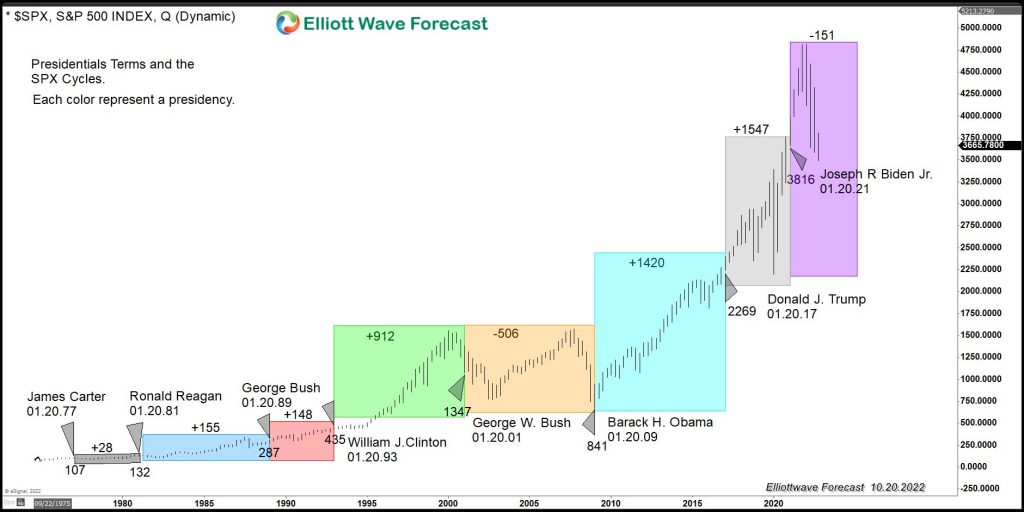

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their will for the better, but there is a vast difference between the two parties regarding the economic agenda. Most of the time, the Democratic side is for a bigger government, more extensive regulations, and higher taxes. However, on the opposite end, the Republican side is for less government, less regulation, and fewer taxes. The SPX is the representation of free enterprise and capitalism. Therefore the Democratic agenda does not fit with the Index advancement, as their agenda tends to limit free enterprise. The following chart displays all presidential terms since James Carter’s 1977 inauguration placed over the monthly SPX chart.

SPX Performance and US Presidential Cycles

There are very interesting key points and eye-opening statements that can be made about how each presidential term has affected the SPX over the years. The index expansion and growth over the years have been fantastic and it is expected that more growth will continue as human nature will always be bullish. Similar to how a correction occurred between 2000-2009, the trend will always be higher.

Key Points:

- The most significant economic advancement was under Donald J Trump. Considering that he was only president for one term, the gap from his opening to his last day was +1547 points. He outperformed all previous presidents in one term, even when Covid-19 created a pullback by itself.

- There has been only one negative presidency: George W. Bush, who finished -506 points for his two terms as president.

- Two term presidents Barack H. Obama and William J. Clinton performed very well, but nothing compared to what Donald J Trump did in one term.

- The expansion since 1992, makes only Clinton, Obama, and Trump close to or above the 1000 points line during their presidential terms.

- George W. Bush was the only negative president post-expansion in 1992, which makes his 2 terms strange since he was a Republican president.

- Joseph R Biden Jr is at the moment, the second president which is negative in his term, however, there are still two remaining years before his term is over.

- Before 1992, Ronald Reagan had the most significant advance of the three presidents, with a plus 155 points.

- George Bush’s performance was very good, considering it was only one term.

We at ElliottWave-Forecast always look at the charts with the Elliott Wave Theory in mind. We can see that the president is sometimes either guilty or benefiting from the market timing; as an example, Barack H Obama entered office in 2009; at that moment, the market was in the process of ending a clear three waves correction from George W. Bush 2 terms, so Obama’s SPX advance had a lot to do with the timing other than his administration economic agenda. It was hard to see a lower market in 2009 when Obama took office, because many stocks in transportation and financing could not trade lower or they will go out of business. They were named “Too Big to Fail”. At the same time, from when George W. Bush took office there was a five waves advance that can be clearly seen from the lows in the Carter era, so he was guilty of bad timing.

In conclusion, we believe the Republican agenda, which is based on free enterprise and less regulation will always be better for the country’s overall economy. Based on the data and the chart we presented, there is nothing explicit on which point one party’s agenda is better than the other. The chart shows the biggest winner is a Republican, Donald J. Trump in one term. However, the most significant loss is also a Republican, George W. Bush. We believe the market performance is based on other factors including market makers, high-frequency machines, cycles and not only on an administration’s economic agenda even when the agenda can help the overall environment of the country’s well-being. Timing and luck also plays a role during a president’s term which can heavily sway the president’s performance and its relationship with the economy.

Source: https://elliottwave-forecast.com/stock-market/us-president-cycles-and-the-spx-performance/