The US Dollar is breaking out after Jerome Powell didn’t seem so sure about a September rate cut. The focus now moves on to Core PCE and NFP, along with tonight’s BoJ rate decision.

By :James Stanley, Sr. Strategist

U.S. Dollar, FOMC Talking Points:

- The Federal Reserve held rates at today’s meeting, but two dissenting votes for a rate cut came in from Michelle Bowman and Christopher Waller.

- Both Bowman and Waller have been loudly talking about rate cuts in the press and that was partly responsible for the USD-weakness that ran into the Q3 open. But at today’s press conference, Jerome Powell indicated that policy may not need any near-term cuts as it’s not that restrictive, with inflation above target and the unemployment rate low.

- On inflation and employment – the next couple of days are big as we get Core PCE tomorrow and Non-farm Payrolls on Friday.

- Also not to get lost in the shuffle is the Bank of Japan rate decision later tonight which could have a large impact on USD/JPY, and as I’ve been talking about there, USD/JPY has a large implication for larger macro flows in and around the USD.

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-central-banks-outlook/

Today’s rate decision was of little surprise as the Fed held rates flat and there were two dissenting votes coming in for a rate cut. As I had said in the Tuesday webinar, the bigger driver was probably going to come from either wordsmithing of the statement, which didn’t really happen, and the press conference following the statement release.

The USD initially pulled back after the statement and into the first five minutes of the press conference. A series of comments from President Trump overshadowed the Fed’s statement and given the two dissenting votes, this highlighted the fact that Trump will soon be able to name a new Fed chair, which very well may be one of those dissenters.

But as the press conference got underway Jerome Powell noted how policy didn’t seem to be all too restrictive, given that inflation remained above target and the unemployment rate remained low. He indicated that a cut in September didn’t seem all that likely, although he walked that back a bit shortly after when he said that they would decide on the September meeting as they got closer to the announcement, disclaiming that no official decision had been made. By that point, however, it was too late as the USD had started to breakout from a very important level of 99.40.

I looked at that backdrop in the Tuesday webinar and as I had highlighted then, this was the price that DXY had hit just before Michelle Bowman’s comment on June 23rd when she said she was ready to cut rates in July. That led to a string of losses in the USD that ran all the way through the end of Q2 with the Dollar setting a fresh three-year-low on day one of Q3. But, since then a different tone has taken over.

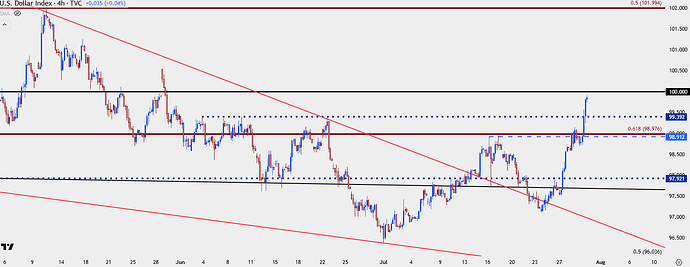

U.S. Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

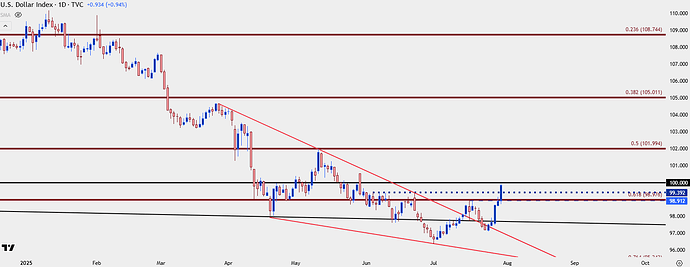

USD Higher-Highs

Now that we have a fresh higher-high in DXY to go along with last week’s higher-low, bulls have an open door to make a larger run. The calendar for the next couple of days becomes of importance for that theme as we have Core PCE data set for release tomorrow, with NFP coming out on Friday morning.

In DXY, the big question is whether we can see support hold at prior resistance of 98.98, which had set the highs two weeks ago, just after CPI was released, and then again yesterday. If we end up with a lower-than-expected Core PCE print, that support becomes a distinct possibility.

A bit closer to current price is that 99.40 level that was resistance ahead of the FOMC press conference this morning, as well as being resistance three different times back in June.

And for resistance, the next big level up is the 100.00 psychological level in DXY.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

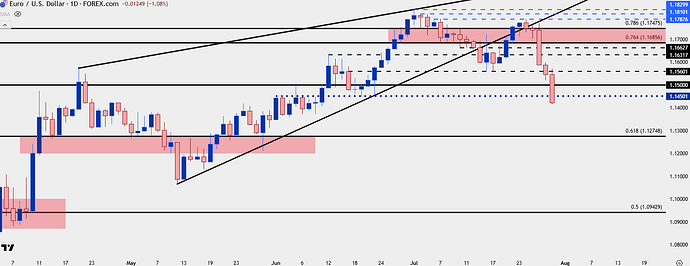

EUR/USD

EUR/USD has been the pair that I’ve been tracking for USD-strength scenarios even going back to last week when prices were rallying-higher. The first zone of resistance looked at in the prior Tuesday webinar held around the ECB meeting and since then price has dropped by more than 363 pips while continuing a bearish reversal from the rising wedge formation.

On a short-term basis, the move has already started to show oversold readings on the four hour chart so breakout strategies could be a challenge. Pullbacks, however, could remain of interest with 1.1450, 1.1500 and 1.1560 all of interest.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

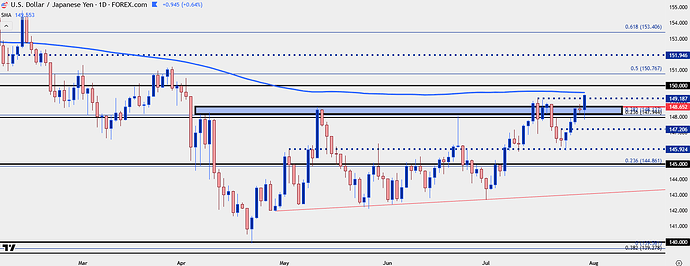

USD/JPY

For USD/JPY the week is pretty much just getting started. Sure, we have the Core PCE and NFP reports that will be applicable for all other USD-pairs, but for USD/JPY there’s also the Bank of Japan rate decision later tonight, and the macro-economic implications are huge.

As the US was lifting rates in 2022 the Bank of Japan remained loose and passive, allowing for a massive carry trade to build. Hedge funds could get loans for very low rates in Japan as the BoJ was holding in very low territory, while then going to invest those funds elsewhere, in economies where rates were already on the rise. That allowed for a pretty significant spread trade and the only problem at that point was exposure to the Yen, which was dropping on the basis of that rate divergence. So, the logical next step was to hedge that part of the trade by buying USD or Euros or GBP and selling Japanese Yen, which is what led to the 50% move from the 2021 lows to the 2022 highs.

This also built and incredibly crowded, one-sided trade. But – those can come off quickly when there’s a hint or whiff of change, which is what explains the large moves in late 2022 and 2023.

Last July is when markets began to warm up to the idea that the Fed would finally be able to cut rates. CPI came in below expected on July 11th and suddenly, that carry trade started to go the other way. It didn’t take long for assets that had been bid by the leverage incorporated from the carry trade to quickly come out of the market, and in short order headlines around the globe were pointing to the unwind of the Yen carry trade as a reason for the global stock sell-off.

But – USD/JPY hit the 140.00 handle just two days before the Fed started cutting. And when the Fed started cutting, long-term US rates started pushing higher, driven by the idea that the Fed was going to feed inflation with those lower rates. And despite the fact that the Fed narrowed the rate divergence between the US and Japan at that next two rate decisions, USD/JPY continued to lift, along with the broader USD market.

As USD fell in the first half of this year, so did USD/JPY, at least initially. But that 140.00 level was back in-play in April and since then, USD/JPY has been clinging to higher-lows even as USD continued to sell-off. As I’ve been highlighting in videos, I think the macro push behind the USD goes back to USD/JPY on the basis of that carry trade, and this is something that could even impact EUR/USD.

At issue is whether we see narrowing rates between the two economies and with the Fed not sounding so sure about rate cuts, there’s been reason for shorts to close positions. Tonight, we’ll hear from the Bank of Japan and whether they take a step back from higher rates and policy normalization which, if so, could drive another leg of strength in USD/JPY.

A big area of resistance sits overhead in the pair around the 150.00 level, with the 200-day moving average almost back in-play and just about 40 pips below the big figure.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

— written by James Stanley, Senior Strategist

https://www.forex.com/en-us/news-and-analysis/usd-breaks-out-after-powell-presser-eur-usd-usd-jpy/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.