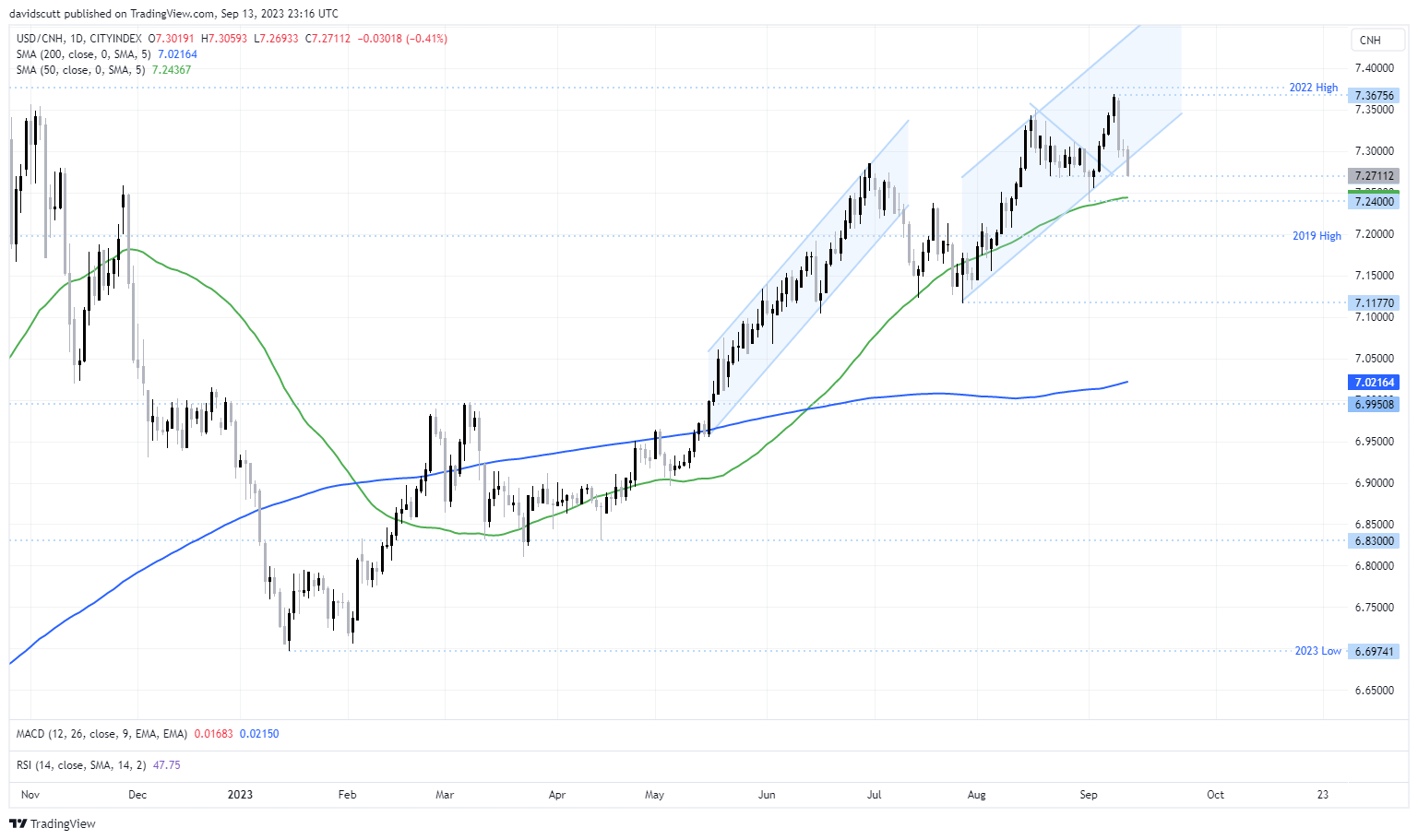

USD/CNH has broken out of the range it’s been in since July, signaling a potential period of consolidation, or even a reversal, from the prevailing bullish trend. But market intervention from the People’s Bank of China (PBOC) once again drove the move, adding uncertainty as to whether it will be sustained beyond the near-term.

PBOC not letting up on efforts to support CNH

Having fixed the USD/CNY midpoint rate 889 pips firmer than expectations on Wednesday, continuing to push back aggressively against market forces in onshore trade, the PBOC moved to support the yuan in offshore markets, announcing a string of short-dated bill sales to soak up excess yuan liquidity, making it costly to short CNH against the US dollar.

In the near-term, the PBOC’s actions worked, seeing the USD/CNH fall to a near two-week low. While the daily chart has been nothing but one-way traffic in 2023, the break of the uptrend established in July is noteworthy, suggesting we may see more weakness in the near-term. USD/CNH stalled at 7.2700 on Wednesday, so that would need to be overcome to open up a potential move towards 7.2400, the low struck in early September and where the 50-day MA currently sits.

USD hawkishness may be nearing saturation point

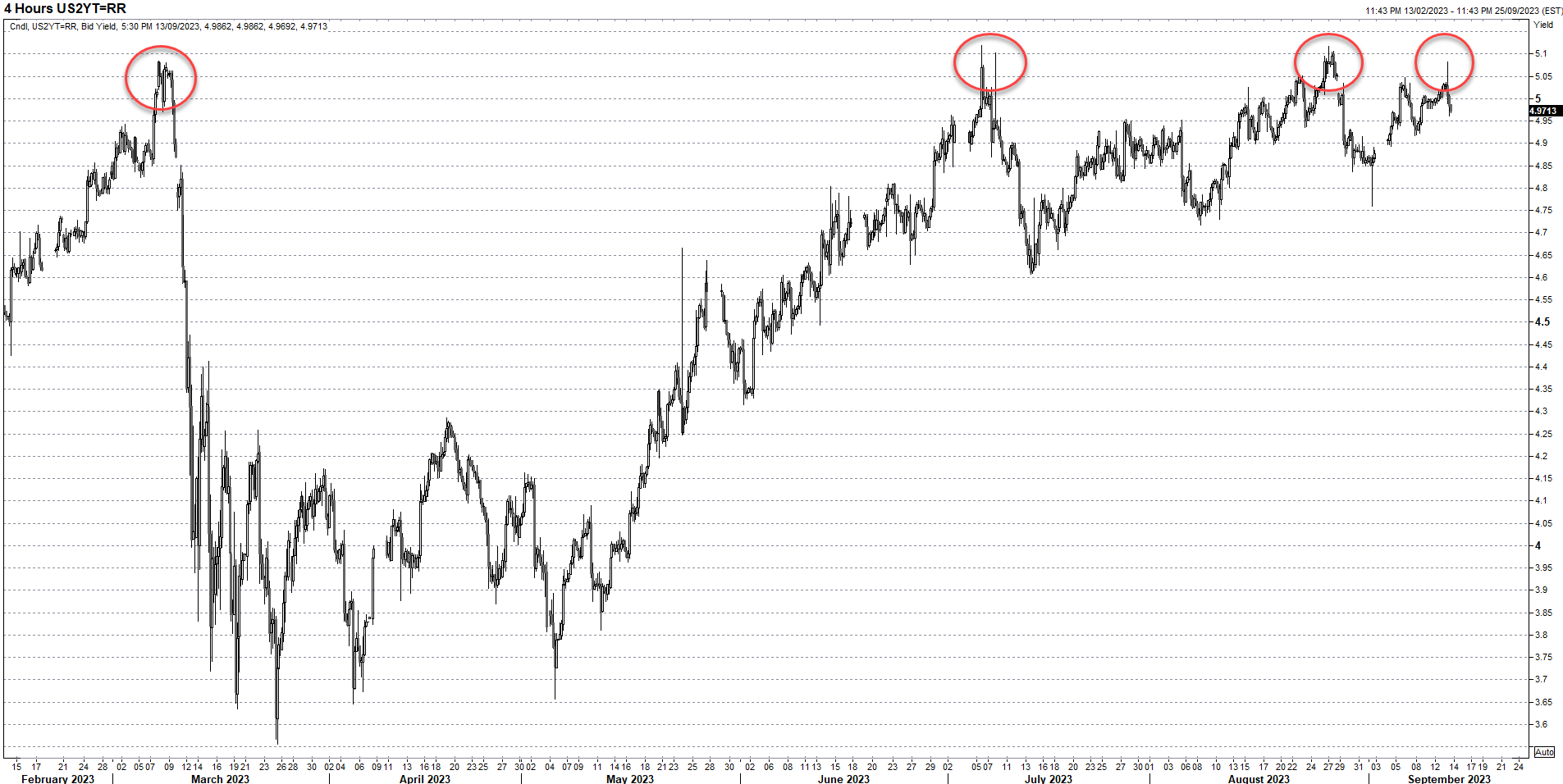

From a fundamental perspective, the inability for the US dollar and US bond yields to push meaningfully higher despite a stronger-than-expected core US CPI print for August was curious, hinting near-term hawkish sentiment may be nearing saturation point. As seen in the daily chart below, US 2-year note yields are not having much success in holding above 5% this cycle, suggesting it may be difficult for yields to break to higher levels.

Source: Refinitiv

China pessimism is already factored in

On the other side of the equation, pessimism towards China’s economy is quickly being baked into market expectations, as demonstrated by the improvement in Citi’s China economic surprise index which now sits at the least-negative level since June. Given this tracks data relative to economist forecasts, it suggests it may only take a stabilisation in economic activity to generate a meaningful market reassessment of the yuan’s outlook, especially when there’s already so much good news factored into the US dollar.

Source: Refinitiv