The ever-weaker yen allowed USD/JPY to drift higher for a third day, and now trades less than a typical day’s range from the 162 handle - a level not tested since 1986. Wall Street indices reached record highs on dovish comments from Jerome Powell’s testimony, and that bodes well for the ASX 200 today.

By :Matt Simpson, Market Analyst

Wall Street indices posted record highs on Wednesday after Jerome Powell told Congress that the US is on a path back to table prices and low unemployment. However, he also warned that inflation has not necessarily been beaten.

Hopes of Fed cuts saw S&P 500 futures surpass 5600 with ease and trade just -12 points below 5700, the Nasdaq futures are just over 100 points from reaching 2100. Fed fund futures imply a 68% chance of a September cut, and a 46.7% chance of another 25bp cut in December. 4 cuts by April are weighted with an 83.4% probability.

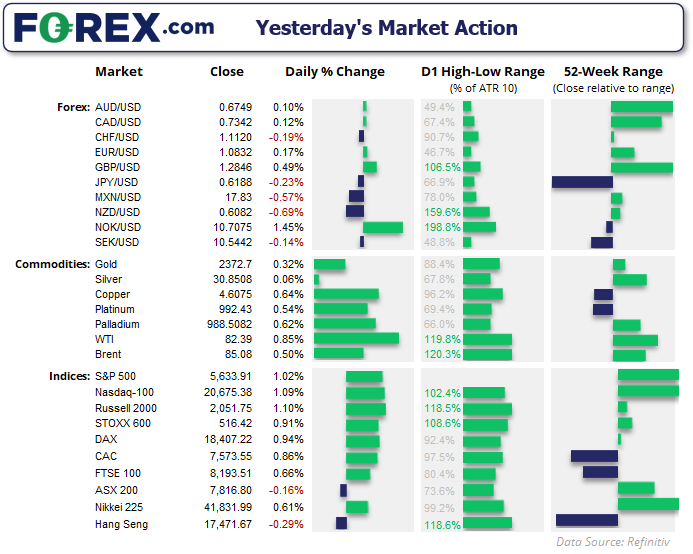

NZD/USD was the weakest forex major on Wednesday after the RBNZ’s surprise U-turn, which removed the surprise hawkish twist presented at the prior meeting. The opening sentence on the statement read “restrictive monetary policy has significantly reduced consumer inflation”, adding they now expect CPI to return within their 1-3% target band by the end of the year. NZD/USD was -0.7% lower, AUD.NZD rose 0.8% during its best day of the year.

Elsewhere, volatility was mostly contained for forex traders with Powell’s testimonies not providing the level of excitement we had anticipated. The yen was lower against all majors except the New Zealand dollar, seeing AUD/JPY rise to a 33-year high and CHF/JPY reach a fresh record high. USD/JPY rose for a third consecutive day and sits less than a day’s trade away from the 162 handle – a level not tested since November 1986.

Events in focus (AEDT):

Markets finally got the dovish comments they wanted to hear from Jerome Powell, and are now hoping a soft set of CPI figures released later today will be the icing on their dovish cake. But with a host of economic data points pointing to a softer economy, inflation may not need to drop too drastically for markets to see what they want. Therefore, anything short of an upside surprise in CPI figures is unlikely to derail expectation of multiple Fed cuts.

- 08:45 – New Zealand food price inflation

- 09:50 – Japan’s core machinery orders, foreigner bond/stock purchases

- 11:00 – Australian inflation expectations (Melbourne Institute)

- 16:00 – UK GDP, construction/manufacturing output, index of services, industrial production, trade balance

- 16:00 – Germany CPI

- 18:00 – China outstanding loan growth, new loans, M2 money supply, total social financing

- 22:30 – US CPI, jobless claims, real earnings

- 01:30 – FOMC member Bostic speaks

Click the website link below to get our exclusive Guide to USD/JPY trading in H2 2024.

https://www.forex.com/en-us/market-outlooks-2024/h2-usd-jpy-outlook/

USD/JPY technical analysis:

USD/JPY has been allowed to drift higher thanks to the weaker yen, after finding support around the 1990 high and MOF intervention level in April. It now trades less than a day’s typical range away from 162, and with little supporting yen prices, then we could find dip buyers stepping back in to have a crack at that level today. The volume cluster around 161.45 could tempt bulls for another leg higher.

Where USD/JPY closes the day is likely down to the incoming US CPI report. If it comes in soft enough, it could see USD/JPY hand back gains. Although, the data may need to come in materially soft as yen weakness is a key feature behind USD/JPY strength of late.

ASX 200 at a glance

- Wall Street indices have left the ASX 200 for dust over the past three months

- Although perhaps the ASX can close the gap with SPI 200 futures rallying overnight

- 1-day implied volatility for the ASX 200 is +/- 0.58% and the 1-week is 1.55%

ASX 200 futures (SPI 200) technical analysis:

The daily chart shows that a series of higher lows formed on the ASX which favoured an eventual upside breakout of its compression pattern. Jerome Powell’s testimony to congress was the trigger which finally saw the ASX break above trend resistance. The bias is now for prices to make their up to at least retest the record high (and potentially reach a new one).

The 1-hour chart the rally from the weekly pivot point was essentially in one more, with little in the way of pullbacks. This is a testament to the strength of the rally. However, resistance has been around the weekly and monthly R1 pivots, and with the RSI (2) having reached overbought for a third time this rally with a series of small doji’s bear the cycle high, perhaps we’ll see a pullback before its next leg higher. Thus keeps the ASX on my ‘dip’ watchlist, with 7900 and 7920 becoming upside targets for bulls.

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.