Market Summary:

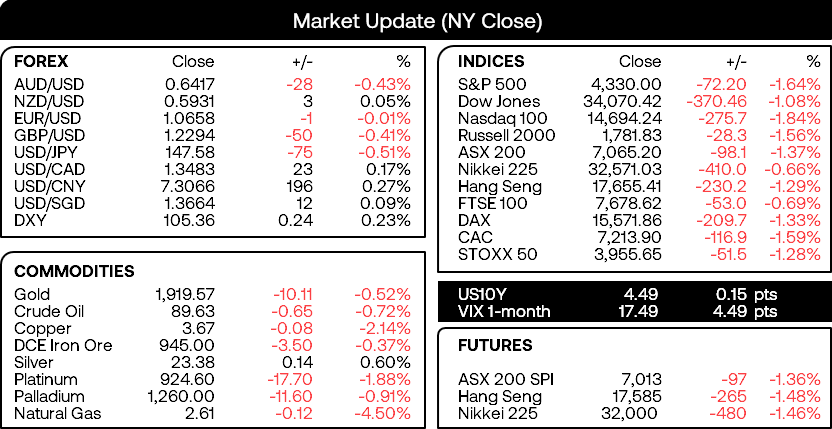

- Global equity markets were broadly lower on Thursday following the Fed’s hawkish meeting, as investors came to grips with upwardly revised growth and inflation targets alongside fewer cuts in the median Fed fund projection in 2024

- US bond yields – particularly at the longer end of the curve – accelerated higher. The 20-year and 30-year rose +18.25 and +18.81bp respectively, which is over three times their average positive daily return over the past year

- Wall Street indices gapped lower, opened around the highs of the day to closed at their lows.

- China’s CSI 300 fell to a YTD low, the China A50 closed beneath 12,400 support for the first time since May (which marked a swing low, btw…)

- The US dollar index (DXY) rose to a 6-month high although traders seemingly booked profits just 15 points from its YTD high, to see the day close with a bearish pinbar

- AUD/USD fell to a 6-day low yet once again 64c came to the rescue for prices to recover slightly and close the day just above it, EUR/USD recovered back above its May low and USD/JPY formed a bearish outside day ahead of today’s BOJ meeting and inflation report

- The Bank of England held interest rates at 5.25% on Thursday, following softer than expected inflation data earlier in the week. The Monetary Policy Committee (MPC) voted 5-4 in favour of the hold, but most notably it was Governor Bailey, Ramsden, Pill and Broadbent which voted for the pause which could back up the case that the terminal rate is indeed in place. GBP/USD fell to a 6-month low.

- WTI crude oil fell for a third day although is only closed marginally lower after volatility cut both ways. Support was found above $88 before prices recovered to $91 and pulled back, to close the day with a spinning top doji (is a low in already?)

Events in focus (AEDT):

- 08:45 - New Zealand’s trade data

- 09:00 - Australian flash manufacturing, services PMI

- 09:30 – Japan’s national CPI

- 10:00 – Japan’s flash manufacturing, services PMI

- 16:00 – UK retail sales

- 17:30 – Germany’s flash manufacturing, services PMI

- 18:00 – Eurozone’s flash manufacturing, services PMI

- 18:30 – UK flash manufacturing, services PMI

- 22:30 – Canada’s retail sales

- 23:45 – US flash manufacturing, services PMI

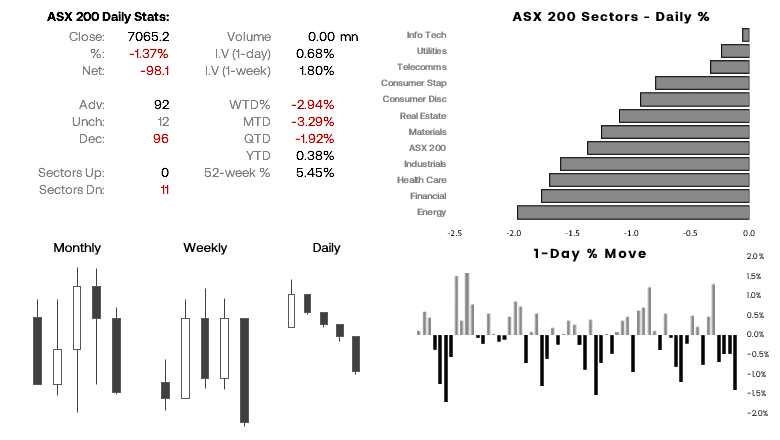

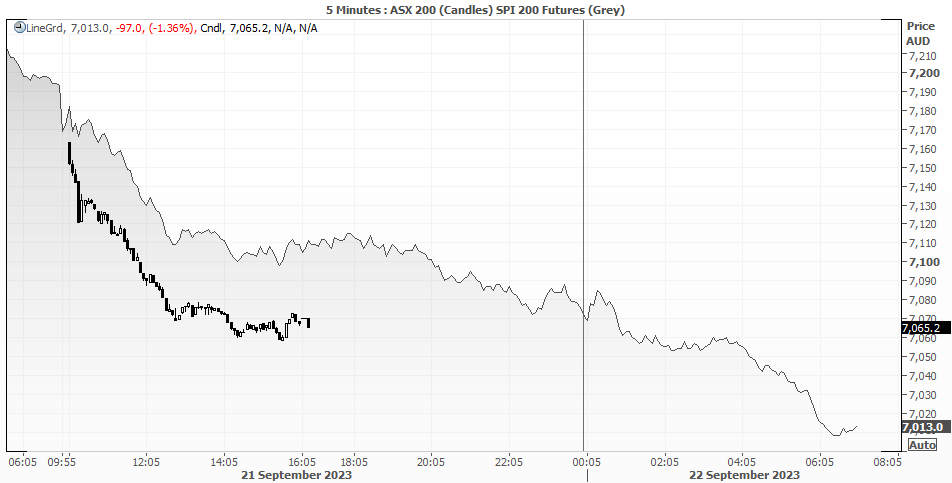

ASX 200 at a glance:

- The ASX 200 endured its worst day in five weeks on Thursday, falling -1.36% by the close and comfortably below 7100

- A weak lead from Wall Street and SPI futures falling -1.36% points to another weak open for the ASX cash index today

- 7,000 is the next major support level for bulls to defend, 7090 (August 22 swing low) is resistance

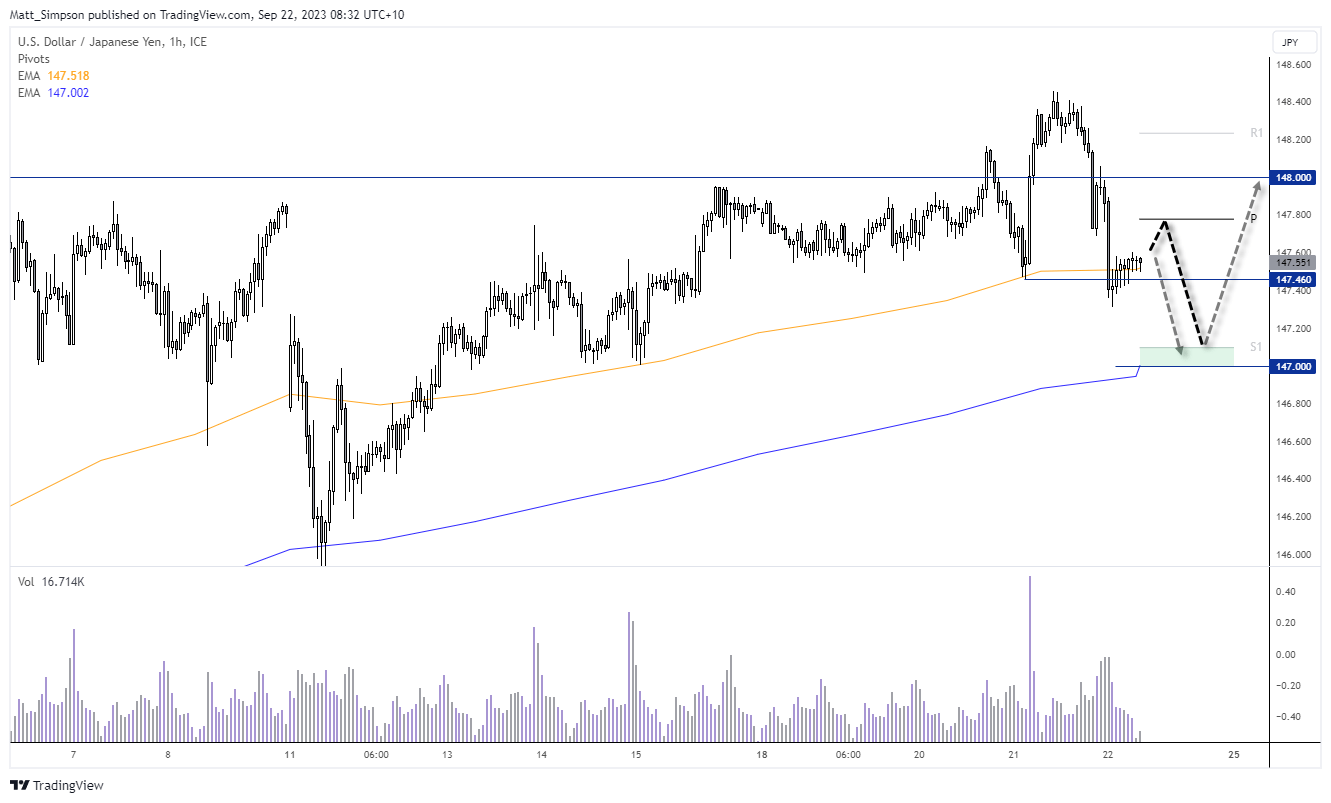

USD/JPY technical analysis ( chart):

The US dollar failed to hold into its initial post-FOMC gains, which saw major pairs reverse course and hold their ground despite higher yields. And that also saw USD/JPY print a bearish outside day after a false break above 148. Whilst that flies in the face of my bias for a move to at least 149 (potentially 150), I had also outlined a scenario where pullbacks towards the 20-day EMA had actually been supported in recent weeks. It therefor appears the latter scenario may be playing out.

The 1-hour chart shows the 10-day EMA and 147.46 low was breached but not conquered, hence the bias for an initial bounce from current levels. Yet the 2-day bearish reversal pattern hints at another leg lower, so perhaps we’ll see a swing high around the daily pivot point. Either way, the 20-day EMA sits around the 147 handle, which may make a potential bearish target for countertrend bears or an opportunity for sidelined bulls to seek evidence of a swing low.