Over the past two trading sessions, USD/JPY has fluctuated by less than 1% on average, creating a scenario of continued neutrality in the pair’s short-term movements.

By : Julian Pineda, CFA, Market Analyst

Over the past two trading sessions, USD/JPY has fluctuated by less than 1% on average, creating a scenario of continued neutrality in the pair’s short-term movements. This comes as markets continue to digest the potential effects of upcoming monetary policy decisions from both the Federal Reserve and the Bank of Japan. For now, the neutral tone prevails, and it is likely to remain in place until new economic data provides clearer signals.

Click the website link below to read our exclusive Guide to USD/JPY trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-usd-jpy-outlook/

What is the Bank of Japan’s Outlook?

The Bank of Japan’s rate decision, scheduled for September 18–19, has begun to partially shift market expectations. While no immediate changes are anticipated, keeping the reference rate at 0.5%, there is speculation about what could happen in future meetings, given inflation’s persistent behavior in the short term.

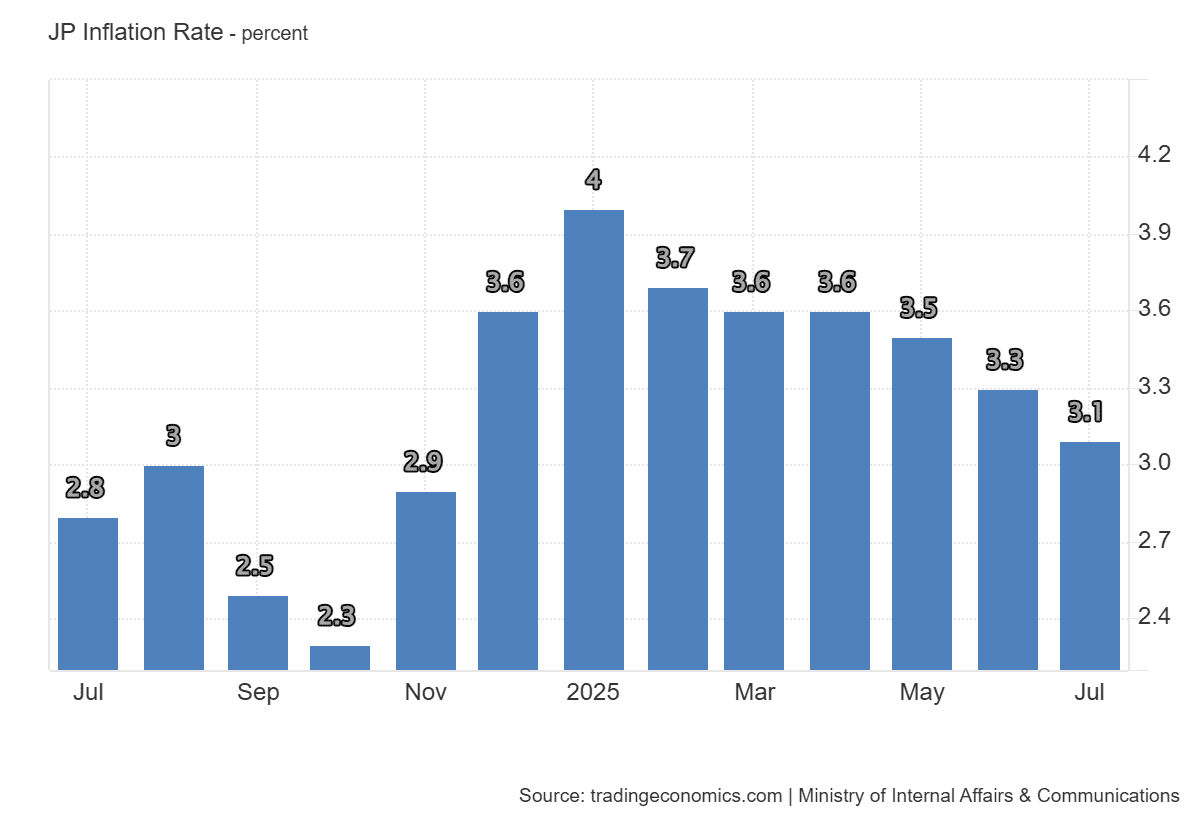

Japan’s annual CPI, while down from the 4% recorded at the beginning of the year to 3.1% in July, still remains above the official 2% target. The slower-than-expected moderation in consumer prices could eventually push the BoJ toward a rate hike in the medium term to ensure inflation is brought under control.

Source: TradingEconomics

This scenario highlights that expectations of a more hawkish stance by the BoJ in the future could become a significant factor supporting yen strength.

In the United States, the likelihood of the Fed adopting a more dovish stance continues to grow, following recent comments suggesting that employment and economic growth may now take priority. Under this scenario, the market anticipates a rate cut from 4.5% to 4.25% at the September 17 meeting. Additionally, uncertainty surrounding the potential removal of Fed Governor Lisa Cook has raised concerns about the central bank’s independence, further fueling expectations of lower rates.

As a result, the wide interest rate differential between the U.S. and Japan could start narrowing faster than expected. While the Fed moves toward cuts and the BoJ potentially adopts a more hawkish stance, the advantage of dollar-denominated assets could diminish. This, in turn, may weaken demand for dollars and strengthen the yen, creating greater downward pressure on USD/JPY in the short term.

USD/JPY Technical Outlook

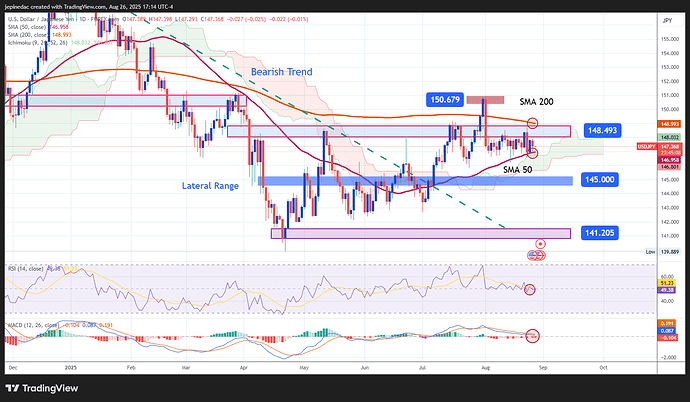

Source: StoneX, Tradingview

- Wide Sideways Range: In recent weeks, USD/JPY has traded within a broad sideways range, with key resistance near 148.493 and major support at 141.205. This behavior shows that, despite attempts to break higher or lower, the pair has failed to breach these reference levels, consolidating neutrality as the prevailing scenario. The inability to escape the channel reflects market participants waiting for new monetary policy signals before defining direction. As long as this pattern continues, the range will remain the most relevant technical structure in the short term.

- RSI: remains close to the neutral 50 level, confirming that buying and selling impulses over the last 14 sessions are balanced. This underscores the absence of a clear bias. A consistent drop below 50 would reinforce bearish pressure, while a sustained move above could strengthen a bullish bias.

- MACD: the histogram remains just below the 0 line, reflecting indecision in short-term moving averages. As long as this condition persists, the sideways formation will likely continue to dominate.

Key Levels:

-

148.493 – Main Resistance: marks the upper boundary of the sideways channel and coincides with the 200-period simple moving average. A sustained breakout here would pave the way for a more defined bullish bias and a stronger upward move.

-

145.000 – Near-Term Support: corresponds to the mid-range level and is reinforced by the Ichimoku cloud. A pullback to this area would maintain the consolidation structure and provide room for fresh rebounds within the channel.

-

141.205 – Distant Support: represents the lower boundary of the range and is the most critical level for sellers. A break below this level would confirm a structural shift to a bearish scenario, with potential for deeper corrections.

Written by Julian Pineda, CFA – Market Analyst

Follow him: @julianpineda25

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.