The next few days will be pivotal for USD/JPY as rate decisions from the Federal Reserve and Bank of Japan (BOJ) collide, providing an environment where we could get an explosive move in either direction. Given the BOJ is not able to declare inflation will be anything other than transitory given weakness in the domestic economy right now, a lot will depend on what happens in the US bond market over the next 24 hours. Based on the balance of risks, the path of least resistance for USD/JPY still appears to be higher.

USD/JPY outlook: two central banks, two different messages

As discussed earlier this week, the resilience of the US economy over the past three months will likely force the hand of FOMC officials to retain hawkish bias at its September monetary policy meeting, ensuring GDP forecast revisions will have an upward bias. It’s likely the dot plot of individual FOMC member year-end Fed funds forecasts will continue to show another hike this year, along with less easing in 2024 given the shifting risks for unemployment and inflation with economic growth humming along at an above-trend pace.

Combined with soaring energy prices fueling downstream inflationary pressures, it risks rupturing the US yield curve higher with many tenors hitting fresh peaks on Tuesday, including benchmark 10-year bonds. That’s important for USD/JPY given the strong relationship it has with yield differentials between the US and Japan.

In contrast to the moderately hawkish message likely to come from the Fed, the BOJ cannot be certain the recent inflationary pulse rippling through the economy will be sustained. Household spending, which accounts for more than half of Japanese economic activity, is worryingly weak, diminishing the prospect for stronger growth, higher wages and sustained inflation environment the BOJ so desperately wants.

USD/JPY stalls as yield differentials steady

Until it can be confident that virtuous cycle is functioning, it’s in no position to do anything other than persist with ultra-easy monetary policy settings. And that suggests directional risks for US yields relative to Japanese yields, and hence USD/JPY, is likely to remain higher.

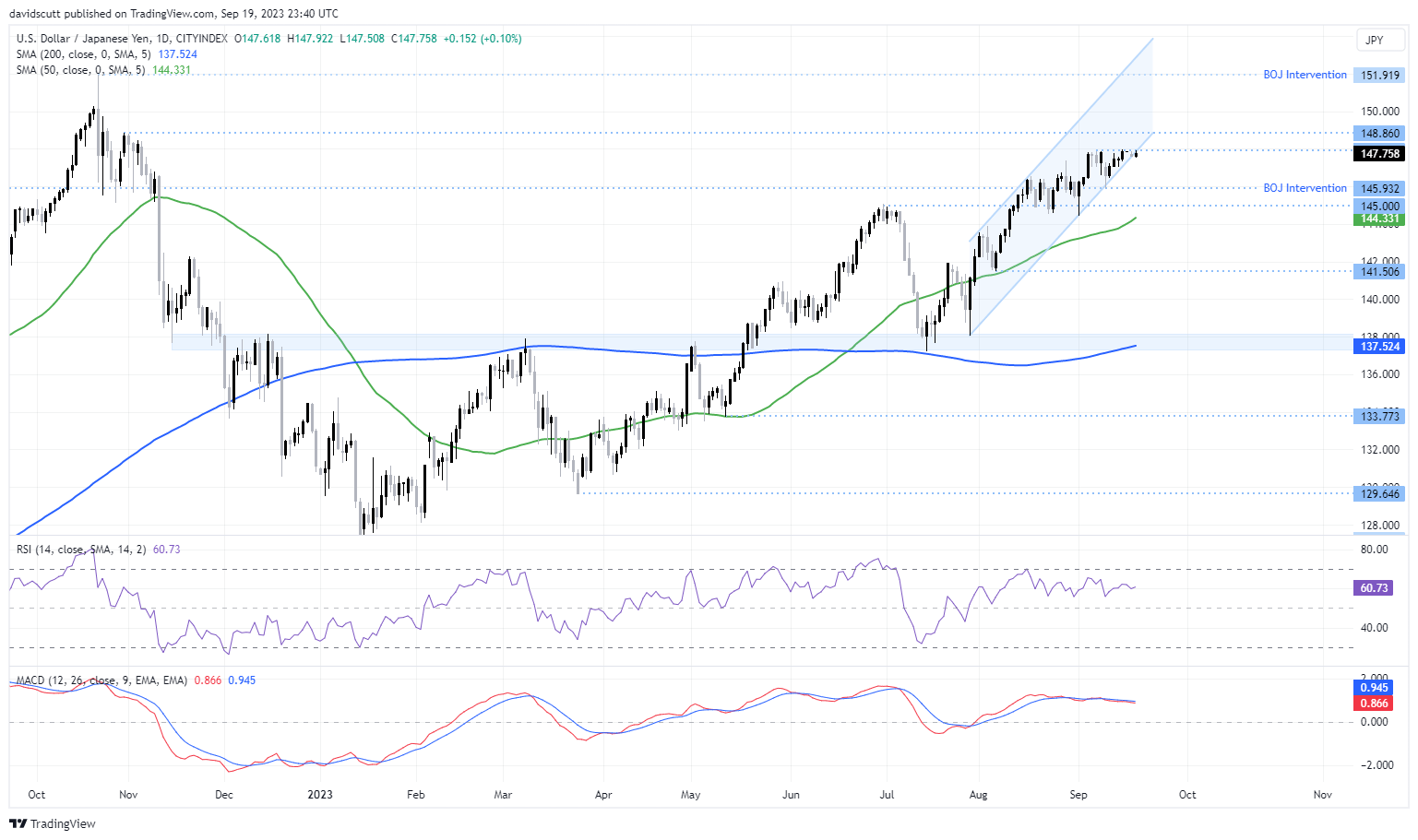

USD/JPY appears coiled for explosive move

While USD/JPY has broken out of the uptrend it’s been in since July, the only real barrier to it breaking back in again is strong resistance at 148.00. While it hasn’t cracked yet, the true test will be if sellers are still willing to defend it should yield differentials break higher again? I doubt it. I’d like to see it break before initiating longs given there is not a lot of visible resistance located until 149.00 and again at the multi-year high below 152.00 struck last year.

If resistance continues to hold strong at 148.00 though these risk events, the bias for USD/JPY may well turn lower. But let’s see what happens first.