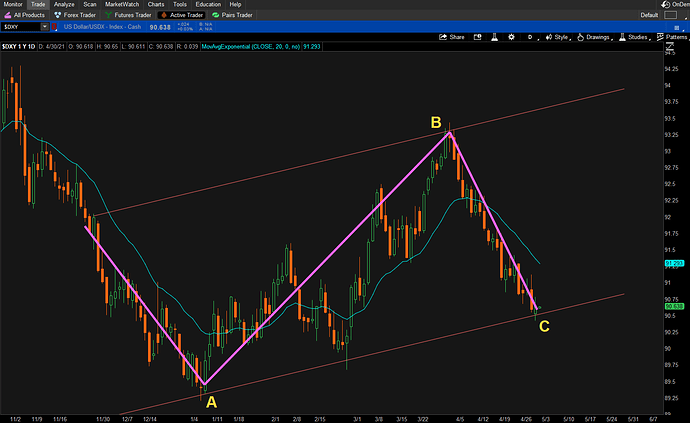

The chart speaks for itself.

Sellers have literally been in control the entire month of April.

We’re testing a key inflection point that will likely lead to profit-taking and buyers attempting to print a higher low.

There are many ways to trade this. Too many, but the one that stuck out to me the most was through gold.

The 20EMA has acted as dynamic support, but, price has failed 7 straight sessions to breakout above the 100 and 200 MA. That is not a sign of confidence for new buyers to enter the market. I tried to structure some options trades in the futures space, but couldn’t get a good risk/reward ration. Instead, I just hit the bid in the futures market, and want to try and structure something around the GLD ETF with some defined risk / long premium trades.

IV percentile is at annual lows, so prices are rock bottom right now and potentially ripe for some bidding up.

XAU has pretty much chopped sideways + retail has been pushing more buy orders through and less sells. This has the potential to catch a lot of people off guard as the recent rally in gold could potentially trap new money. Stops are likely clustered around 1760, so a breakdown beneath there could see some liquidation and shorts pressing for the momentum trade.

Don’t forget, this is also a dollar-related trade. This is why I think there’s some decent edge here-- both sides of the market are in play.

This is not investment advice.

2 Likes

That’s a tough one, always lots of speculation.

DXY took a hit in 2020 as did the world. Then the 1st Q of 2021 looked like things were turning around, then April it took a nose-dive. Why? Gremlins I suspect.

After it bounced off this monthly support I thought it might be headed north for a while. But I’m not holding my breath, last time it broke this level in 2015 it blew up though. I think if it falls past 88.0 then it will continue the downhill ride.

As for Gold, shorter term, we might see a dip, but I’m still holding out for 1840…

1 Like

Very tough at the moment. I can see the dollar going down to 88.00ish. There could be a correction before that though

1 Like

Thanks for sharing. Hopefully USD bounces back soon.

1 Like

Wow. That took literally no time.

Even with this massive 1 day gain, gold is still only slightly down. That is relative strength, so, will need to take that into consideration next week.

Signing off for the weekend, will need to wait and see where the dust settles next week.

I think a lot of people are trapped long the USD here…That crazy one day rally off point C failed to bring higher prices to the tune of 5 straight sessions up against the D1 20 EMA. The failure + impulsive selling indicates bears are likely still in control here.

Anyone that bought that momentum either got stopped out on that liquidation candle, or, are looking for a bounce back to the channel (“dead cat bounce”) to get flat / reduce deltas. The primary channel has been violated and lower USD prices should be expected.

This analysis aligns well with FXCM retail sentiment r.e. little fish continuing to press their long USD bets. This could be a sucker / relief rally.

Now they are feeling the pain. With more to come. That rally was a relief for some longs to cover for a scratch or small loss. Those that waited are now trapped and liquidation may likely follow.

Breakout, pullback and expected re-test of recent lows?

Retail buy-side order flow continuing to grow into Swissie weakness - 24hr change +.4

Retail continues to buy the dollar…