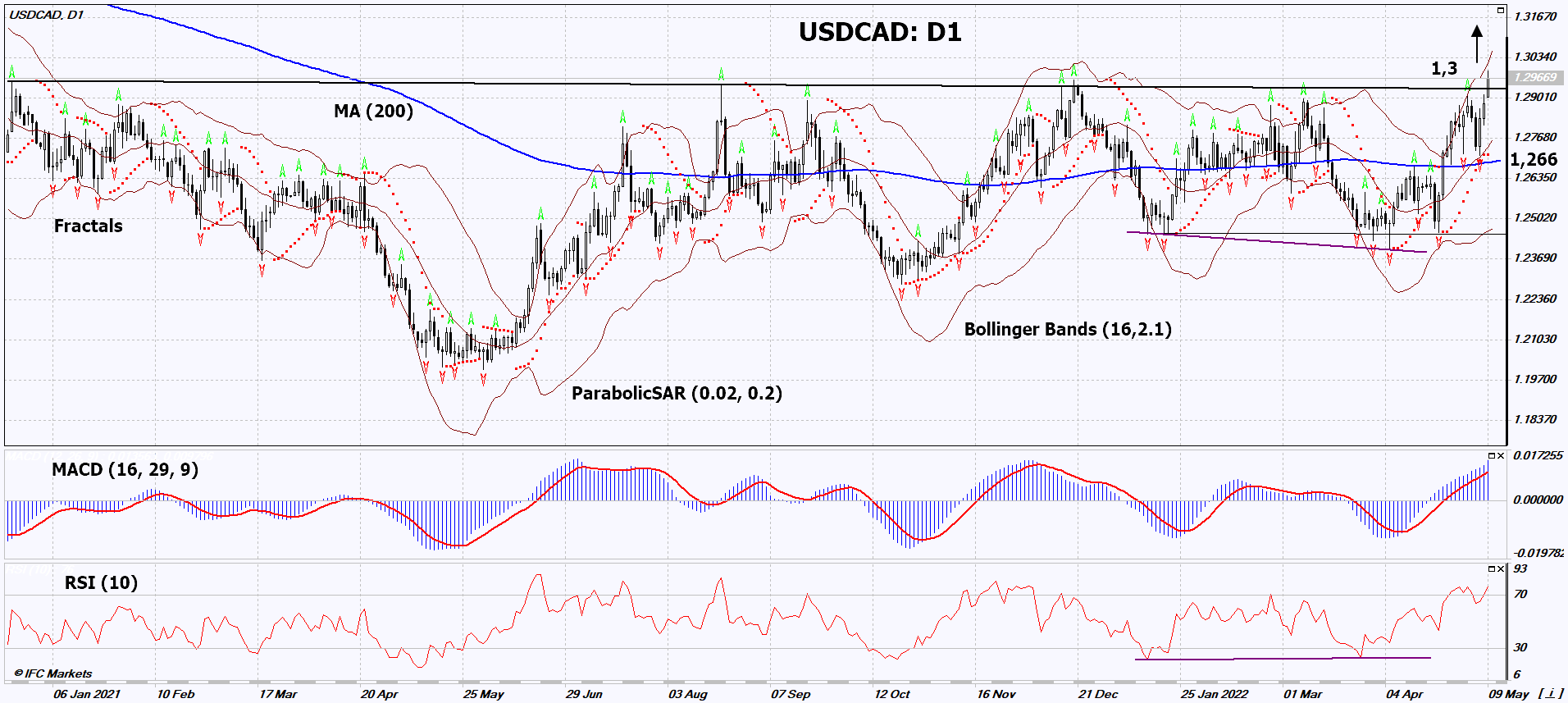

USD/CAD Technical Analysis Summary

Buy Stop։ Above 1,3

Stop Loss: Below 1,266

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

USD/CAD Chart Analysis

USD/CAD Technical Analysis

On the daily timeframe, USDCAD: D1 has broken the long-term resistance line up. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if USDCAD: D1 rises above its latest high and upper Bollinger band: 1.3. This level can be used as an entry point. Initial risk cap possible below the Parabolic signal, 200-day moving average and the last two down fractals: 1.266. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (1.266) without activating the order (1.3), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - USD/CAD

Correction of world oil prices may have a negative impact on the Canadian economy. Will the USDCAD quotes continue to rise?

From January to April 2022, China reduced oil imports by 4.8% y/y. The main reason for this was the lockdown due to a new outbreak of coronavirus in Shanghai and some other regions. In addition, the European Union and Japan are going to stop importing Russian oil and generally reduce the consumption of hydrocarbons. All this can have a negative impact on global demand. Meanwhile, the export of oil and oil products occupies the largest share in Canada’s total exports (20%). Therefore, the dynamics of the Canadian dollar may depend on oil prices. Last week, the Canada Trade Balance for March ($2.486 billion) was published, which turned out to be worse than expected. This week in Canada is not expected to release important economic data. In the US, the Consumer Price Index and Producer Price Index for April will be published on Wednesday and Thursday. They can affect the USDCAD rate. Market participants do not rule out a slight decrease in inflation after the record level of 8.5% y/y, recorded in March.