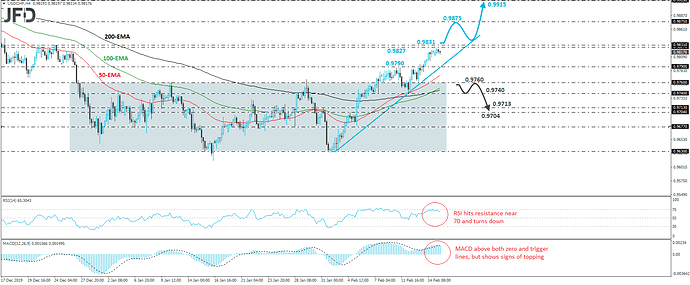

USD/CHF traded somewhat higher today, but it hit resistance at 0.9827 and then it pulled back somewhat. Overall, the pair is printing higher highs and higher lows above an upside support line taken from the low of February 3rd, while lately, it managed to distance itself from the upper end of the sideways range that was containing most of the price action since December 27th. Having all this in mind, we will consider the near-term outlook to be positive for now.

However, in order to get confident on a trend continuation, we would like to see a clear break, not only above 0.9827, but also above 0.9831, which acted as a strong resistance on December 20th and 24th. Such a move would confirm a forthcoming higher high on both the 4-hour and daily charts and may initially pave the way towards the 0.9875 zone, near the peak of December 12th. Another break, above 0.9875, may extend the advance towards the 0.9915 hurdle, which is fractionally below the high of December 6th.

Shifting attention to our short-term oscillators, we see that the RSI turned down after testing several times its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. It could fall below its trigger soon. Both indicators detect slowing upside speed and suggest that some further retreat maybe in the works before the bulls decide to shoot again, perhaps for the rate to test the aforementioned upside line.

In order to abandon the bullish case though, we would like to see a decisive dip back below the 0.9760 barrier, the upper end of the pre-discussed range. Something like that may signal the rate’s return within the range and turn the outlook back to neutral. USD/CHF could then slide towards the 0.9740 level, defined as a support by the lows of February 7th and 12th, the break of which may encourage the bears to target the 0.9713 or 0.9704 levels, marked by the inside swing highs of January 31st and February 4th respectively.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.