COT report shows rising net-longs in JPY and VIX futures, while US dollar shorts deepen ahead of Jerome Powell’s Jackson Hole speech.

By : Matt Simpson, Market Analyst

This week’s Commitment of Traders (COT) report reveals shifting sentiment across major futures markets. Asset managers increased net-shorts on the US dollar ahead of Jerome Powell’s Jackson Hole speech, while Japanese yen positioning showed signs of recovery after weeks of weakness. Meanwhile, net-long exposure to VIX futures surged to its highest level since 2022, signalling traders are bracing for volatility as we move into September.

View related analysis:

- Australian Dollar Outlook: Dip Buyers to Circle The Aussie

- Japanese Yen Outlook: BOJ Hike Talk Builds as USD/JPY Eyes 149

- Gold, Silver, Crude Oil Outlook: Technical Analysis, Market Positioning

Charts prepared by Matt Simpson - data source: CME, LSEG

Weekly COT Report Highlights: US Dollar Shorts Deepen, Yen Recovers, VIX Net-Longs Surge

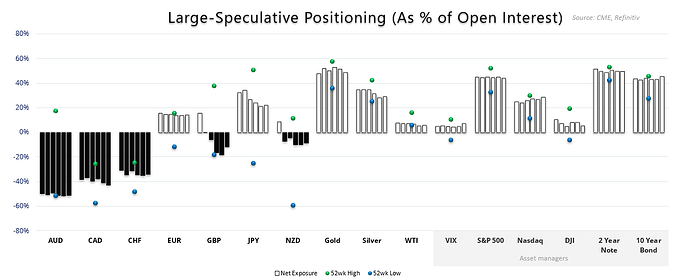

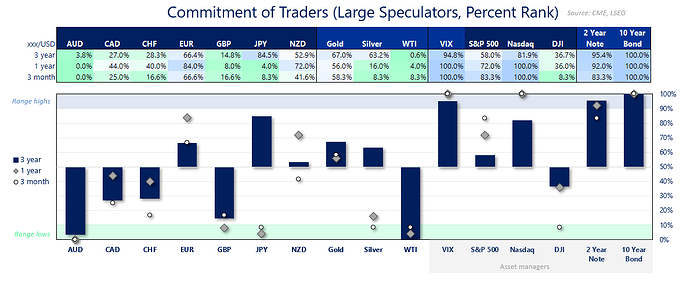

- US Dollar ( USD ): Asset managers increased net-short exposure by 3k contracts ahead of Jerome Powell’s Jackson Hole speech

- European dollar ( EUR ): Large speculators increased net-long exposure by 3.3k contracts

- British pound ( GBP ): Net-short exposure fell -13.9k contracts to -25.2k

- Japanese yen ( JPY ): They increased gross-longs to the yen for the first week in four

- Australian dollar ( AUD ): Traders increased gross-short exposure by 6.9k contracts to 94.9k

- Canadian dollar ( CAD ): Net-short exposure increased by 3k contracts

- Swiss franc ( CHF ): Effectively flat on the week, net-short at 27.2k contracts

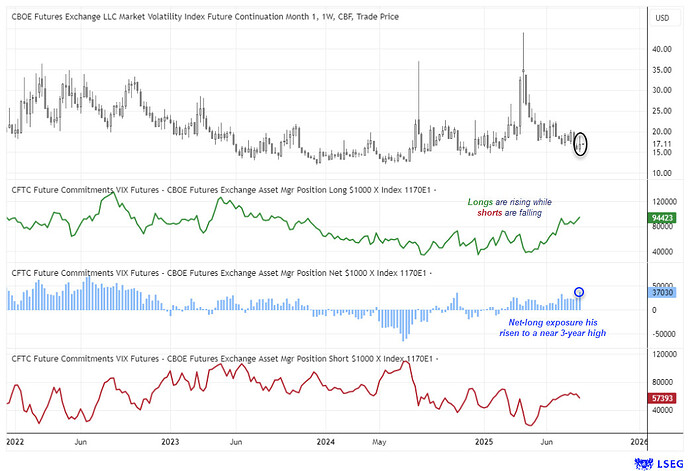

- Volatility Index Positioning ( VIX ): Net-long exposure rose to a near 3-year high

- Gold (GC): An increase of short bets pulled net-long exposure to gold lower by -12.8k contracts

- Crude Oil ( WTI ): Net-long exposure rose 3.5k contracts to 120.2k

- S&P 500 ( ES ): Asset managers reduced net-long exposure by -15.8k contracts

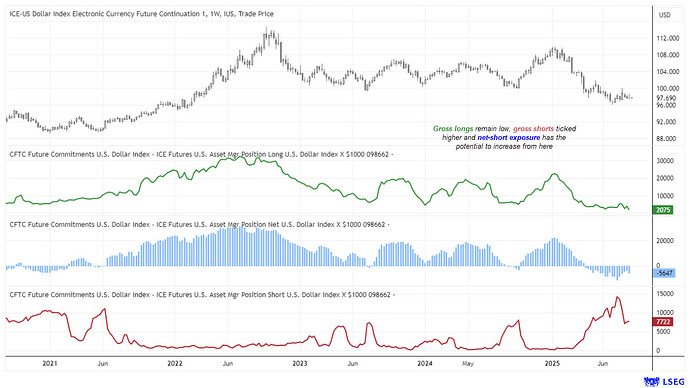

US Dollar Positioning (IMM Data): Weekly COT Report Analysis

Asset managers are rarely short USD futures, though they have been since Mid April. And while the 11.k contracts of net-short exposure may not sound a lot, it was its record high reached five weeks ago. The 2000 increase of net-short exposure could therefore be deemed as significant, especially since this was before Jerome Powell delivered a speech that was slightly more dovish than expected.

Asset managers have a very low gross-long exposure of 2075 contracts and gross shorts only ticked higher by 187 contracts last week, to 7722. Though we could find that gross-shorts rose considerably more in the next report, and as they do not appear to be at a sentiment extreme is suggests further downside for the US dollar.

Chart prepared by Matt Simpson - data source: CME, LSEG

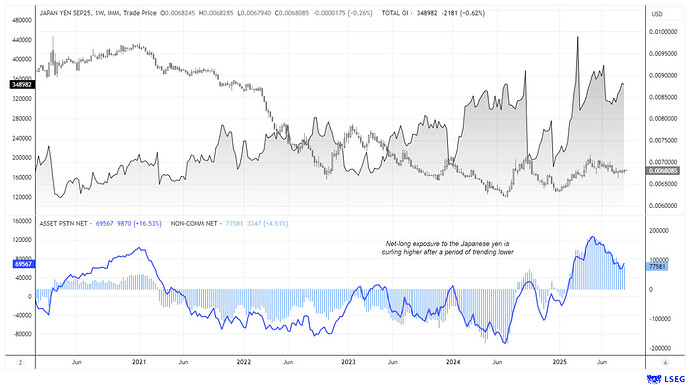

JPY/USD Positioning: Japanese Yen Futures – Weekly COT Report

Net-long exposure for the Japanese yen has been in a downtrend since April, though there’s reason to believe bulls may be returning to the table.

Large speculators increased their net-log exposure to the yen for the first week in three, and asset managers increased their by their fastest weekly pace in 18.

And with murmurs of Bank of Japan (BOJ) hikes resurfacing while the Federal Reserve (Fed) veer towards cuts, perhaps it is time for the Japanese yen to regain traction against the US dollar and send USD/JPY lower.

Chart prepared by Matt Simpson - data source: CME, LSEG

Volatility Index Positioning (VIX): Weekly COT Report Analysis

Traders appear to be anticipating heightened volatility as we head into September, with asset managers pushing their net-log exposure to VIX futures to their most bullish level since October 2022.

Moreover, this heighted level of net bullish exposure has been fuelled by a 7% increase in gross-longs to VIX (+6.2k contracts) alongside a -8.7% fall in gross shorts (-5.5k contracts).

Note the bullish outside week on the VIX futures chart which could also point towards a potential swing low for volatility.

Chart analysis by Matt Simpson, Source: CME Futures, LSEG

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.