With yen futures at a sentiment extreme, hawkish comments from the BOJ hint at a top for USD/JPY. And with ASX 200 futures hitting a record high ahead of the NY close, a break above 7700 is now in focus.

By :Matt Simpson, Market Analyst

Market Summary:

- US core PCE inflation rose to an 11-month of 0.4% m/m, although this was in line with expectations, as was PCE inflation at 0.3% m/m

- The annual rate of inflation also hit consensus estimates with PCE at 2.4% y/y and core PCE at 2.8% y/y

- A surge in services costs such as finance and housing was the main driver of core PCE in January, but with the annual rate of PCE falling to a 3-year low bets are still on for the Fed’s first cut to arrive in June

- Fed fund futures imply a 52.8% chance of a June cut, which is in line with some economists such as those from ING. A second 25bp cut has a 41.1% probability in September, according to Fed funds

- The US dollar index formed a bullish outside day after finding support at the 200-day EMA, EUR/USD closed on its 200-day EMA and USD/CAD looks like it wants to break above its 200-day EMA, AUD/USD is trying to recover back above 0.6500 yet remains anchored to Wednesday’s low

- The yen was the strongest forex major on Thursday following comments from BOJ member Takada, renewing expectations that the BOJ will finally ditch negative rates in the coming weeks or months

- 2% inflation in now in sight according to Takada, and that it is now necessary for the BOJ to consider their exit strategy from their ultra-loose monetary policy

- Wall Street indices turned higher and look set to retest their record highs if Thursday’s bullish momentum carries over to Friday, which paints a positive picture for APAC stocks today – and the ASX 200 futures contract has already reached a record high ahead of New York close

- Australian retail sales failed to recoup the -2.1% loss in December by rising just 1.1% in January, which was also beneath 1.6% expected. Whilst it does not spelling impending doom, it is yet more evidence of sluggish growth the Australian economy

- RBNZ governor Orr reiterated the central bank’s statement that the current cash rate of 5.5% is restricting domestic demand, and the outlook for inflation remains balance to pour cold water on expectations of another hike. The RBNZ’s chief economist also noted that softer government spending as a % of GDP is also helpful

Events in focus (AEDT):

- 08:45 – New Zealand building consents

- 09:00 – Fed Goolsbee speaks

- 09:00 – Australian manufacturing PMI (AIG)

- 10:30 – Japan’s unemployment rate, jobs/applications ratio

- 11:05 – RBNZ Gov Orr speaks

- 11:30 – Japan’s manufacturing

- 12:10 – FOMC member Williams speaks

- 12:30 – China PMIs (manufacturing, services, compositeNBS)

- 12:45 – China manufacturing PMI (Caixin)

- 21:00 – Eurozone CPI

- 01:45 – US manufacturing PMI (final – S&P Global)

- 02:00 – ISM manufacturing, US consumer sentiment (University of Michigan)

Click the website link below to get our exclusive Guide to USD/JPY trading in 2024.

https://www.forex.com/en-us/market-outlook/

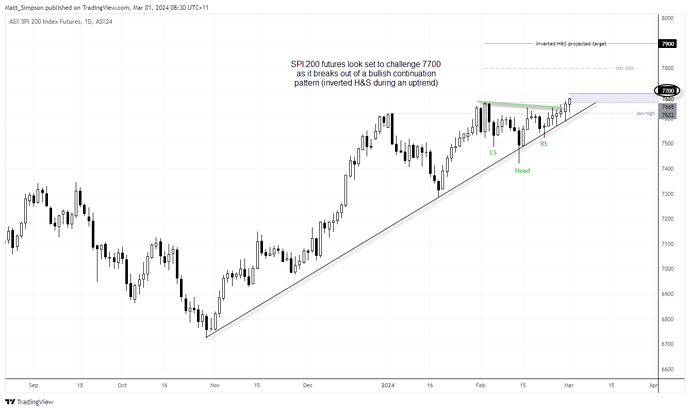

ASX 200 futures technical analysis:

The ASX 200 breached a record high ahead of Thursday’s close, and SPI 200 futures have extended that lead slightly ahead of the US market close. The daily chart shows that ASX futures respected a bullish trendline, two intraday spikes aside. What has caught my eye is the inverted head and shoulders pattern on the daily chart, which is a bullish continuation pattern in an uptrend. The inverted H&S projects a target around the 7900 handle, and a 100% projection of the prior leg sits around 7800.

First however, we may need to see a break or daily close above 7700 before becoming confident that the next leg higher is truly underway. Bulls could either seek the actual break, or see if prices retrace and respect the 7765 – 770 area as support before considering longs.

USD/JPY technical analysis:

The Japanese yen surged during the Asian session following hawkish comments from the BOJ, which saw USD/JPY initially fall over 1% and seemed on track for its worst day of the year ahead of the European open. Even though USD/JPY recouped just under half of the day’s losses, the prominent bearish engulfing candle brings the potential that the pair may have topped – or is very close to.

As noted in one of my prior COT reports, the Japanese yen futures appear to be near a sentiment extreme which could pave the way for a stronger yen. With the potential for the BOJ to ditch negative rates once again on the horizon and markets still looking for any reason for the Fed to cut, maybe USD/JPY has finally topped. But what their pair really needs to a sharp drop is for the Fed to actually signal cuts. Patience may still be required with shorting USD/JPY.

For now, bears could seek to fade into retracements towards 151 with a stop above and initially target the 148.8 – 149.2 support zone, a break of which assumes the larger move south has begun.

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.