The US dollar index rallied in line with last week’s bias on assumed short-covering. AUD/USD bears are retuning whilst traders pushed net-long exposure higher, making GBP/AUD longs of interest over the coming weeks.

By :Matt Simpson, Market Analyst

View the latest commitment of traders reports

Last week I outlined a scenario where Fed members were likely to push back on imminent rate cuts and spur short-covering on the US dollar. And so far, that is playing out well. I continue to suspect the US dollar has upside potential in the coming weeks, although it a it is now retracing lower on the daily chart. Fear not, as this could provide bullish opportunities at more favourable prices as the week develops. It is also interesting to note that traders were increasingly bearish on AUD/USD futures ahead of a large job growth miss, and that net-long exposure to GBP/USD futures remain on the rise. And that could bode well for bullish bets on GBP/AUD over the coming weeks.

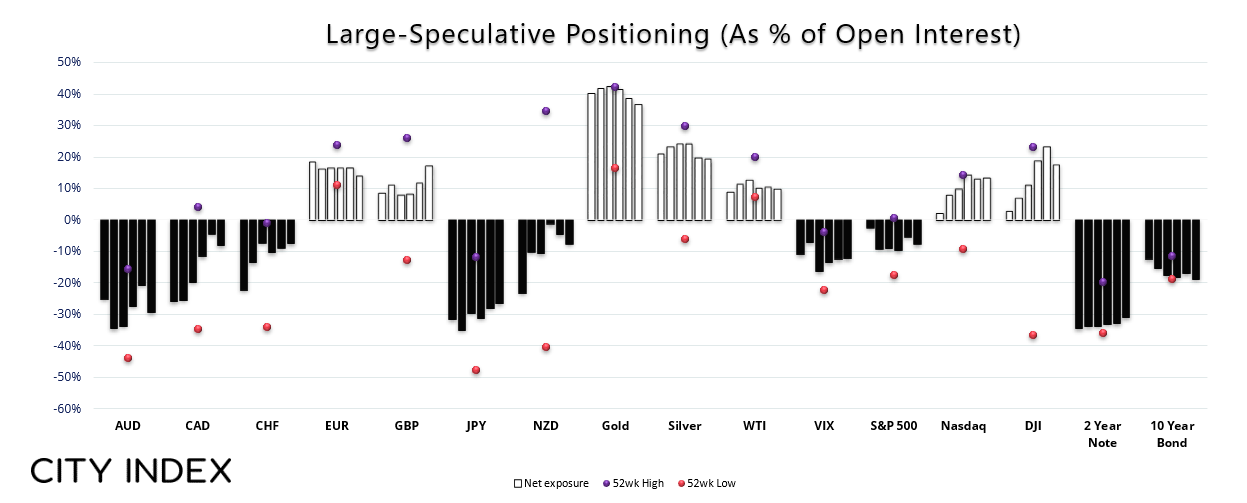

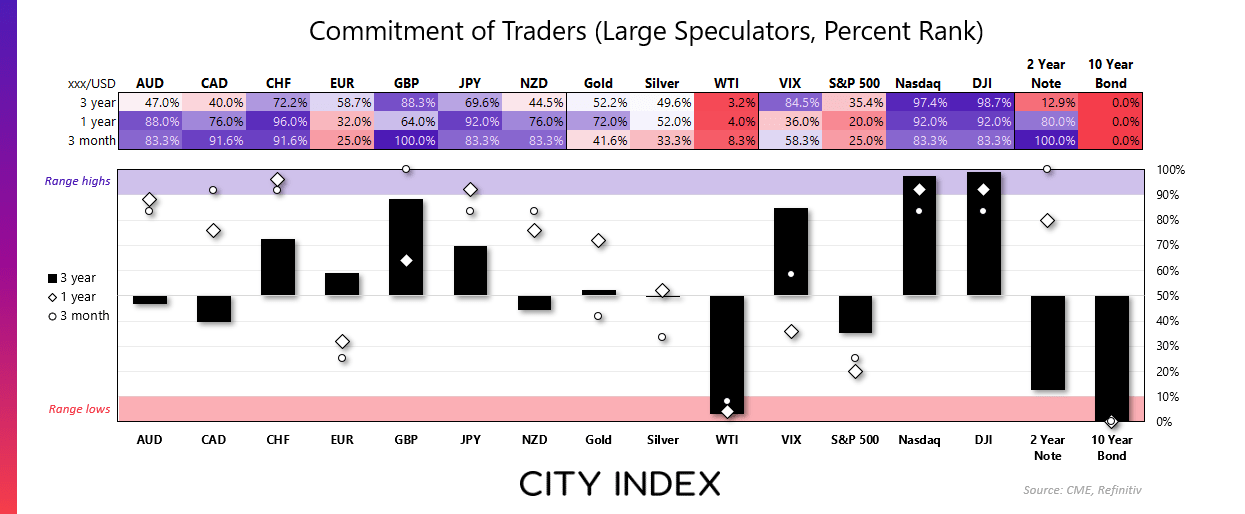

Market positioning from the COT report - as of Tuesday Jan 16, 2023:

- Large speculators increased their gross-short exposure to AUD/USD futures by 17.8% (14.1k contracts)

- They also increased long exposure to GBP/USD futures by 9.1% and reduced shorts by -11.6%

- Gross-short exposure to WTI crude oil increased by 15.1% among large speculators

- They were also increasingly bearish on metals, and increased gross-short exposure to palladium by 29.7%, platinum by 13.3% and copper by 7.1%

- Bearish positioning against the 2-year bill continued to diminish, with net-short exposure falling to a 20-week low

- Yet net-short exposure to the 10-year note reached a record high

- Traders took a bearish view on key metals markets, by increasing gross-short exposure to copper by 7.1%, platinum by 13.3% and palladium by 29.7%

- Gross-short exposure for WTI crude oil also rose by 15.7%

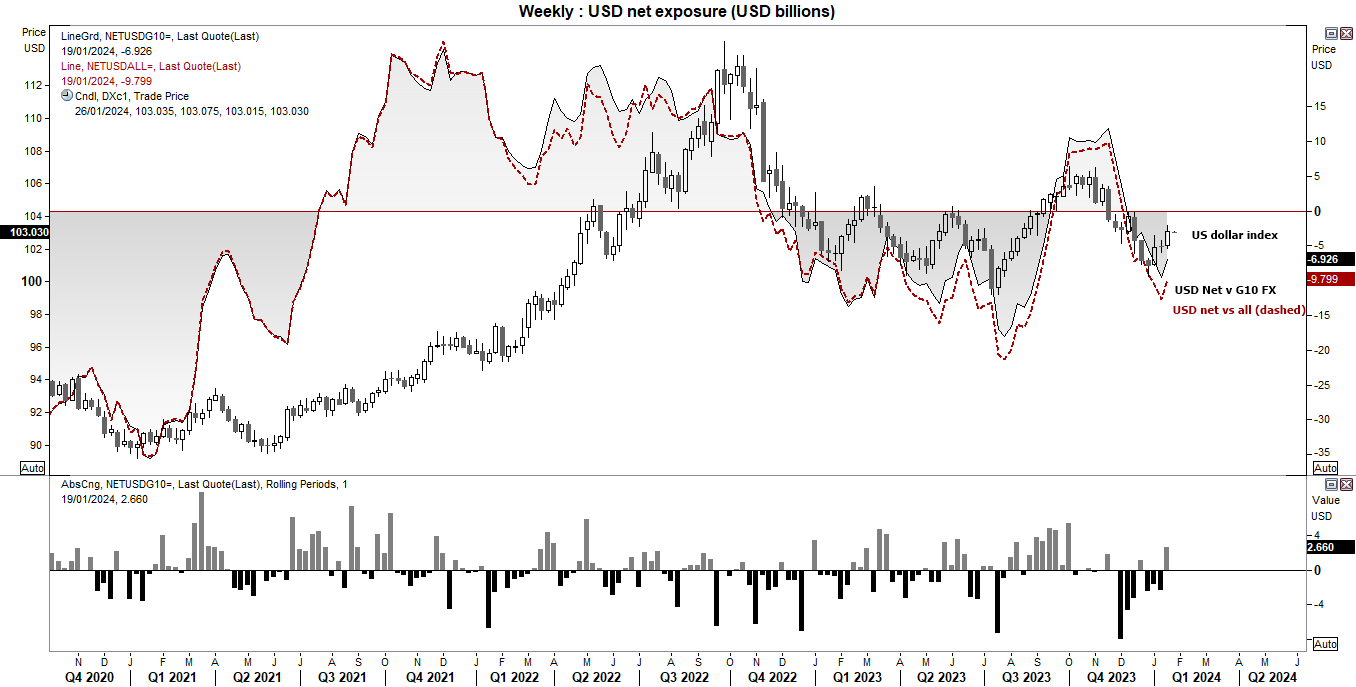

US dollar index (DXY) and IMM positioning – COT report:

According to data compiled by IMM (International Monetary Market), traders decreased their net-short exposure to the US dollar last week, against the G10 and all markets tracked. This was in line with last week’s bias, where I argued it more likely that market pricing for multiple Fed cuts was too aggressive and that Fed members were to not be as dovish as hoped. And that is how it played out. The US dollar index rose for a third week, and it could rise for a fourth if PCE inflation data is not as soft as hoped. With that said, it appears as though Friday’s boas for a retracement on the daily timeframe is playing out, so bulls could seek to enter dups if or when evidence of a swing low arrives.

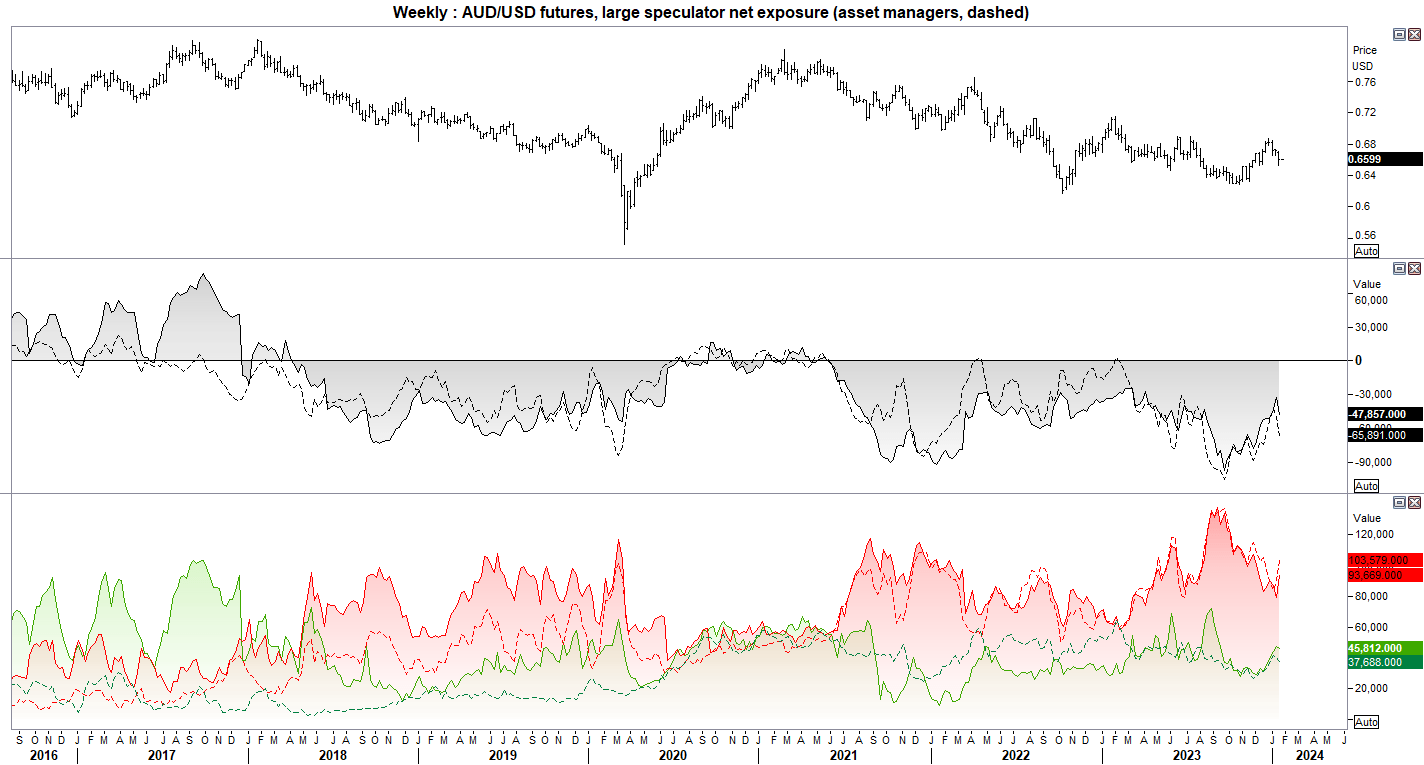

AUD/USD (Australian dollar futures) positioning – COT report:

Futures traders have remained net-short AUD/USD since May 2021, although their bearish positioning had been reduced by two thirds since reaching a record level of net-short exposure in September. But with traders now fully satisfied the RBA’s rate has peaked at 4.35% and now pricing in cuts for 2023, we could be looking at an increase of net-short exposure over the coming months.

Last week’s COT report reveals that large speculators increased their gross-short exposure to AUD/USD futures by 17.7% and trimmed longs by -3.2%. And when you consider this was ahead of Thursday’s employment report which saw over 100k full-time jobs shed in December, we can only assume bearish bets would have increase and should show up in this week’s official COT report. And as net-short exposure to AUD/USD is nowhere near a sentiment extreme, AUD/USD could be looking at further downside over the coming weeks or months. And a pair to short it against could well be the British pound.

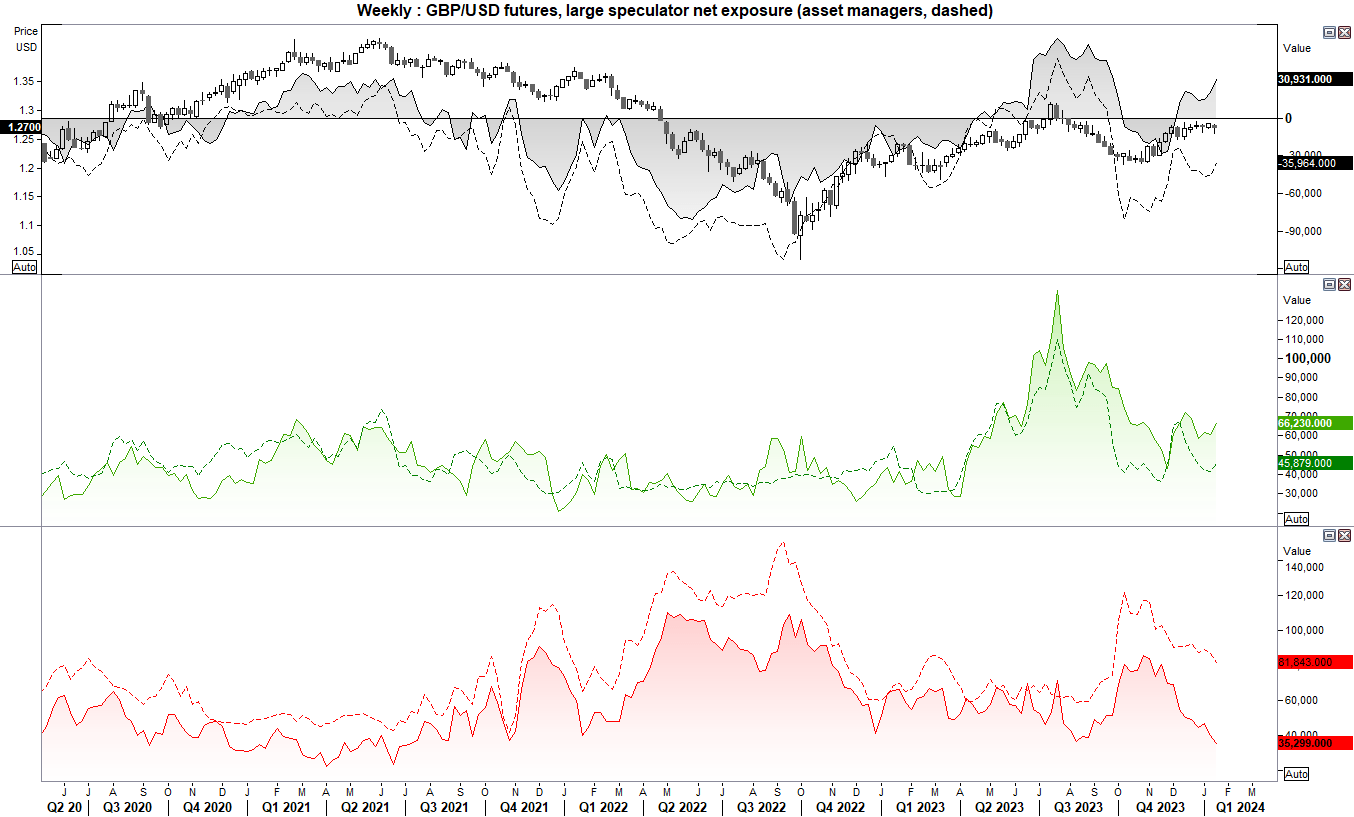

GBP/USD (British pound futures) positioning – COT report:

At the end of 2023, traders were becoming increasingly excited that the BOE were likely to be the first major central bank to cut rates, and do so several times in 2024. Unfortunately, incoming data has not backed this up. And this has seen British pound perform well this year and be the only forex major to withstand US dollar strength.

Net-long exposure among large speculators rose to an 18-week high as traders reduced short positioning by -11.8% and increased longs by 9.1%. And that was ahead of last week’s hot inflation numbers, and therefore likely that we’ll see a further increase in net-long exposure last week.

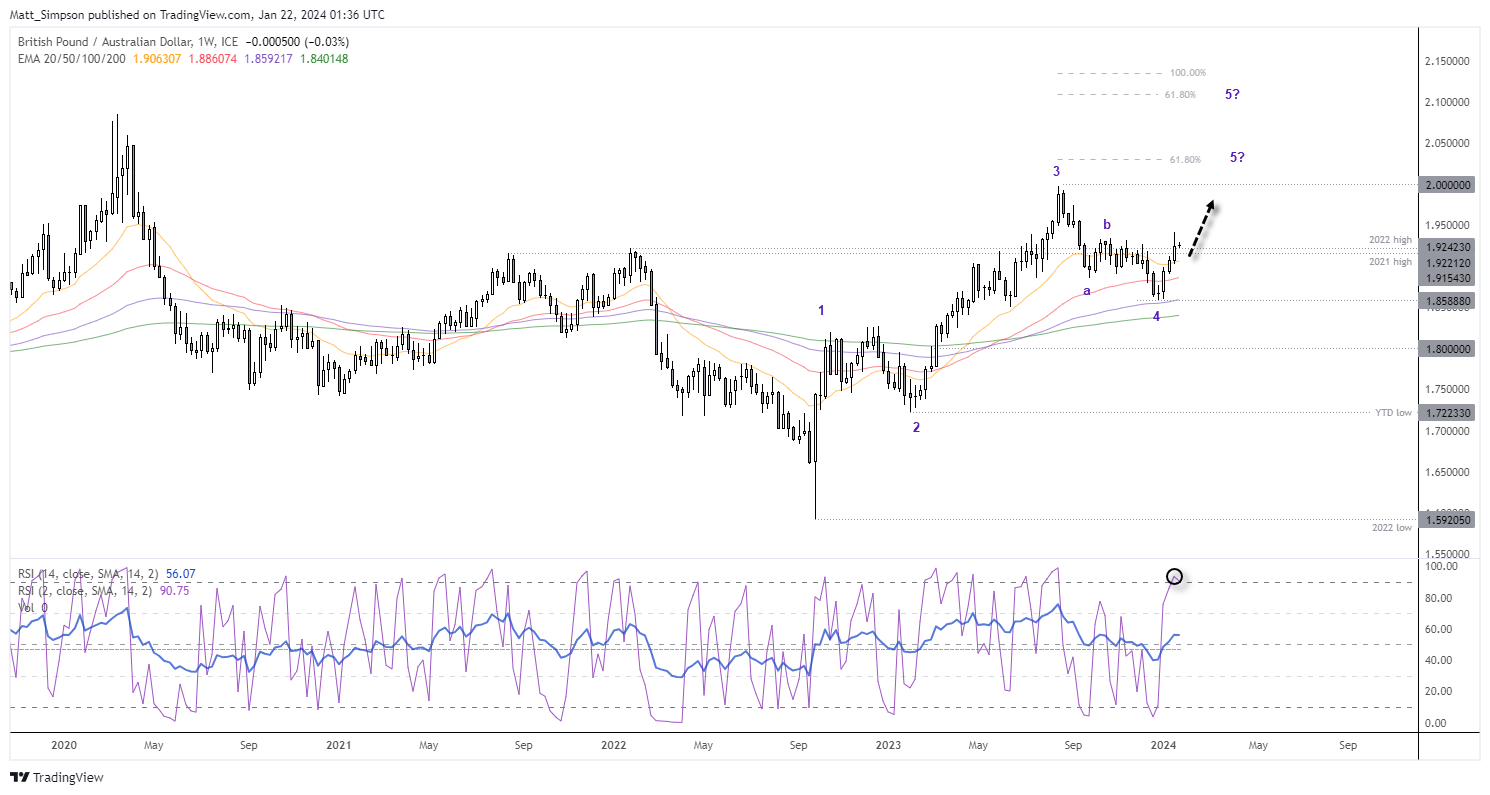

GBP/AUD technical analysis (weekly chart):

The GBP/AUD weekly chart trades within an established uptrend and completed a 3-wave retracement just above its 100-week EMA late December. The strong rally from the September 2022 low could now be within its fifth wave higher, assuming the December low was the end of wave four.

The 61.8% Fibonacci expansion of waves 1-3, projected from 4 sits around 2.1, and the 61.8% expansion of wave 3 from wave 4 at 2.03. However, RSI (2) is overbought so bulls may wish to seek a pullback before considering longs, with an initial target at the highs around 2.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.