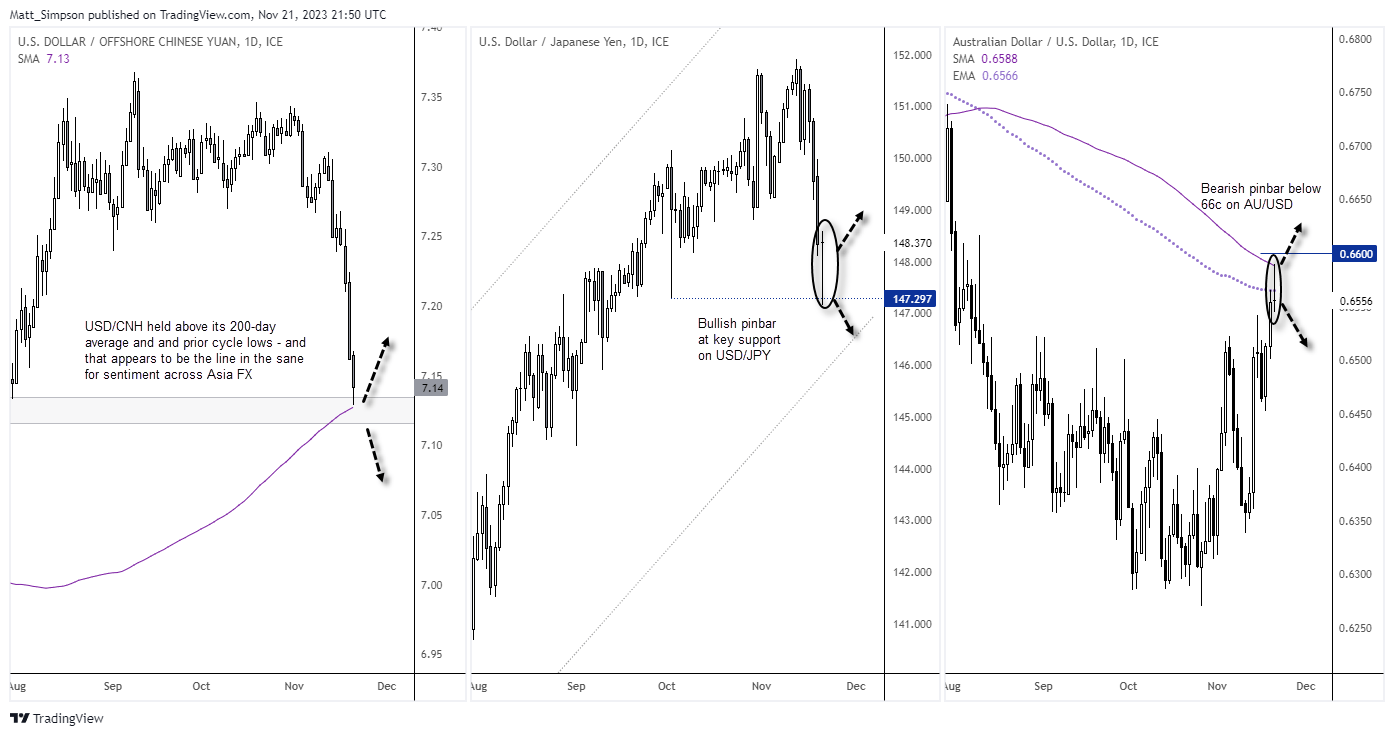

We watched with bated breath to see if USD/CNH would break its 200-day average on Tuesday and pave the way for the next bout of US dollar weakness. Yet with that key level holding as support, it leaves room for some US dollar strength, a higher USD/JPY and weaker AUD/USD.

By :Matt Simpson, Market Analyst

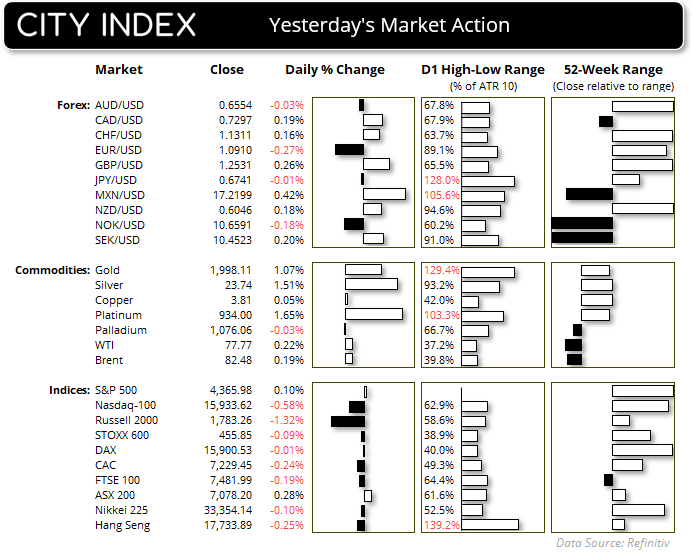

Market Summary:

The release of the FOMC November minute did little to sway the opinion that the Fed have reached their terminal rate. Although expectations of a surprise were low given CPI and PPI data has softened since their last meeting and job claims had risen to a 2-year low, which overshadowed any hawkish message from the Fed.

Whilst participants noted that inflation remained unacceptably high above 2% with “limited progress” in bringing down core services excluding housing CPI, “all members” agreed interest rate decision would be made on a per-meeting basis – and data so far points towards no further hikes and a sooner cut. Fed fund futures currently imply the odds of a 25bp cut in May 2024 at 46.3%.

- I suspect the RBA are sat on another hike looking at the latest RBA minutes, although as before they’d prefer not to hike if they can get away with it. The tone of the minutes has shifted to the hawkish side with Bullock at the helm, and the RBA seem concerned that demand continues to support higher prices and that rising house prices indicates that “policy was not especially restrictive”

- AUD/USD came close to reaching my 66c target before pulling back from that key level like clockwork, as USD/CNH failed to break its 200-day average.

- Perhaps the RBA should take note that Canada’s inflation levels are coming in below target, which keeps the BOC in pause mode and raises hopes that AU inflation could follow suit to remove the RBA’s hawkish bias.

- We’re seeing signs that the dollar bearish move is running out of steam and could potentially be due a bounce. EUR/USD formed a 2-bar bearish reversal around the August 30 high, USD/JPY bounced from key support at 147.33 and USD/CNH is holding above its 200-day MA.

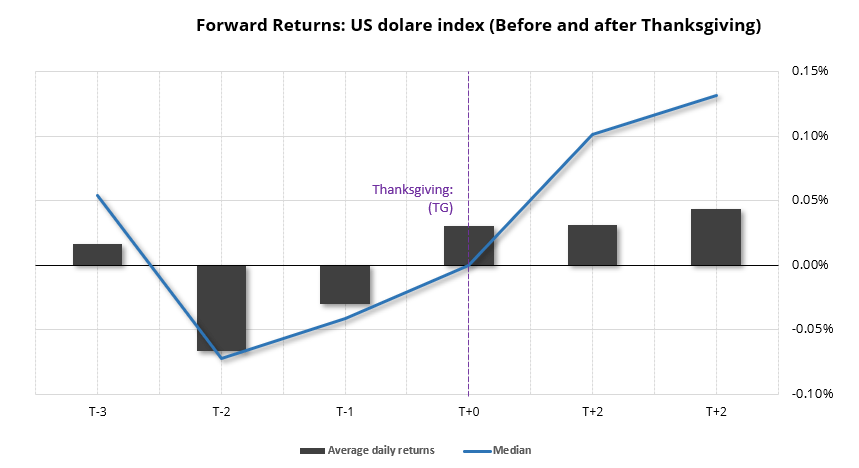

- The seasonal tendency for the US dollar index is for it to soften ahead of Thanksgiving and strengthen thereafter, although given the selloff already seen and the fact key levels suggests the dollar strength may arrive a little early

- Gold traded briefly above $2000 before closing just beneath it, which keeps that key level in focus for traders over the near-term

- Crude oil rose for a third day but already the rebound is losing steam ahead of Next week’s OPEC meeting. Markets have responded to chatter of oil production cuts, but could this be a classic buy the rumour, sell the fact setup? I suspect OPEC will have to come out swinging to send oil prices materially above $80, until then it may make a decent level to fade into.

Events in focus (AEDT):

- No major economic data is scheduled today’s Asia session

- 19:35 – Speech by Michele Bullock, RBA Governor – A Monetary Policy Fit for the Future – at the ABE Annual Dinner, Sydney. The Governor will talk about the recent monetary policy decision and progress on the implementation of recommendations of the Review of the Bank.

- 20:00 – BOE and ECB financial stability reports

- 00:00 – US jobless claims data

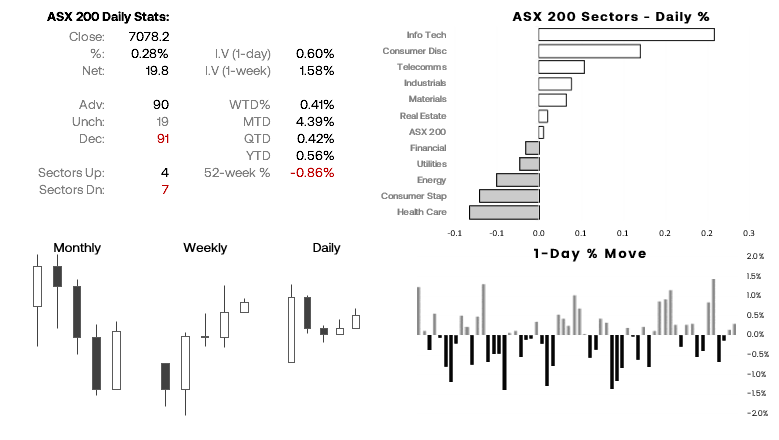

ASX 200 at a glance:

- The ASX 200 formed a second small bullish day, although its lack of bullish volatility makes it less convincing we’re heading towards a strong bullish move

- A weak lead from Wall Street and flat SPI 200 futures makes for an uneventful open today for the cash market

- Bias is currently and today’s range is likely to be low due to the Thanksgiving holiday (unless a new catalyst arrives)

USD/JPY, AUD/USD, USD/CNH technical analysis (daily chart):

We were keeping a close eye on how USD/CNH behaved around its 200-day average on Tuesday, as it appeared to be a make-or-break moment for the US dollar and sentiment across Asian FX. Yet with USD/CNH failing to break beneath its 200-day MA, USD/JPY was allowed to recoup its earlier losses and close the day flat with a long bullish pinbar candle. Meanwhile, AUD/USD formed a bearish pinbar just beneath 66c (in line with yesterday’s bias) and closed beneath its 200-day EMA. Oevrall, I see the potential for the US dollar retrace higher to help support USD/CNH, USD?JPY and weigh on AUD/USD over the near-term. And if the US dollar seasonality plays out after Thanksgiving, the dollar could continue to strengthen into next week before reversing. At which point I’ll be seeking bullish setups on AUD/USD around support levels and seeking to fade into USD/JPY for its next leg lower.

View the full economic calendar

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.