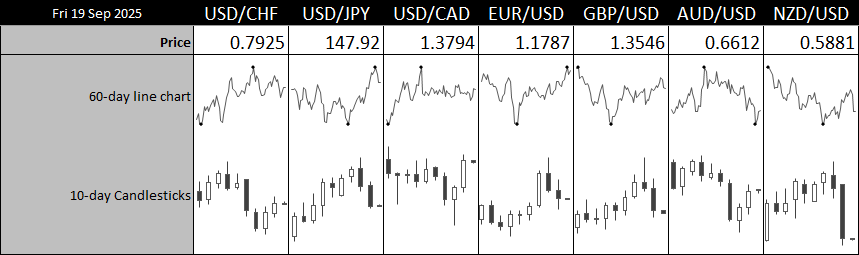

US dollar rallies as Fed signals limit easing, while BOJ caution risks further yen weakness. USD/JPY and EUR/JPY bulls eye breakout levels.

By : Matt Simpson, Market Analyst

The US dollar index rallied for a second day after the Federal Reserve (Fed) delivered a less-dovish-than-expected 25bp cut. Powell’s pushback against a larger 50bp cut wrongfooted traders who had pre-emptively positioned for a jumbo-sized move, which is usually reserved for times of crisis.

The Bank of Japan (BOJ) is expected to hold interest rates at 0.5% today while presenting a cautiously optimistic outlook. Traders will be watching for any hints of an October hike, which an ex-BOJ official believes is likely, even if ultra-dovish Sanae Takaichi wins the election. Strong corporate profits and steady wage hikes are seen as sufficient justification for the BOJ to act in Q4.

However, with no “sources” in the media leaking clues ahead of today’s meeting, it seems unlikely the BOJ will commit to signalling a move now. That could allow the Japanese yen to weaken further in line with recent momentum – a scenario that would continue to support USD/JPY and EUR/JPY bulls.

View related analysis:

- USD/JPY, EUR/JPY, AUD/JPY Outlook: Dollar, Yen Weakness Into FOMC, BOJ

- EUR/GBP Outlook: Euro Favoured as Dollar Declines, British Pound Lags

- EUR/USD, USD/JPY, VIX, Gold, Crude oil: COT Report Analysis

Chart prepared by Matt Simpson - data source: LSEG

USD/JPY and EUR/JPY Technical Outlook Ahead of BOJ Decision

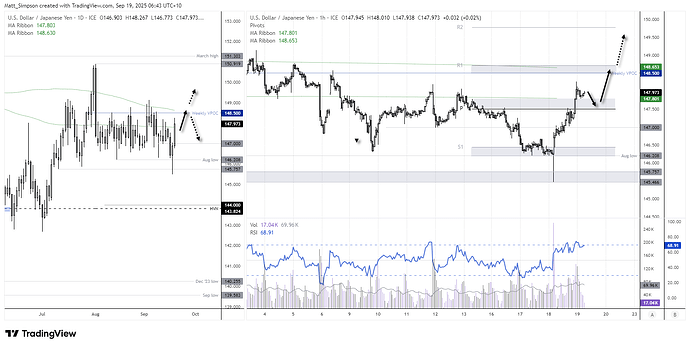

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

The US dollar’s rebound and low expectations of a BOJ hike has meant that USD/JPY has failed to break materially lower from its range once again. That said, I have finally removed the lower VPOC in light Wednesday’s false breakout for bears. But Wednesday’s lower tail does reveal a false break and sharp reversal around the July 20 low (145.76).

Momentum for USD/JPY is pointing firmly higher within its range, and the day closed above its 200-day EMA. A strong directional rally can be seen on the 1-hour chart.

A move up to the top of range and potential retest of the 200-day EMA (147.80) could be on the cards. Bulls could seek pullbacks to the monthly pivot point (147.50) and target the monthly S1 pivot around the 200-day SMA.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

Click the website link below to Check Out Our FREE “How to Trade USD/JPY” Guide

https://www.forex.com/en-us/whitepapers/

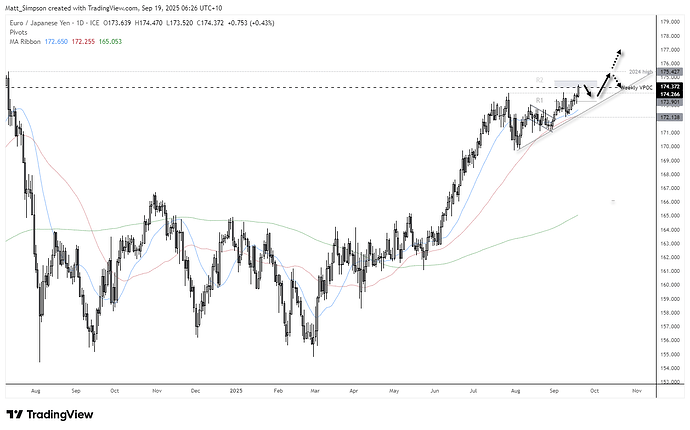

EUR/JPY Technical Analysis: Euro vs Japanese Yen

The euro (EUR) has broken higher against the Japanese yen (JPY), with EUR/JPY now trading at its strongest level since July 2025. This bullish breakout could open the path towards retesting the 2025 highs. With the daily trend structure firmly intact, traders may look for continuation signals on intraday charts or pullbacks into support zones.

Should a retracement unfold on the daily timeframe, key support levels include the monthly S1 pivot at 173.30, the 20-day EMA at 172.65, and the rising bullish trendline from the August low. Given the momentum, a retest – or even a potential breakout – of the 2025 high remains a realistic target for euro bulls.

Near-term resistance sits at the high-volume node (HVN) at 174.26 and the monthly R2 pivot at 174.75, which could temporarily cap upside and prompt a minor pullback.

Chart analysis by Matt Simpson - data source: TradingView EUR/JPY

Key Economic Events for Traders (AEST / GMT+10)

07:00 NZD Westpac Consumer Sentiment (NZD/USD, AUD/NZD, NZD/JPY)

08:45 NZD Exports, Imports, Trade Balance (Aug) (NZD/USD, AUD/NZD, NZD/JPY)

09:01 GBP GfK Consumer Confidence (Sep) (GBP/USD, EUR/GBP, GBP/JPY)

09:30 JPY CPI, National CPI, National Core CPI (Aug) (USD/JPY, EUR/JPY, Nikkei 225)

09:50 JPY Foreign Bonds Buying, Foreign Investments in Japanese Stocks (USD/JPY, EUR/JPY, Nikkei 225)

12:30 JPY BoJ Monetary Policy Statement (USD/JPY, EUR/JPY, Nikkei 225)

13:00 JPY BoJ Interest Rate Decision (USD/JPY, EUR/JPY, Nikkei 225)

13:00 NZD Credit Card Spending (Aug) (NZD/USD, AUD/NZD, NZD/JPY)

16:00 GBP Retail Sales, Core Retail Sales, Public Sector Borrowing, Public Sector Net Cash Requirement (Aug) (GBP/USD, EUR/GBP, FTSE 100)

16:30 JPY BoJ Press Conference (USD/JPY, EUR/JPY, Nikkei 225)

17:00 EUR German PPI (Aug) (EUR/USD, EUR/GBP, DAX)

19:00 EUR ECB President Lagarde Speaks (EUR/USD, EUR/GBP, DAX)

19:30 EUR ECB Supervisory Board Member Tuominen Speaks (EUR/USD, EUR/GBP, DAX)

20:00 EUR ECOFIN Meetings, Eurogroup Meetings (EUR/USD, EUR/GBP, DAX)

21:30 INR FX Reserves (USD) (USD/INR, EUR/INR, GBP/INR)

22:00 CNY FDI (Aug) (USD/CNH, AUD/CNH, CNH/JPY)

22:30 CAD Retail Sales, Core Retail Sales (Jul) (USD/CAD, EUR/CAD, CAD/JPY)

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.