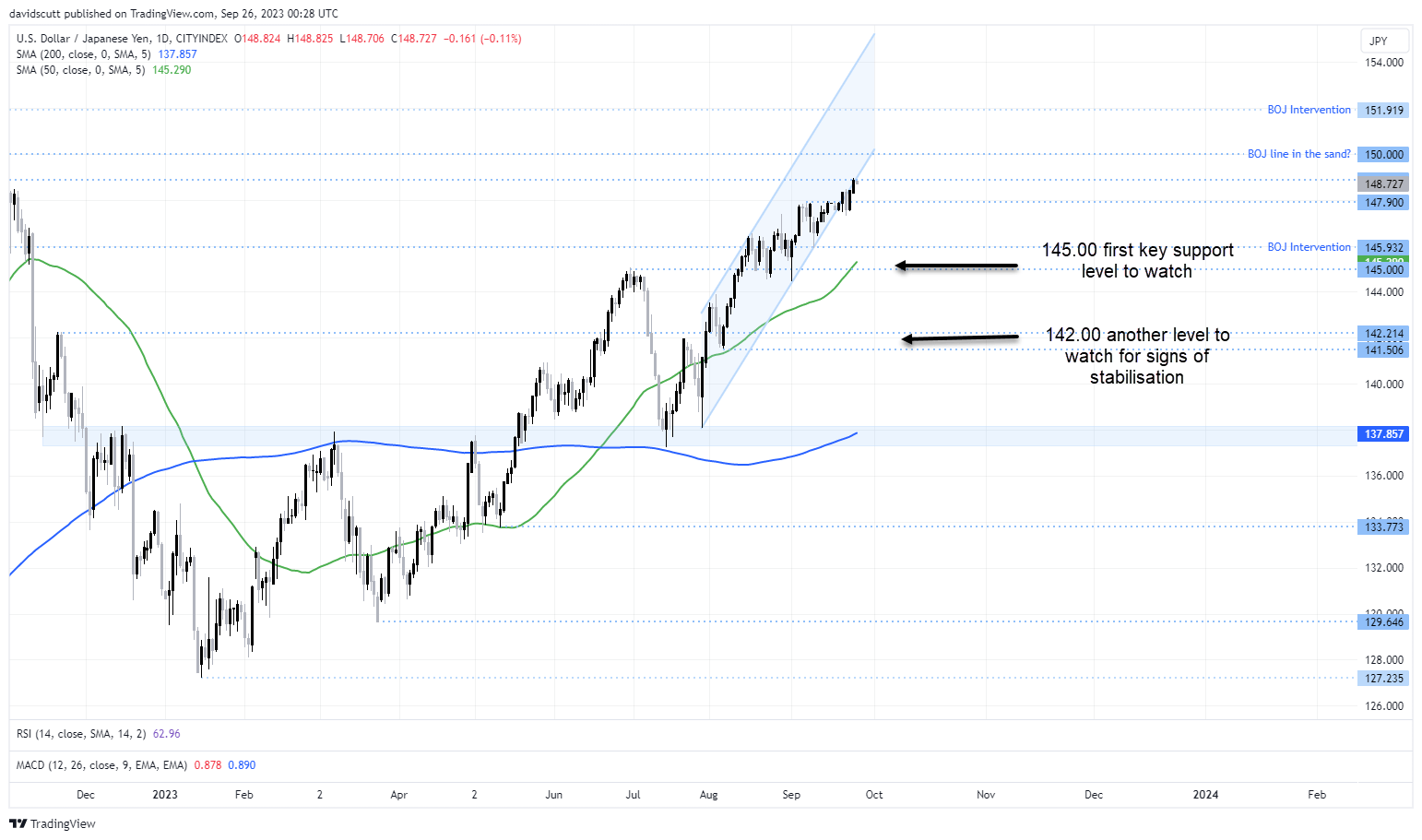

Any attempt to support the Japanese yen through direct market intervention is unlikely to have success beyond the short-term when the fundamentals are so strongly working against it. But that’s unlikely to deter Japanese government officials from ramping up the intervention warnings after USD/JPY surged to 11-month highs on Monday, corresponding with the spread between US and Japanese 10-year bonds blowing out to over 380 basis points, the highest level this year.

Intervention may provide better entry levels for long USD positions

Unless spreads narrow meaningfully between the US and Japan – either by markets collectively rethinking the outlook for US monetary policy or the Bank of Japan unexpectedly removing yield curve control, both of which appear extremely unlikely in the short to medium term – it suggests verbal and direct intervention will provide opportunities for traders to enter long USD positions at better levels with an eye to fading knee-jerk initial reactions.

The difficulty in predicting the reaction in USD/JPY is you cannot say with any certainty if the Bank of Japan (BOJ) will intervene on the government’s behalf. And, if it does, how much the JPY would need to strengthen by before it is satisfied with the results? I know other analysts have looked at past episodes of BOJ intervention, but I’m not convinced that what happened previously will be useful for what may happen on this occasion. Instead, looking at where support is located on the charts may help determine which levels provide decent risk-risk reward for those seeking to fade the initial market reaction.

USD/JPY support levels to watch

On the daily, 145.00 has acted as a support and resistance zone in recent months, suggesting this level should be watched closely as a potential entry level. Further down, the pair has also done quite a bit of work either side of 142.00, providing another zone to watch for a potential entry point.

Any intervention beyond this would be unlikely given it would risk the wrath of policymakers in other monetary jurisdictions. Given the firepower possessed by the BOJ, traders considering fading a direct intervention move should ensure their position sizing and stop levels have been evaluated thoroughly, including looking for signs of relative stabilisation in USD/JPY.

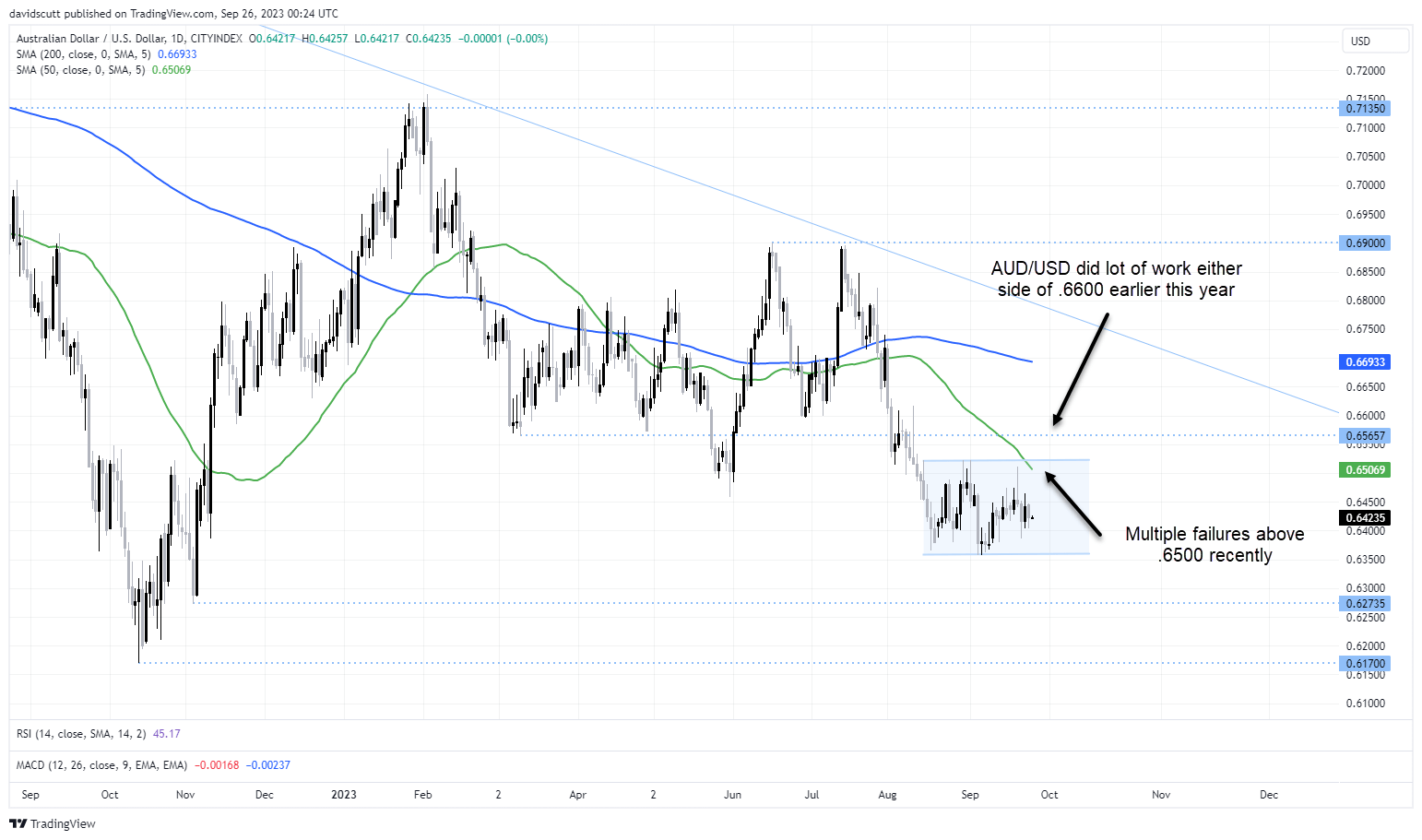

While the reaction in USD/JPY is likely to the most acute, intervention to support the JPY would likely support other currencies against the USD, especially those which have large short positions against them or have suffered large falls during the latest episode of US dollar strength.

AUD/USD pops provide opportunities to fade

AUD/USD is one pair that immediately spring to mind. On the topside, it has struggled above .6500 recently, trying and failing on four separate occasions to break above this level over the past six weeks. Above there, just below .6600 is another zone to watch given this previously acted as support for several months earlier this year.

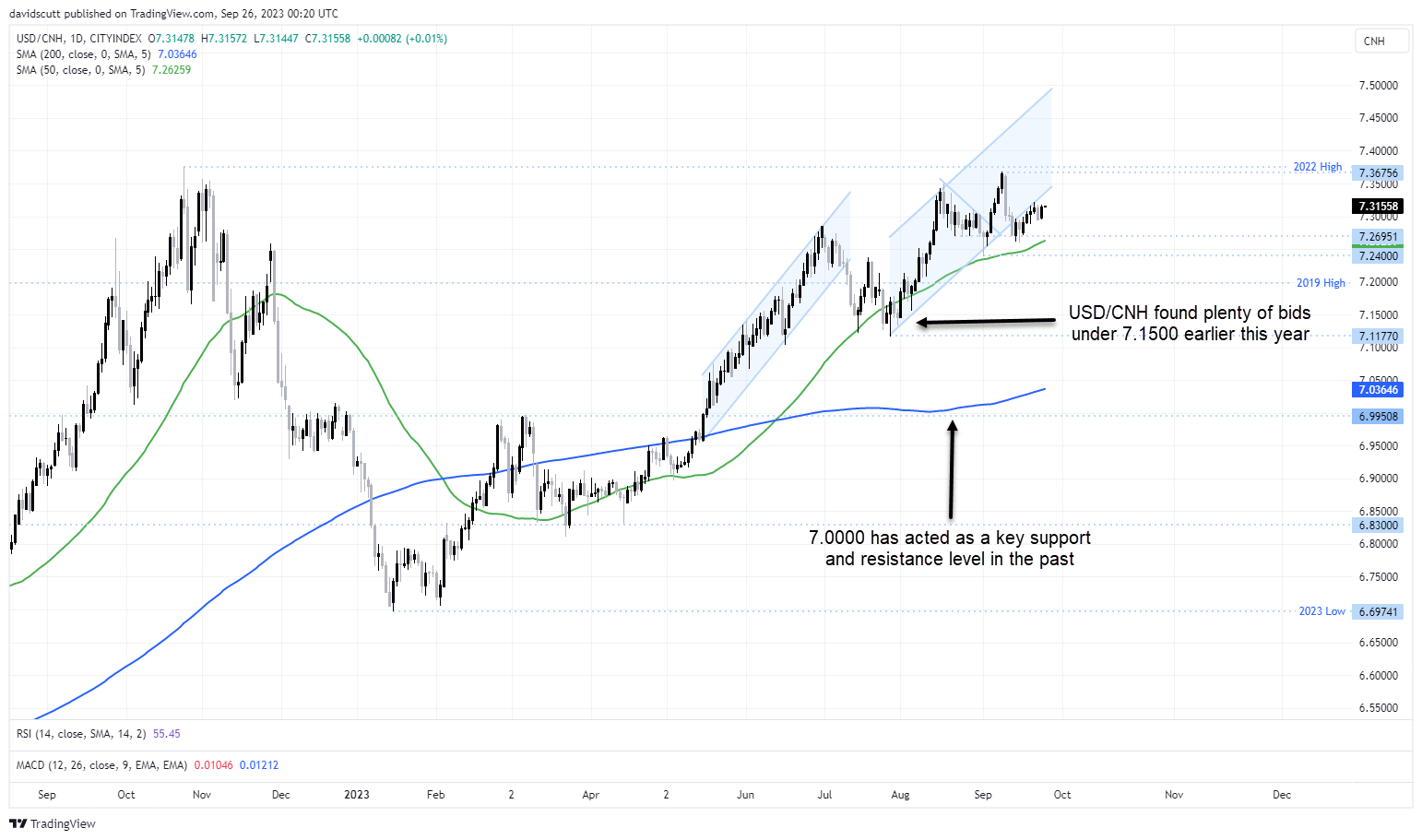

USD/CNH another candidate for knee-jerk reaction

USD/CNH is another pair that been largely one-way traffic of late, providing another option to reset USD longs should we see another intervention episode. It found plenty of bids below 7.1500 earlier this year, suggesting that may provide a decent entry level. Further down, a more pronounced support level is located at 7.0000.