you have understood the market and your positions really well. You do not marry your positions and you adjust to the market accordingly. This trader sounds boring as he or she does not work on luck but instead on logic, intelligence, and experience.

Anyone can do this – therefore, so can you!

Source: Typical journey of a trader