The BOJ’s intervention prevented large speculators from reaching a record level of net-short exposure, asset managers continued to trim net-long exposure to the US dollar and US indices and also flipped to net-long the VIX.

By :Matt Simpson, Market Analyst\

View the latest commitment of traders reports

Market positioning from the COT report - as of Tuesday April 30, 2024:

- Futures traders reduced net-long exposure to the US dollar (against all CME futures markets) by -$3.5 billion dollars, according to IMM data

- Large speculators were net-short EUR/USD for a second week, although gross shorts were trimmed to bring net-short exposure slightly lower

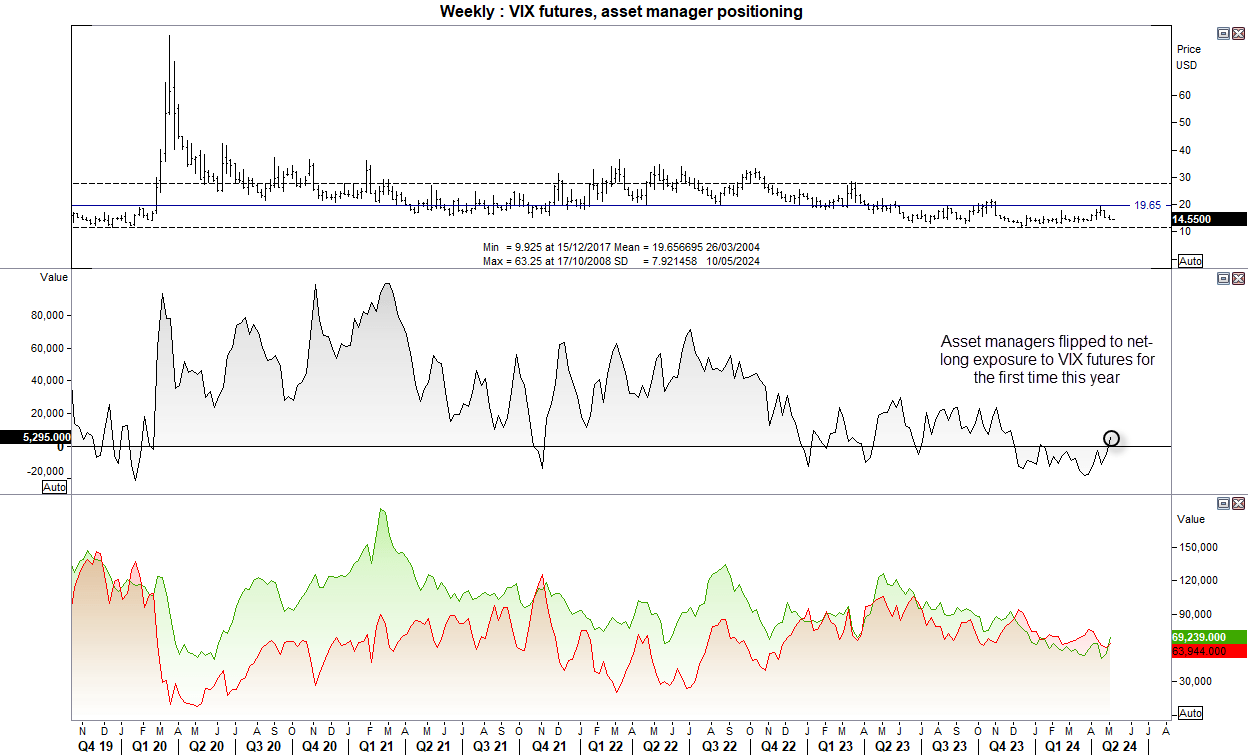

- Asset managers flipped to net-long exposure to VIX futures for the first time since December

- Large speculators trimmed net-short exposure to commodity currencies (AUD, CAD and NZD)

- They also increased net-short exposure to GBP/USD futures for a second week

- Asset managers increased net-long exposure to the 2-year and 10-year bond

- Both sets of futures traders trimmed net-long exposure to silver

- Asset managers increased longs and trimmed shorts to gold

US dollar positioning (IMM data) – COT report:

Futures traders reduced their net-long exposure to the US dollar by their fastest rate in five months last week. And that was before the Fed closed the door on further hikes at their meeting on Wednesday, ISM manufacturing contracted, ISM services softened and NFP job growth fell short of expectations. So there is a decent chance that futures traders have culled further longs and re-established shorts.

Quite how much further downside awaits for the US dollar from here remains up for debate, because incoming data needs to continue to deteriorate for traders to reprice the several cuts they so desperately seek. Still, it could be argued that positioning for the US dollar remains high by recent standards, and price action on the US dollar index suggests a retracement against its 6% rally from the December low has begun.

A 38.2% retracement from the close high sits at 38.2%, the 50% at 103.73 and 61.8% at 103.17.

GBP/USD (British pound futures) positioning – COT report:

Asset managers pushed net-short exposure to GBP/USD futures to a record high, just as large speculators flipped to net-short exposure. It is not often we see such a divergence between the two sets of traders. Yet last week asset managers increased long bets which slightly reduced net—short exposure, and whilst large specs increased net-short exposure for a second week it was only by a marginal amount.

Click the website link below to get our exclusive Guide to central banks and interest rates in Q2 2024.

Has there been a rethink ahead of this week’s BOE meeting? Ot is it simply down to the reduction of net-long exposure of the US dollar. Either way, I feel more inclined to pay more attention to large speculators as a guide for sentiment extreme as asset managers are likely using shorts as a hedge. And that means they may continue to increase their current short exposure beyond record highs if the BOE signal cuts and begin ahead of the Fed. And that manes this week’s BOE is of upmost important to help decipher if or when they BOE may begin easing.

VIX futures positioning – COT report:

Asset managers flipped to net-long exposure to VIX futures for the first time since early December, likely as a hedge towards increased volatility with US indices pull back from their record highs. Large speculators remain net short, which doesn’t say much as they have been short since January 2019 and have spent around 90% of their time with such positioning. But they are around their least bearish levels since November – so perhaps there are some concerns for the stock market brewing.

The question now is whether asset managers are right to hedge. Again, it likely comes down to incoming economic data. For a risk-on rally to materialise and persist, incoming data needs to be soft enough to fend off Fed hawks yet not too soft as to rekindle fears of a hard landing. As that could surely weigh on the stock market and send the VIX higher. And if it gets really bad, large speculators will also flip to net-long exposure for the first time in five years.

S&P 500, Dow Jones, Nasdaq 100 futures (DJ) positioning – COT report:

Asset managers were trimming their net-long exposure to US indices before they flipped to net-long the VIX. Out of the three indices, they are closer to net-short exposure to the Dow Jones, remain the most bullish the S&P 500 and slightly less bullish the Nasdaq. The Dow Jones appears to be the best market for bears if we do get an actual downturn. But ultimately, if real money accounts are stepping away from the stock market then perhaps breaks to new highs should be treated with suspicion.

JPY/USD (Japanese yen futures) positioning – COT report:

You may have herd a thing or two last week about the BOJ intervention on the Japanese yen. Monday’s intervention was enough to reduce net-short exposure of large speculators and asset managers, although not by a huge amount in retrospect. Still, there may have been two more interventions on Wednesday and Friday of last week which resulted in a high-to-low span of -835 pips. So I think it is safe to assume that more shorts were trimmed by the end of the week.

Click the website link below to get our exclusive Guide to USD/JPY trading in Q2 2024.

Yet the BOJ have a problem. If traders are now trimming long exposure to the US dollar whilst decreasing shorts to other currencies, the central bank have their work cut out of their plan is to continue controlling them depreciation of the yen. It also seems unlikely they’ll want the yen to become notably stronger too, assuming they want exports to remain favourable with trade partners. Therefore, I suspect a reasonable chance that USD/JPY might now trade in a choppy range as opposed to simply rolling over.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.