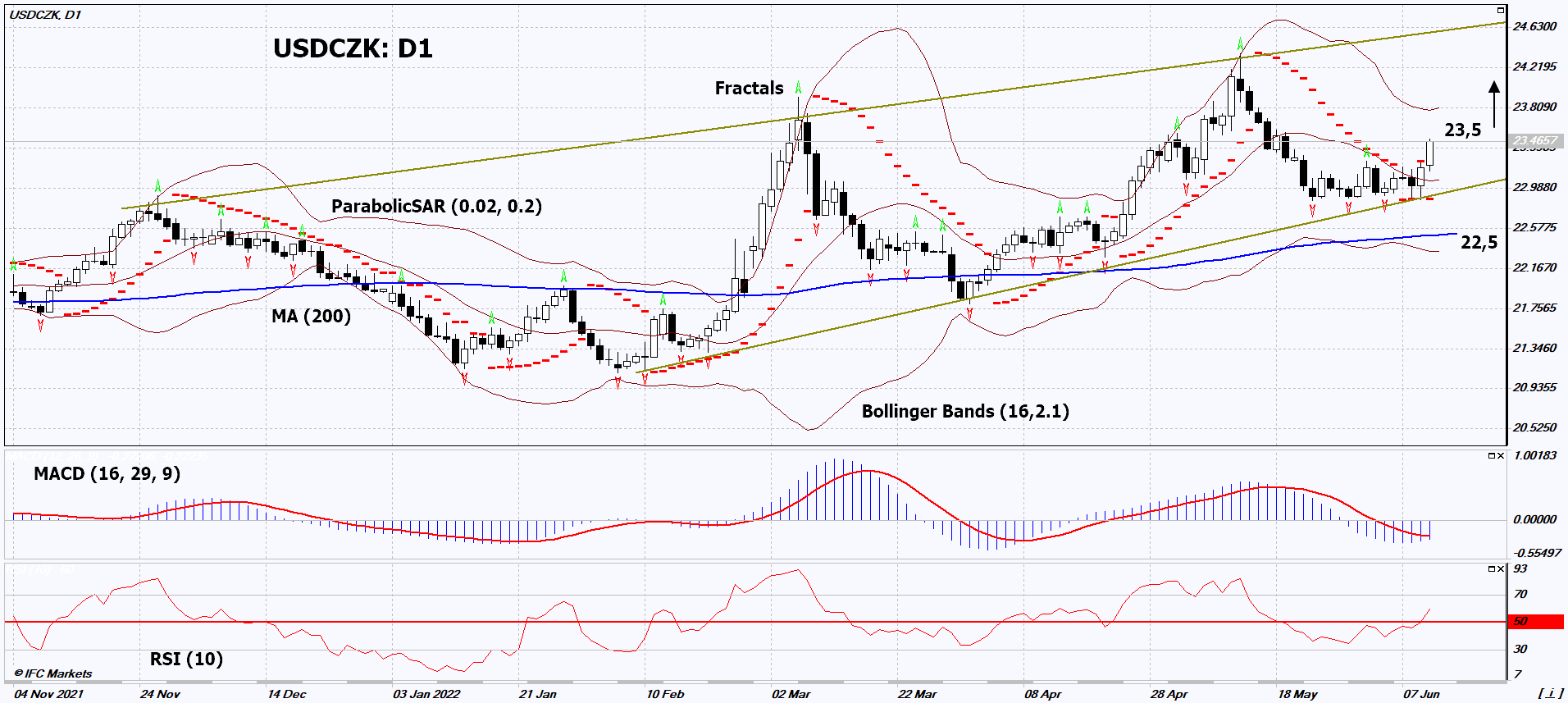

USD/CZK Technical Analysis Summary

Buy Stop։ Above 23,5

Stop Loss: Below 22,5

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

USD/CZK Chart Analysis

USD/CZK Technical Analysis

On the daily timeframe, USDCZK: D1 is in a rising channel. Price pushed off from its lower border and moves towards the upper border. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if USDCZK: D1 rises above the last high of 23.5. This level can be used as an entry point. Initial risk cap possible below Parabolic signal, 3 latest down fractals and 200-day moving average line: 22.5. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (22.5) without activating the order (23.5), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - USD/CZK

Czech companies are going to pay taxes in euros. Will the USDCZK quotes continue to rise?

Czech finance minister Zbynek Stanjura said the Czech government plans to allow local companies to pay taxes in euros from 2024. The corresponding decision can be approved by the parliament at the end of this year or at the very beginning of the next. In his opinion, this will increase the volume of loans received from the European Union. Recall that now the EU includes 27 countries. Of these, 8 countries, including the Czech Republic, have their own currencies. An additional negative for the Czech crown may be weak economic data published last week. In April, the trade deficit of the Czech Republic turned out to be almost 2 times worse than the forecast and showed a record deficit of CZK 28.4 billion. Industrial Production was also 2 times worse than expected and decreased by -3.8% y/y. Czech inflation in May increased for the 11th consecutive month and soared to 16% y/y. This is the highest since December 1993. In this review, we consider the USDCZK pair, as it has more technical signals than EURCZK.